Newly Released ‘Sentiment Index’ Shows CRE Investment Improving, Yet Caution Prevails

The CRE Finance Council (CREFC), the industry association that exclusively represents the $5.6 trillion commercial and multifamily real estate finance industry, announced the results of its “Second-Quarter 2023 CREFC Board of Governors (BOG) Sentiment Index.”

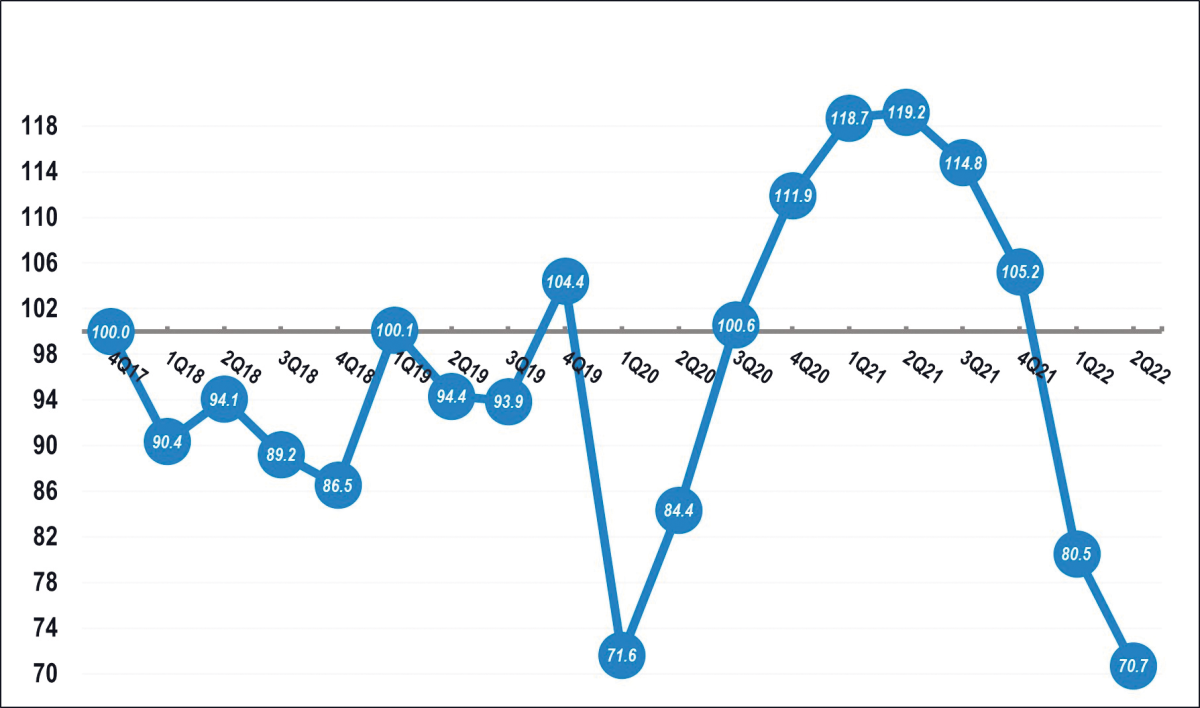

The Sentiment Index, initiated in the fourth quarter of 2017, serves as a barometer for the industry, capturing the perspectives of a diverse swath of the industry, including balance sheet and securitized lenders, loan and bond investors, private equity firms, debt funds, servicers, and rating agencies.

CREFC’s quarterly Sentiment Index is derived from the Board’s responses to nine core questions on the state of the CRE finance market. The Sentiment Index tracks the market pre-COVID, during COVID, and today as we continue to recover from the worst of the pandemic’s impact.

2Q 2023 Survey: Key Areas of Concern

The 2023 second-quarter survey indicates a cautious, modest recovery in market confidence from the previous quarter. The overall index value increased to 78.5 from 67.5 in the first quarter of 2023, suggesting a more positive outlook for the sector. However, concerns still persist across several key areas, as summarized below:

1. Economy: Respondents’ expectations for the U.S. economy over the next 12 months were divided, with 10% predicting improvement, 35% expecting little change, and 55% calling for worsening conditions. In the previous quarter, the sentiment was more bleak, with only 2% anticipating improvement.

2. Policy: Regarding the impact of federal government legislative and regulatory actions, 4% believe there would be a positive effect, 47% expect neutrality, and 49% anticipate negative consequences. The sentiment improved slightly from the previous quarter when no respondents expected a positive impact.

3. Rates: Mortgage rates and cap rates were viewed negatively by 65% of respondents, while 6% expressed a positive outlook, and 29% remained neutral. The sentiment regarding rates improved from the previous quarter, when 88% held a negative view.

4. CRE Fundamentals: Expectations for CRE fundamentals remained pessimistic, with 84% predicting a worsening situation and 16% foreseeing no change. No one anticipated improvement. These figures align with sentiment in the first quarter of 2023.

5. CRE Transaction Activity: In terms of investor demand for commercial real estate and multifamily assets, 25% expected an increase, 45% predicted stability, and 29% anticipated a decrease. Although the sentiment improved from the previous quarter, a notable portion of respondents remained cautious.

6. Financing Demand: Borrower demand for CRE and multifamily loans/financing is expected to increase by 53% of respondents, while 29% anticipate no change and 18% predict a decline. The sentiment reflected a positive trend compared to the previous quarter.

7. Liquidity: Expectations for liquidity in the CRE debt capital markets revealed relatively balanced sentiment, with 14% expecting improvement, 41% foreseeing no change, and 45% anticipating a contraction in liquidity. The sentiment remained stable compared to the previous quarter.

8. CMBS Capital Markets: Respondents expressed a mix of sentiment regarding expected trends in CMBS and CRE CLO demand/spreads, with 14% optimistic, 41% neutral, and 45% pessimistic. These figures align with the sentiment observed in the previous quarter.

9. Industry Sentiment: The overall sentiment for all CRE finance businesses remains cautious, with 67% expressing a negative outlook, 25% maintaining neutrality, and only 8% expressing a positive sentiment. Although the negative sentiment persisted, there was a slight improvement from the previous quarter. Sentiment for the industry peaked in 2Q 2021 when the survey found that 83% had a favorable outlook, with only 3% having an opposing view.

Additionally, the survey included two topical questions unrelated to the index, focusing on the Federal Reserve’s monetary policy and credit standards for CRE loans. Regarding the Fed’s terminal target rate by year-end 2023, 47% of respondents believed there would be no change, while 37% expected a 25 basis point increase. Eight percent anticipated a terminal target rate above the current range, and 8% predicted a rate below the current range. Looking at credit standards for CRE loans, 57% of respondents anticipated further tightening, 41% expected standards to remain steady, and 2% predicted some relaxation.

“The survey’s findings underscore the balance between improving sentiment and lingering concerns within the sector,” said Lisa Pendergast, executive director at CREFC. “As we continue to navigate economic uncertainties and evolving policy landscapes, the industry must remain resilient and adaptable to ensure long-term growth and stability. CREFC will continue to be a resource and advocate for the industry and its members during these uncertain market conditions.”

CREFC is the trade association for the commercial real estate finance industry. Over 300 companies and nearly 18,000 individuals are members of CREFC. CREFC’s members serve a critical role in the U.S. economy by financing office buildings, industrial and warehouse properties, multifamily housing, retail facilities, hotels, and other types of commercial and multifamily real estate.

CREFC’s BOG Sentiment Index aims to gauge quarter-to-quarter shifts in market conditions for the CRE finance market and the outlook for the future. The Sentiment Index equally weights the responses to each question and then sums those weighted responses to create a single index.