Why read a 5-year-old book about ExxonMobil now? Two words: Rex Tillerson

If you want a deeper understanding of what has been inaugurated in Washington, read Steve Coll’s “Private Empire: ExxonMobil and American Power.” Rarely has a book been so profoundly and presciently relevant to events that would take place five years after its publication.

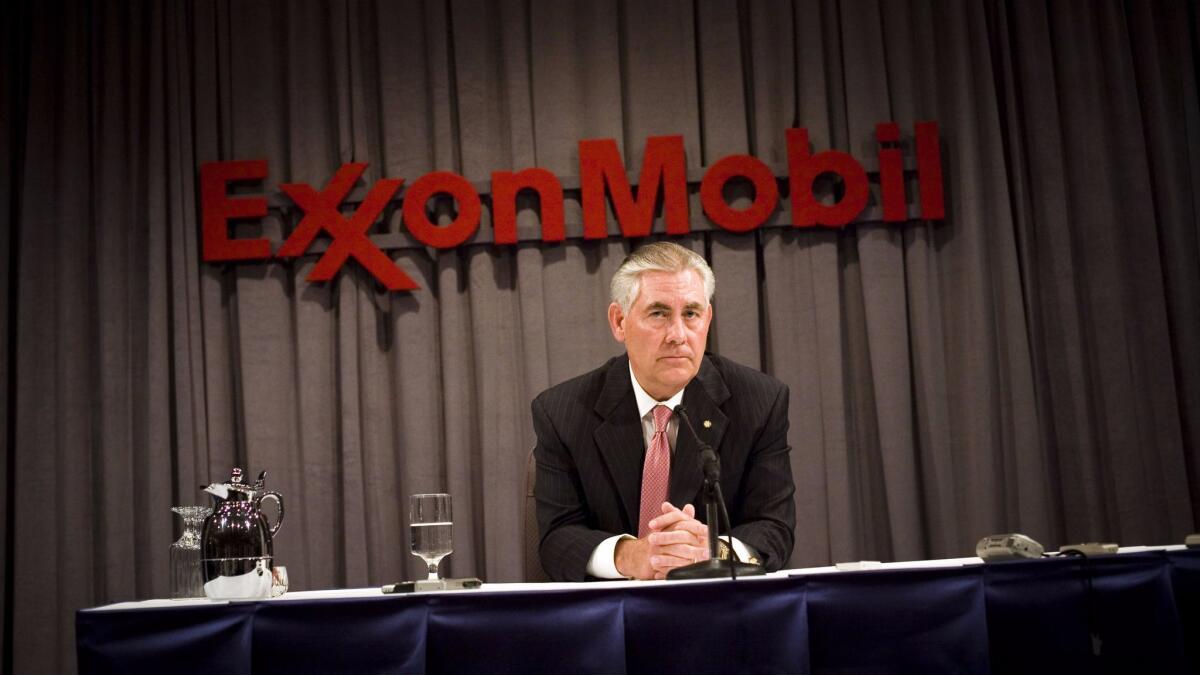

It is not just a book about a company — incoming Secretary of State Rex Tillerson’s gargantuan, profit-spawning alma mater. It is the portrait of an ethos. And as the pattern of Cabinet appointees makes plain, this ethos has just been ushered out from behind any vestige of discretion to rule unabashed over the executive branch of our government.

Full disclosure: I know and like Steve Coll. I hosted him in Kandahar, Afghanistan, when he was working on a January 2012 New Yorker article. But we have scarcely intersected since, and my judgment is not contaminated: I would not recommend his Pulitzer Prize-winning but wordy “Ghost Wars,” for example. “Private Empire” is a much better book.

Weighing in at more than 700 pages, it is wordy too. Readers may want to dip in and out of its various narrative threads, as their particular issues or regions of interest suggest — be it climate change, sea-soiling spills, human rights, the fate of specific countries such as Chad or Venezuela, or the cynicism of corporate influence strategies.

Through the aggregation of these strands, Coll’s trademark marriage of encyclopedic research and thriller writer’s style and construction delivers a clear and unimpeachably substantiated picture. It is a picture of relentless focus on shareholder return above any other consideration, of a cult-like corporate culture characterized by secrecy, rigid conformity and aggressive exploitation of dominant positions, alongside a consistent pattern of public deception.

Media coverage and Tillerson’s confirmation hearings have focused heavily on his relationship with Russia and touched on his attitude toward human rights and potential conflicts of interest when dealing with countries where ExxonMobil operates. But “Private Empire” reveals an underlying mindset that in my view has even more profound implications for his fitness to serve the nation.

One of the most telling passages comes early, in a description of the culture of “rule books and fear-inspiring management techniques” at Exxon. “Analogous to natural selection,” writes Coll, a merciless grading system “hardened Exxon’s culture and wrote the corporation’s DNA.” A point would come in potential managers’ careers “when they either committed to Exxon or left. Those who stayed did not find the … system ironic or extreme; they liked it. … Restless free thinkers and habitual dissenters who accidentally got hired (often as scientists) tended to decide quickly that they would be happier elsewhere. The result was a corporation led in its upper management ranks by … true believers.”

Answering senators’ questions, Tillerson dwelled on his “pivot” away from this world — away from all he had striven to assimilate and become since the age of 23 — assuring them that “if confirmed to be secretary of State, [I] will have one mission only, and that is to represent the interests of the American people.” But 41 years in the environment Coll describes is not dispensed with overnight.

“The ultimate measure (and the chief purpose)” of this culture, writes Coll, “was Exxon’s financial performance.” This sounds self-evident. But the ExxonMobil story encapsulates a profound cultural shift that has swept much of the world beginning in the 1980s: the triumph of money over almost all other measures of social value and standing. I spent two weeks in Nigeria in 2015 asking people if the meaning of money had changed in their lifetimes. The answers were emphatic (yes), articulate and often surprising in their details. Americans have responded with equal fervency. The growing fixation is one of the most significant trends of the last several decades. And ExxonMobil is a chief exemplar. At issue here, as Coll makes clear, is not the profit motive. It is profit as the exclusive motive in the face of trade-offs of broader and broader import.

To stay competitive in this race with no finish line — for “financial performance,” shareholder value, zeroes in bank accounts — elites have been writing rules (or ensuring their selective enforcement) in their own favor. “Private Empire” documents countless examples, including Exxon’s unilateral decision to ignore SEC regulations on how oil holdings should be counted, its bombardment of government scientists with Freedom of Information Act requests while designing protections for its own information “far more severe than anything [one executive had] seen while holding a top secret clearance.”

Compounding the “financial performance” incentive is the way ExxonMobil is valued. It’s not enough for the company’s success to sell fossil fuels and petrochemicals and make money. Coll charts how Exxon’s entire corporate strategy is shaped by the need to gain equity control over, or “book,” new reserves to replace oil it has produced in a given year. For, unless the company opted to expand into other activities or energy sources — which ExxonMobil has declined to do — failure to replace reserves would guarantee an eventual end to the company. And who would buy shares in a doomed company?

The obsessive push to beat its competitors in replacing reserves flies in the face of many realities pertaining to the outside world — a place with which Tillerson is relatively unacquainted, having never lived abroad, as Coll notes. The first, of course, is climate change. If ExxonMobil must keep finding, extracting and selling oil ad infinitum, then no climate concerns can be brooked.

Coll documents the company’s consistent efforts to block international climate agreements and also its deceitful campaign to debunk science while predicating its own planning on that very science.

(As head of the Columbia University Graduate School of Journalism, Coll more recently created the Energy and Environmental Reporting Project, which, in partnership with the L.A. Times, ran a series of stories expanding on the book, unearthing internal documents that showed what the company knew about climate change as far back as the 1980s. On Jan. 12, in one of the investigations resulting from that L.A. Times reporting on the topic, a Massachusetts Superior Court judge ordered ExxonMobil to surrender documents it had sought to withhold.)

Exxon’s attitude is similar to that of Goldman Sachs, which in the lead-up to the 2008 financial crisis bet against the very securities it was selling its customers.

It is unwise, in this context, to credit Tillerson’s belated conversion to the reality of global warming — and even his past support for a carbon tax. “Private Empire” argues convincingly that the shift was a public relations calculation aimed at deflecting criticism without deviating from the overall aim of ensuring governments “lack the political will to … force any big shift away from oil.” Indeed, with more urgency since the conclusion of the Paris climate accord, the company’s survival depended on a Trump victory in November. But the manifestly suicidal basis to this entire business model raises questions about the analytical acumen of those who cleave to it.

Exxon’s need to find replacement reserves has driven the search for oil ever farther and deeper, and in more dangerous locations. The inevitable consequence is spills that devastate irreplaceable natural treasures and human livelihoods, and an exacerbation of the “resource curse” in rich, tragically afflicted developing countries like Equatorial Guinea or Nigeria, where corrupt officials gorge on oil money while much of the population endures crippling poverty. Time and time again, Coll illustrates that ExxonMobil’s instinctive response was to deceive the public about the reality of these consequences.

The picture that emerges from “Private Empire” is of a company and its senior management bereft of the most elementary concept of the public interest or honor’s dictate to take responsibility for the consequences of one’s actions. Coll depicts a company arrogantly conscious of its own sovereignty — as against that of the United States. With the appointment of this company’s CEO, and so many others of his ilk, in the name of an anti-corruption campaign, what we are witnessing is the outright acquisition of our government by what can only be described as a kleptocratic cartel.

Sarah Chayes, a senior fellow at the Carnegie Endowment, is author of “Thieves of State: Why Corruption Threatens Global Security,” which won the 2016 L.A. Times Book Prize, and with Sarah Peck, of “The Oil Curse: A Remedial Role for the Oil Industry.”

“Private Empire: ExxonMobil and American Power”

Steve Coll

Penguin Books, paperback edition: 704 pp., $20

More to Read

Sign up for our Book Club newsletter

Get the latest news, events and more from the Los Angeles Times Book Club, and help us get L.A. reading and talking.

You may occasionally receive promotional content from the Los Angeles Times.