The In-House Counsel Awards: Full Video and Shared Insights from the Event

As part of this year’s inaugural In-House Counsel Leadership Awards, the L.A. Times B2B Publishing team staged a virtual event panel discussion exploring the hot button issues and trends affecting the legal landscape in 2021 as it pertains to in-house counsel and the companies and people they serve.

The panel was moderated by K1 Investment Management’s Jordan Wappler and featured expert commentary from Alan Wayne Lindeke of The Change Company and Nicholas Sanchez of Miller Kaplan. Their bios and some of their shared insights are included below.

Moderator: Jordan Wappler

Vice President

K1 Investment Management

Jordan Wappler is a vice president at K1 Investment Management, where he is responsible for legal due diligence, structure, negotiation and execution of growth capital and buyout investments, including Rethink First where he serves as board director. Wappler joined K1 from Kirkland and Ellis LLP and received his J.D. from Stanford Law School and B.A. from Stanford University, graduating with Academic Distinction.

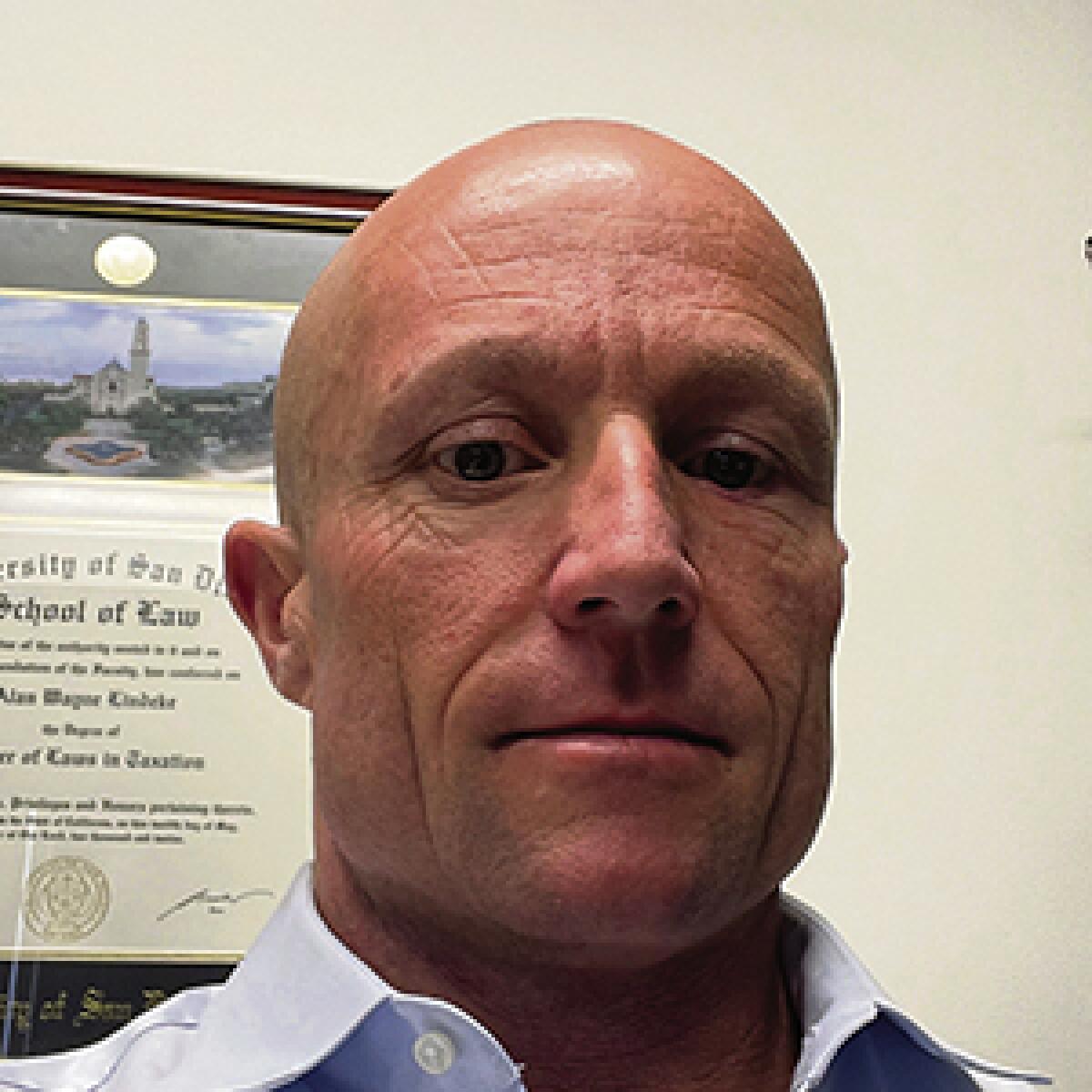

Alan Wayne Lindeke

General Counsel

The Change Company

A tenured general counsel with a demonstrated history of working in the banking industry, Alan Wayne Lindeke is skilled in operations management, management, legal compliance, sales management and customer service. Lindeke received his J.D. from Washburn University School of Law, a Masters of Laws (LL.M) in Taxation from the University of San Diego School of Law and a Certified Regulatory Compliance Manager (CRCM) designation from the American Bankers Association.

Nicholas Sanchez

Partner/Tax Attorney

Miller Kaplan

Nicholas Sanchez started his career, nearly 15 years ago, with Damasco & Associates (which became part of Miller Kaplan in 2016). In addition to offering general tax advisory and consulting services, Sanchez advises his clients regarding the tax implications of settlements and judgments arising out of class action litigation, administrative enforcement actions, bankruptcies, and receiverships. He is a trusted expert in all tax aspects of Qualified Settlement Funds, including the tax characterization of distributions, taxation of attorney’s fee awards, and information reporting and withholding compliance

Shared Insights From The Event

SANCHEZ: Tax laws and policy are perpetually in a state of flux, but it has been rather dramatic lately, which I think will continue into 2022. The ink was barely dry on Treasury’s guidance with respect to the sweeping changes under the Tax Cuts and Jobs Act of 2017 when we saw numerous pandemic-related relief provisions implemented under the CARES Act and its progeny. Now we have proposals under President Biden’s “American Jobs Plan,” “Made In America Tax Plan,” and “American Families Plan” that would see domestic and global tax reform, an infrastructure spending plan that may allocate $40-80 billion annually towards improved tax enforcement, along with numerous other tweaks that will keep businesses, their in-house counsel and compliance teams, and their outside advisors very busy.

LINDEKE: The newest post-pandemic challenge for in-house counsel has been establishing a fair, efficient, and effective policy for determining which employees should continue to work remotely, as the world tries to find its new normal. There is great potential for improved efficiencies through elimination of time wasted commuting and time spent getting ready for work - which, when managed correctly, can result in enhanced work productivity and more time available for the employee to spend time with family and friends. However, not all employees possess the mature wisdom required to stay on task when faced with lack of direct supervision. Furthermore, despite technological advances in online meetings, employees who work remote are deprived of the day-to-day/ face-to-face social interaction which is an essential component to fostering a strong synergistic and collaborative work environment. While balancing Equal Opportunity Employment Act, Americans with Disabilities Act, various privacy laws and state mandates, it is equally important to remember general principles of equity and fairness. Those who are succeeding while enjoying the benefits of working remotely should be afforded such consideration.

SANCHEZ: One of the big changes coming will be in the area of corporate taxation. The Treasury recently announced that 130 countries have agreed to a global corporate minimum tax. If implemented, this will have a dramatic impact on taxes and tax planning for multinational corporations. At home, President Biden’s American Jobs Plan would raise the corporate income tax rate to 28% from 21%, repeal certain loopholes, and impose a 15% minimum tax on book earnings.

LINDEKE: While in-house counsels have a mandate to always do what is in the best interest of their client, that often includes balancing immediately realized profits with the costs associated with socioeconomic factors (such as social justice movements) which have the potential to cause upside gains or downside risks depending on how an organization navigates these choppy waters. Educating C-suite executives on the significance of these factors and guiding them toward responsible decision-making should be of paramount importance to in-house counsels. Notwithstanding, when an organization can do well by doing good is a win-win.

SANCHEZ: The pandemic has created unprecedented shifts in how organizations do business, one of the most obvious being the developing trend of employers allowing employees to work remotely on a permanent basis or at least under a hybrid arrangement, to accommodate employee relocation, as well to expand their geographic hiring pool as they consider the types of positions and teams that can be successful remotely. From the lens of a tax professional, there are two interrelated tax compliance issues that businesses need to consider: (1) state income tax nexus and apportionment rules; and (2) payroll. These issues predate the pandemic, but companies will need to consider this complex area of multi-state tax planning and compliance.