Q&A: Exploring CDFI’s Role In Solving Some Of Society’s Biggest Challenges

- Share via

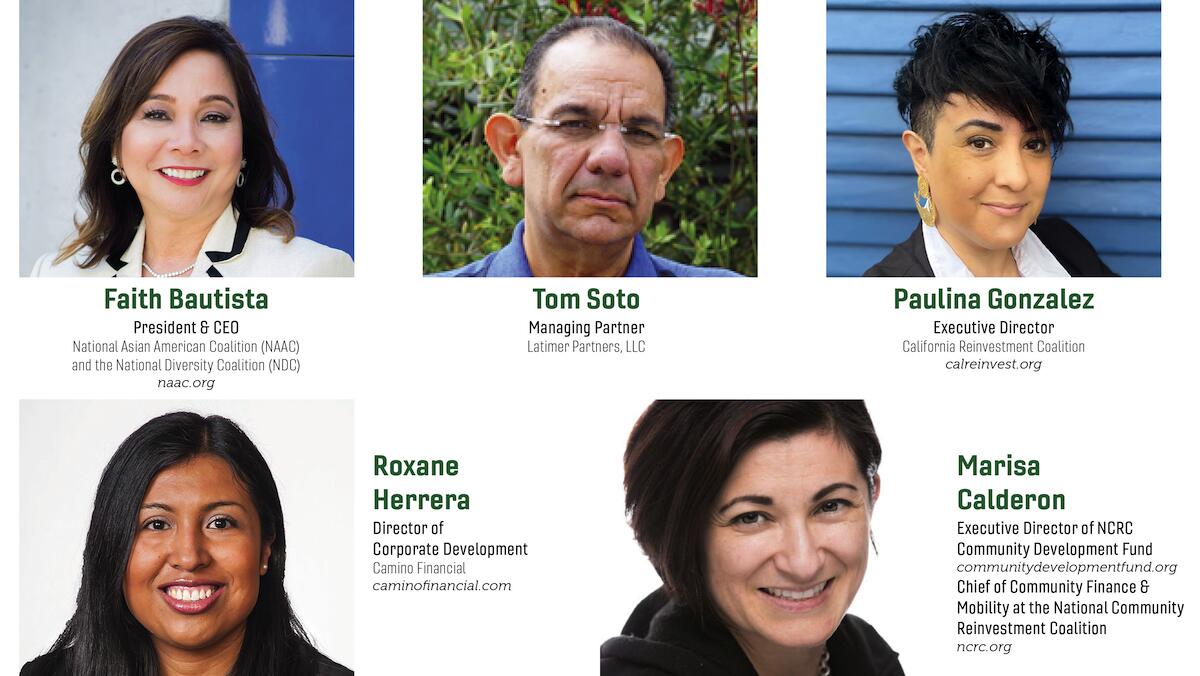

To take a closer look at the CDFI landscape and what is needed to move the critical concept forward, we have turned to some of the region’s leading experts – in community finance, corporate equity and diversity, investing and governance, who graciously weighed in for a discussion and shared insights on the state of CDFIs in 2021 and moving forward.

Q: What role can CDFIs play to bring greater equity to lending and banking services?

Faith Bautista, President & CEO, National Asian American Coalition (NAAC) and the National Diversity Coalition (NDC): Community Development Finance Institutions (CDFIs) address the unmet need and challenges, which the low- and moderate income (LMI) minority communities face in terms of financial inclusion. The loan programs under CDFIs cater to those who cannot obtain or do not qualify for conventional types of loans from traditional banking and financial institutions for say, the purchase of a home or a small business loan. CDFIs are also a viable option that protects and discourages them from availing offers from predatory, hard money lenders. CDFIs are the friendly intermediary that offers and assists those who have a legitimate financial need but do not qualify in terms of what the traditional financial system requires.

Paulina Gonzalez, Executive Director, California Reinvestment Coalition: Generations of Black, Indigenous, and other communities of color have been systematically excluded from accessing small business loans, consumer loans, and mortgages through traditional banks. Even more troubling, decades of redlining have left some communities of color without a bank in sight. When this happens, BIPOC are forced to turn to high-cost a, check-cashing services, and payday lenders to fill the gap. So, CDFIs are an important part of the financial services ecosystem for these communities because they provide credit and financial services to people and communities that are underserved by mainstream commercial banks and lenders. CDFIs also help deploy vital resources and recovery efforts quickly and effectively to BIPOC communities where financial institutions fail to do so. Two clear examples of this are the 2008 foreclosure crisis and the economic impacts of COVID, where CDFIs were able to step in and help stem the financial loss of low-to-moderate income and BIPOC families who did not have a financial buffer.

“The more successful small businesses are, the more jobs they create and, thus, would create that financial inclusion effect on the underbanked.”

— –Bautista

Tom Soto, Managing Partner, Latimer Partners, LLC: CDFIs are central to the future of community banking and to the need for increased access to capital for the underbanked, low-income, and diverse communities around the country, which are becoming more and more the majority of the market. CDFIs’ requirements that call for increasing access to capital by those communities and an increasing role of community reinvestment dollars by retail banks are key to supporting lower- to middle-market businesses within those communities, which are the highest capacity for job growth and good economics. In addition, we find that the ravaging of payday lending of our communities is becoming more and more of a detriment to those communities’ futures.CDFIs ca nplay a role in mitigating the impacts of payday lending and getting payday lending out of our communities. So indeed, there is a considerable role that CDFIs play in bringing greater equity to lending and banking services within those communities, and the banks should have much more of a gun to their heads to make sure that they support CDFIs’ efforts.

Marisa Calderon, Executive Director of NCRC Community Development Fund; Chief of Community Finance & Mobility at the National Community Reinvestment Coalition: As a community development financial institution (CDFI), our mission is focused on the overall financial and long-term success potential of the entrepreneurs with whom we work. We’re a mission-based lender, meaning we are focused on ensuring that underserved borrowers have the tools, knowledge and expertise to succeed. In general, our goal is to ensure our borrowers are credit-ready to receive capital, and where that is not yet the case, we aim to work with them to become credit-ready for the capital needed to operate and grow their businesses. Part of that readiness also means making sure borrowers have a banking relationship so that they can participate in mainstream finance opportunities.

“When done with community input, banks can address both racial and socioeconomic inequities when they invest in communities.”

— –Gonzalez

Roxane Herrera, Director of Corporate Development Camino Financial: CDFIs serve as first responders by bringing affordable capital to the underbanked, who are often overlooked by traditional lenders. Yet, more affordable capital is needed to enable CDFIs to scale and deploy this impact capital to the underbanked. The CDFI Fund has pilot programs such as the Small Dollar Loan Program, Rapid Response Program, and Emergency Capital Investment Program (subordinated debt, etc.). Additionally, during the pandemic, fintechs and CDFIs deployed PPP funds faster, and this proves the need to empower those “first responders” to move more impact capital. CDFIs - especially those operating in low- and moderate-income areas - distribute flexible capital enabling micro businesses to grow. However, more impact capital is needed. Camino seeks to close funding gaps as an AI-powered CDFI fintech. Our fintech platform uses proprietary AI software to aggregate data and build machine learning models that drastically reduce financing costs for Latino small businesses with limited or no credit history. Our role as a national CDFI fintech is to use our proprietary credit-assessment technology to be more efficient in identifying a larger pool of creditworthy borrowers to deploy impact capital at scale.

Q: How can the government better support CDFIs?

Gonzalez: First and foremost, California – as well as the federal government -- needs to recognize that our communities are not well-served by Wall Street banks. Individual states have the power to pass community reinvestment laws that ensure credit unions have an obligation to invest in CDFIs as away to increase support for excluded communities. California, specifically, can better support CDFIs by establishing a CDFI fund with taxpayer dollars.

“By investing with CDFIs, banks and ESG investors could help spur the development of affordable housing and help finance homes for lmi communities and communities of color.”

— –Calderon

This would increase neighborhood stability and would also provide an economic jumpstart for struggling communities. SB625 in California sought to do just that and should be seriously considered as the state grapples with how to assist communities in COVID recovery. A strong network of CDFIs ensures that recovery efforts, like PPP loans, are more likely to reach the communities that need them the most.

Soto: The government can better support CDFIs by increasing the demands on community reinvestment dollars by retail banks. In addition, as we find the rise of fintech financial technology online and part of our community algorithm by increasing access to capital, more of these fintech opportunities should be given greater access to becoming a CDFI, given that they are the growing portion of the banking and financial services sector. And we should assure that as we go into this new era of the revised budget plan that is being discussed in the Senate right now that CDFIs are given the financial throw weight to assure that all of this is much more attractive and seen as a standard in banking practice by increasing access to capital through CDFIs.

Calderon: Government can make historic investments so that CDFIs have lending and operating capital. It can also encourage the private sector - via banks and other entities - to partner with CDFIs to enable them to have the resources to carry out their mission. Because of the Community Reinvestment Act (CRA), banks are obligated to make loans and invest some of their capital in communities where they have branches and take deposits - so that they don’t, for example, take deposits in low-income communities but only lend in wealthy communities. However, today’s lending landscape has changed dramatically, and there are many non-bank lenders - such as fintechs and mortgage lenders - that aren’t bound by the CRA to help under-resourced communities. Meanwhile, borrowers of color are disproportionately served by non-bank lenders. By revisiting and strengthening CRA requirements, as is happening right now, the government can also ensure that financial institutions and lenders other than banks are held to CRA standards. Banks provide capital to CDFIs because it satisfies their CRA obligations, but also because CDFIs already have relationships in the communities they want to serve - low- and moderate-income (LMI) communities and communities of color. It’s a trusting handoff, and it’s a relationship that CDFIs could also expand to nonbank lenders.

Herrera: A number of ways: a) Loan loss reserves or an LLR fund to offset losses for smaller loans to LMI borrowers. b) Guarantee or Guarantee Pool similar to what foundations are starting to aggregate i.e., Community Investment Guarantee Pool to “insure” or de-risk lending to LMI borrowers with small-dollar loan programs (extend Community Advantage program). c) Tax incentives for private investors to participate in Program Related Investments, Donor Advised Funds, or Equity like equivalent investments to help fund CDFI loan programs. d) Unrestricted grants (similar to what Mackenzie Bezos Scott allocated) to support technology to deploy capital faster to LMI borrowers. Another data point is to ease compliance reporting, as impact investors over-reported during COVID, and this restricts CDFIs from using resources in transformative ways to drive impact across communities affected by the pandemic. e) Deregulate smaller, community banks in their tier-one capital ratios and the risk assessment of smaller dollar, micro business credit from regulators. f) Welcome non-bank fintechs into the fold of SBA-guaranteed programs. As seen with PPP, fintechs moved smaller loans to underserved markets.

“CDFIs serve as first responders by bringing affordable capital to the underbanked, who are often overlooked by traditional lenders.”

— –Herrera

Bautista: As the whole country moves forward to recovery from the effects of the pandemic, there are two things I think government regulators must be able to do to be of better support. First is to be vigilant in creating policies and adjusting rules that will ensure better recovery chances and protect the financial well-being of the LMI communities. Second is to plow in more resources and funding towards CDFI programs. There are millions of families and individuals and small business owners out there who still need the much-needed financial support in order to recover-most of them were not given the opportunity to obtain financial help. More resources from the government mean more opportunities for the CDFIs to help.

Q: How can banks and ESG investors best partner with CDFIs?

Soto: Access to capital is the last frontier of civil rights. Banks and ESG investors should give some preference to CDFIs if they see that the technologies that the CDFI is going to support or the businesses have some form of mitigation with respect to things like carbon and responding to climate change but also helps to improve access to better education or healthcare or community benefit. ESG is not just about climate change. It is about improving the quality of life for all the communities that we serve. As part of President Biden’s Justice 40 executive order, CDFIs can play a key role as frontline communities become more of a priority. And CDFIs’ function is to assure access to capital to those on the sidelines and those in the lower markets that otherwise have no access to capital.

Calderon: Banks and investors focused on environmental, social and governance (ESG) objectives can also partner with CDFIs and align their missions to strengthen underserved and under-resourced populations. Generally, a lot of focus now is on small businesses, but there should also be a focus on expanding access to affordable housing, including single-family housing intended for homeownership. By investing with CDFIs, banks and ESG investors could help spur the development of affordable housing and help finance homes for LMI communities and communities of color.

Herrera: Camino is enhancing our national neo-CDFI fintech strategy to deploy micro and small-dollar loans at scale via strategic bank partnerships and ESG investments. However, moving impact capital at scale via CDFIs has been an obstacle. Traditionally, CDFIs have struggled to scale impact capital via technology and AI. This is why Camino is building the largest network of impact capital and financial resources to guide entrepreneurs along their proverbial “camino” or “path” towards building generational wealth. Using technology like our proprietary credit score, CaminoScore, to accurately evaluate and support micro businesses is fundamental to building resilience and propelling micro business growth. One way impact investors can help is via expansion of impact capital relief programs (i.e., Rebuilding CA/NYC Forward funds). More support of federal funding for CDFIs is also needed, as evidenced by the SBA’s Community Navigator pilot that’s creating a hub-and-spoke model to advance strategic partnerships. Camino is looking to expand its network of strategic partnerships with CRA-motivated banks, ESG investors, policymakers, research institutes, and corporate partners to address the underbanked capital need for the Latinx community.

Bautista: The principle is the same with respect to how government regulators can help. What needs to be pointed out for the banking sector is that they should be able to help CDFIs maximize their programs for the LMI communities. After all, the Community Reinvestment Act (CRA) which banks need to uphold and comply with is foremost.

“Access to capital is the last frontier of civil rights.”

— –Soto

Gonzalez: Under the federal Community Reinvestment Act (CRA), banks have an obligation to meet the credit needs of every community they do business in. When done with community input, banks can address both racial and socioeconomic inequities when they invest in communities. When they do so in partnership with CDFIs, they can expand the capacity to serve BIPOC communities. Going beyond that, banks can be better partners to CDFIs by prioritizing nonprofit CDFIs led by People of Color and through targeted investment in smaller CDFIs. To do this, banks will need to re-evaluate their investing criteria and take risks. It’s not enough for banks to invest in large CDFIs, banks must also invest in the small CDFIs led by People of Color, because those CDFIs are closest to our communities, their needs, and understand their pain, and they know best how to address them. CDFIs cannot meet the needs of our communities alone. It takes an ecosystem of CDFIs, banks, credit unions, and nonprofit lenders to close the gap left by redlining.

Q: Where is the most need for increased support and what needs to be done now?

Calderon: A lot is said about affordable housing, but in my view, having an affordable place to live isn’t enough - the fact is, having access to the wealth-building opportunity that homeownership creates needs to be a front-and-center priority. Simply having affordable rental options is not enough if we want to spur wealth creation in historically underserved communities and have an impact on bridging the racial wealth gap. That’s a starting point from which we have to build.

Herrera: A number of things need to be done: a) Improve the Community Advantage program, which was uniquely designed to do smaller loans and incorporate community-driven lenders, many non-bank CDFIs. The program is scheduled to end in 2022, and we need to revisit the program and create a version 2.0, taking a hard look at the lender eligibility criteria, loan requirements, and design around solopreneurs and micro businesses as well as other underserved markets. b) More federal relief capital for hard-hit industries or entrepreneurs from low-income households with poor or no credit history that were most impacted or those that couldn’t access funds. b) Expanded grant funding to support marketplace lending expansion similar to what Connect2Capital launched, add more CRA motivated lenders, insurers, impact investors, or ESG asset managers, as part of an impact capital commitment to provide subordinated debt or access to their balance sheet in a low-cost manner to insulate losses (or add a distribution funnel for loans they are declining to be sent to CDFIs who are doing the hard work to deploy smaller dollar loans or those deemed “too risky or costly”).

“CDFIs – especially those operating in low- and moderate-income areas – distribute flexible capital enabling micro businesses to grow. However, more impact capital is needed.”

— – Herrera

Bautista: As I mentioned, everyone is on an effort to recover from the damages and economic slowdown brought about by the pandemic.This emphasizes the need to focus efforts on providing bridge micro-loans to individuals and families, housing down payment assistance, and small business loans. My organization, the National Asian American Coalition (NAAC), which is a CDFI, is currently developing a digital lending platform in order to help increase loan beneficiaries on a much grander scale and faster approval process.

“CDFIs can play a role in mitigating the impacts of payday lending and getting payday lending out of our communities.”

— –Soto

Gonzalez: BIPOC, low-income communities are most susceptible to crises. With climate change upon us and an ongoing and uneven COVID recovery, state, local, and federal governments must increase their support of CDFIs. There are entire communities that are unserved by California’s current CDFI infrastructure, especially rural communities that have long suffered from disinvestment. CDFIs, who have historically focused on excluded communities, like rural areas, are long overdue to receive critical support.

Soto: Congress and states that regulate small amounts of lending should put more priority on how CDFIs can help to increase access to capital to improve the quality of life for the communities that are underbanked, underserved, and underrepresented. These are the communities that are helping to create the markets that are pushing Wall Street to a bull run and increasing alpha for a lot of the investors. However, it’s these communities that have felt little of the benefit as a result of that alpha being generated for the investors by using the technologies being put out to market. We need to find increased support, and what needs to be done now to assure that CDFIs identify the type of talent and educational opportunity within those communities is to support the businesses that are supporting them in order to create good economics for those low income in diverse communities.

Q: Where is the most need for increased support to serve the underbanked and what needs to be done now?

Herrera: Latino borrowers struggled to obtain loans given: limited personal or business credit history, registered under Tax Identification Number (in the absence of an SSN), limited financial reporting and tracking, no available collateral, or too small or expensive to underwrite by a bank. During the pandemic, Camino’s U.S. Latino Small Business Credit Survey noted a trend where Latino borrowers were discouraged to apply for PPP by lenders and some didn’t apply thinking they wouldn’t get funding or lacked connections. Further, the smallest micro businesses were left behind with limited access to capital. Using our proprietary CaminoScore technology has resulted in more capital in the hands of more Latino owned businesses. For borrowers who did have a pre-existing traditional credit score, Camino was able to offer better, less burdensome terms, freeing up more capital for growth.

Camino is also expanding our virtual technical assistance, enhancing our CaminoScore (enabling alternative data)and automating processes to lower transaction costs for the underbanked. Overall, Camino is leveraging our AI technology to help distribute billions in lower-cost capital for the underbanked.

Bautista: Our tact as NAAC is to strengthen the small business first and foremost. The more successful small businesses are, the more jobs they create and, thus, would create that financial inclusion effect on the underbanked. An integral component of our digital lending platform is the “social borrowing circle,” which creates a community of borrowers that empower each other to be financially responsible and accountable for their loans. Thus, this creates a pathway for the underbanked to achieve financial inclusion.

Gonzalez: Unfortunately, the traditional banking model is built on profits, rather than serving the needs of people, which has placed basic banking services out of reach for BIPOC and low-income communities. Roughly 43% of unbanked and underbanked people make less than $15 per hour; 46% are Black, and 41% are Latinx. The disabled community and seniors also make up a large percentage of the underbanked and unbanked. There need to be alternatives to the extractive and exclusive Wall Street banking system that has historically failed to meet the needs of BIPOC and low-income communities through overdraft fees, monthly minimum balance account fees, and consumer reporting agencies like the ChexSystems.

“Simply having affordable rental options is not enough if we want to spur wealth creation in historically underserved communities and have an impact on bridging the racial wealth gap.”

— –Calderon

Soto: We need to lower the bar for those types of incredibly simple and accessible fintech platforms that are not outrageous with their APR and give them consideration for being a CDFI. We could also work with states and local governments in the community banking arena and federal credit unions to offer wider access to them being CDFIs and thus the communities that they serve. It is very important that startup businesses and small businesses be given this opportunity as well, given that they are the fastest-growing segment of economics in the country most of the time and especially with diverse business owners which we find to be the growing majority of startups.

Calderon: Unbanked and underbanked populations are disproportionately people of color and immigrant populations. More culturally competent outreach can address unique perspectives in unbanked and underbanked populations; this includes engaging with consumers in their language of preference and via media they already consume, like radio, and through grassroots community-based connections and other trusted advisors. This outreach needs to come with an understanding of the cultural context from which they came. For instance, perhaps a potential borrower came from a place where government or financial institutions were unstable, and so they’re understandably distrusting of big corporate or government outreach. A lot of this is recognizing that if you’re the government or a large bank you may not be the best messenger. Trusted advisors, like CDFIs, have genuine relationships and connections in underserved communities.

One of the many things banks must thoughtfully consider is maintaining their branch footprint, especially within LMI communities as this is critically important in ensuring unbanked and underbanked communities have access to banking options. Given an environment of increasing mergers and acquisitions where cost-cutting is a consideration, closing branches should not be one of the options on the chopping block. When people are banked, they have access to information, education, credit-building opportunities and financial products that are not abusive. It’s about ensuring unbanked and underbanked populations are aware of how to build credit and have access to participate in traditional banking and financial services.