Q&A: Social & Environmental Governance (ESG) panel

- Share via

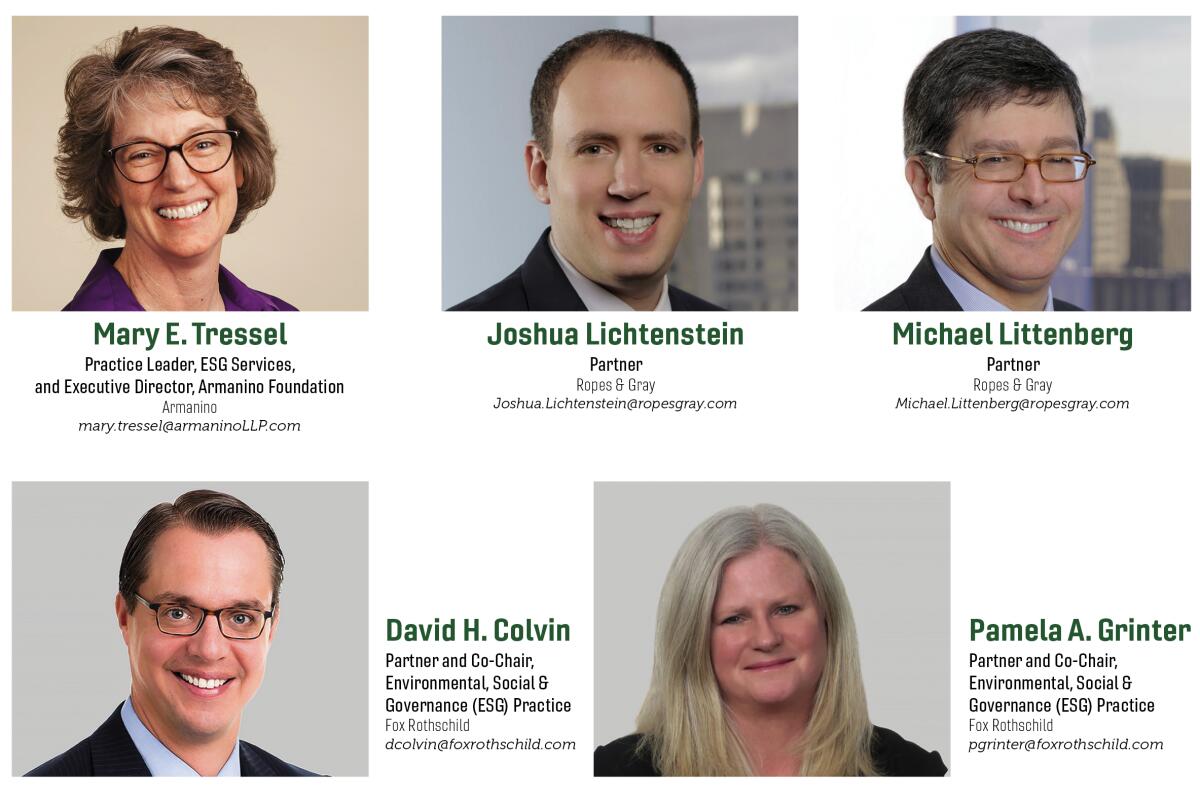

ESG criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. Environmental criteria consider how a company performs as a steward of nature. Social criteria examine how it manages relationships with employees, suppliers, customers, and the communities where it operates. Governance deals with a company’s leadership, executive pay, audits, internal controls, and shareholder rights. To take a closer look at the legal ramifications, benefits and risks of ESG practices, we asked some of the region’s leading legal experts to weigh in.

Q: How do you advise your clients regarding how they can put sustainable financial principles into practice?

Mary E. Tressel, Practice Leader, ESG Services, and Executive Director, Armanino Foundation, Armanino: We advise our clients to complete an ESG readiness assessment to determine where they stand today. That starts with looking at the good work they are doing in environmental, social and governance categories that they can take credit for. Many businesses might not know how their current efforts can be classified as ESG or don’t realize what they’re doing well. We can show them their current state through a readiness assessment and then talk to them about their goals--where do they want to go in the future, and what do they want to achieve? Then we help them build a strategic road map that ties those goals to the organization’s strategic business plan. In terms of sustainable financial principles, we talk to companies about their competitors and their key stakeholders. We can then choose from dozens of ESG frameworks to see which are a good fit for an organization based on its key stakeholders and existing industry specific ESG frameworks. We then make our recommendation about which framework(s) to pursue. Common frameworks that we would evaluate against are the Global Reporting Initiative, the Sustainable Accounting Standards Board and B Corporation.

Q: What are the key benefits for businesses that implement ESG initiatives?

David H. Colvin, Partner and Co-Chair, Environmental, Social & Governance (ESG) Practice, Fox Rothschild & Pamela A. Grinter, Partner and Co-Chair, Environmental, Social & Governance (ESG) Practice, Fox Rothschild: In today’s business climate, ESG initiatives can be critical to creating long-term and sustainable business value. Businesses face heightened pressure to be more accountable to a range of stakeholders, including investors, employees and consumers. Businesses benefit from developing and deploying a strong ESG profile in the following ways: A) New growth opportunities -- Businesses that adapt rapidly to changing environmental and socio-economic conditions are better positioned to identify strategic opportunities and meet new challenges. Investors and consumers increasingly reward businesses whose environmental and social policies and practices align with their values. Adopting an ESG profile aimed at developing sustainable environmental practices, improving employee welfare and increasing diversity throughout the ranks, among other measures, can enhance a company’s brand and provide a competitive edge by attracting new investments, new customers and quality employees. B) Efficiency and cost savings -- Resource efficiency can promote improved financial performance by simultaneously reducing a company’s operational costs and environmental footprint. For example, 3M’s “pollution prevention pays” (3Ps) program resulted in a two-billion-pound reduction in pollutants released into the environment and savings of more than $1 billion. Another study, “ESG and the Cost of Capital” by Ashish Lodh of MSCI Research, found that businesses with high ESG scores often experience lower costs of capital, equityand debt than those with low ESG scores. A strong ESG profile can also increase overall productivity by attracting and retaining quality employees. Research has shown that a positive workplace culture, coupled with a motivated and loyal workforce, can improve productivity and retention while reducing labor costs, enhancing the overall value of the business. C) Improved risk management -- Businesses that ignore environmental, social and governance risks can incur significant economic and legal costs and leave themselves exposed to reputational damage. Incorporating an ESG framework into operations and processes can help mitigate those risks. Environmental measures can address risks related to climate change, natural resource supply constraints and environmental regulatory changes. Social measures can mitigate risks related to employee welfare and workforce readiness. Governance measures can provide assurance that companies do not engage in illegal activity and avoid conflicts of interest.

Q: When it comes to ESG, what are some common risks that companies should avoid, and how can they avoid them?

Joshua Lichtenstein, Partner, Ropes & Gray & Michael Littenberg, Partner, Ropes & Gray: The most common risk drivers are over-promising and under-delivering, and the related driver of viewing ESG as merely a PR exercise not backed up by substance. An ESG strategy can - and should be - ambitious, but it also needs to be executable and aligned with a company’s actions and culture. When done right, an ESG strategy should be an integral part of how the company manages risk and opportunity, rather than something that sits off to the side. Depending upon the particular company, common risks of a poorly conceived or implemented program are cynicism within the company, which can impact recruiting, retention, morale and productivity, adverse publicity, negative customer or consumer sentiment and even increased scrutiny from regulators and shareholders (for public companies) and increased litigation risk. The best way to avoid these risks is to have a program that is genuine, realistic and appropriately resourced.

Tressel: A lack of internal controls around reporting is a red flag. Many ESG metrics are not included on a balance sheet. While great controls for financial reporting exist, metrics around diversity, equity and inclusion, as well as things like your carbon footprint, are not yet regulated by the SEC. A company can say they’ve invested in these programs and are taking steps forward. Still, they must have evidence and facts to back these statements, particularly as ESG reporting is likely to become regulated and even mandated soon. Having one source of data and knowing the audit trail behind it will help companies ensure their ESG reporting meets the standards of different ESG frameworks and helps future-proof their business for regulations to come. Partnering with internal controls experts can help companies prepare for shifts and new requirements in ESG reporting.

Colvin & Grinter: There are a number of risks to consider:

Risk#1 - Involve all appropriate stakeholders in the materiality assessment. One of a company’s first tasks when developing an ESG profile is to conduct a materiality assessment. Industry-specific standards, such as those developed by the Sustainability Accounting Standards Board (SASB), can be a good place to start, but those guides are just the first step. To create a comprehensive ESG profile that captures a company’s goals and objectives, the company should involve all interested stakeholders. Any solid materiality assessment should seek input from the organization’s legal, environmental health and safety, human resources and information technology departments. Companies that take a narrow approach to ESG run the risk that important operational and cultural components will be overlooked. In short, make sure that all essential stakeholders are involved.

Risk #2 - Adopt attainable, meaningful, measurable and reportable goals. A common pitfall of ESG programs is the failure to identify key performance indicators (KPIs) that will be measured to assess the company’s progress toward its ESG goals and objectives and reported to key stakeholders. ESG programs should include short- and long-term goals and identify metrics the company will use to measure and report progress. There is a balance to be achieved in creating an accountable ESG program while preserving the necessary flexibility to adapt to changing conditions and circumstances. While certain ESG goals can be measured by financial indicators, others consist of implementing environmental and social policies designed to reduce or eliminate potential risks. Companies can avoid problems with setting and achieving their goals by identifying KPIs that are meaningful, achievable, realistic and reportable. Companies should also incorporate mechanisms for adapting and updating their ESG goals over time.

Risk #3 - Take a hard look at corporate culture and internal activities. Failure to recognize endemic problems is a major risk that can be avoided by taking a hard look at internal practices and structures. The company may be plagued by a toxic work culture, inappropriate sales or marketing practices, environmental justice issues or other potentially catastrophic events on the horizon. A thorough risk analysis that critically evaluates the company’s culture and risk points from a variety of perspectives should reveal information that could be harmful if publicly known or disclosed. If major risks are identified that could negatively impact the company from an ESG perspective, it is essential that the company put in place a transparent process for identifying and addressing them.

Q: Is the state of California more ESG-focused than other regions? How do ESG practices differ in other regions?

Lichtenstein & Littenberg: For sure, California is at the forefront of what is considered “ESG regulation,” as distinct from the broader body of California environmental and labor rights legislation. This includes, going back more than a decade, the adoption of the Transparency in Supply Chains Act and continuing with adopted or proposed legislation on board diversity, climate risk disclosure and overseas child labor. And, most recently, in late September, the adoption of the Garment Worker Protection Act. However, ESG is a national and global trend, so it’s not so much a question of how California practices differ, but rather how a company doing business in California holistically, efficiently and effectively manages to ESG requirements and expectations across all of the markets in which it is active. With the continuing increase in ESG requirements and expectations globally, a siloed California-only approach is not prudent for most businesses.

Q: What are some key areas of focus to consider for companies as they consider enhancing social sustainability?

Tressel: Most of us would think about social and racial justice, given recent events and our social climate. Social sustainability also includes being involved in your community. Corporate foundations and corporate citizenship programs that include volunteerism or donations help create partnerships and support social enterprises. Local purchasing and hiring policies also have a positive impact, and looking at local suppliers and diversity, equity and inclusion in your suppliers can enhance social sustainability. Social sustainability also shows in how you care for your employees, from health and wellness benefits to tuition reimbursement. Companies can even implement things like a 360-degree review process and ensure their job postings use inclusive and equitable language. Having a formal philanthropy program and measuring the impact of investments in the community is another way to ensure giving back and doing good meets ESG standards that your stakeholders care about.

Q: Looking to the future, what do you envision aiding and/or impeding the continuation of the recent upward trajectory in impact finance? How do you predict it will develop?

Lichtenstein & Littenberg: We are seeing governments around the world making ESG-favorable changes in law, including the European Union and U.S. states. The U.S. DOL has also recently proposed a new rule explicitly recognizing how climate change and other ESG factors that haveamaterial impact on financial risk and return are appropriate considerations in selecting retirement plan investments. If finalized, this rule will further enable private pensions and 401(k) plans to invest in ESG funds. These changes should lower historical barriers to ESG investing by institutional investors. As these investors create more demand for ESG, we expect that there will be a continued “snowball” effect where more and more asset managers will offer ESG funds or adopt portfolio-wide ESG initiatives, like making net zero carbon pledges. Long-term, ESG may transition from a special feature of impact funds to a baseline expectation for investment funds generally.

Q: Do you feel the “invest in ESG” trend is likely to continue growing steadily for years to come?

Colvin & Grinter: The “invest in ESG” trend is likely to continue for the foreseeable future, although the way we approach it may change. In addition to investors, a company’s ESG stakeholders include suppliers, customers and employees. These groups will all continue to drive companies to assess material ESG issues, improve on performance in ESG areas and accurately report on ESG gains. Investors will continue to expect insight into a target’s progress on ESG initiatives as well as its impact in ESG areas. More investors will target their investments in ways that align with their values, and this type of investing will become more mainstream. Not only are individual investors engaging in values-based investing, but professional investors are also increasingly offering a broad range of ESG products. ESG investments are more than just a value statement. Companies that have completed a material ESG analysis and are addressing ESG-related issues may also financially outperform their competitors. ESG disclosures may be a sign of a company’s strong health; that the board values and is addressing performance in these areas is an indicator of a well-run enterprise. At some point, however, the balance will shift. Rather than ESG being an independent review point or disclosure demand, material ESG issues will be imbedded in all levels of company analysis and reporting. ESG will become ingrained in performance and analysis of the company’s core business. Incorporating strong ESG business practices into company operations makes good business sense, maximizing shareholder value.

Lichtenstein & Littenberg: There is a sense of momentum in the ESG finance sector, and we believe it is based on the combination of investor desire for ESG funds and regulatory changes that are encouraging more ESG focused funds. The regulatory changes in particular are important, because new mandates from the European Union, the U.S. DOL and state governments for ESG investing (and for incorporating ESG factors into investment decision-making) will result in more long-term institutional commitments to ESG funds and strategies. We also expect to see steady growth as ESG funds become more common in 401(k) plans, because 401(k) plan investors tend to hold their investments long-term and continue to commit capital to those investments.

Q: Is ESG something of value to companies of only specific industries?

Tressel: ESG may be more mature within a single industry than another, but the ROI of ESG is possible regardless of what a company does. A nonprofit can realize ROI from investing in ESG just as well as a for-profit entity, and companies that produce green products like electric vehicles and renewable energy are poised to create value in an ESG-driven world. Every company, however, can achieve value, and every organization can take on ESG initiatives with small steps and accountability that lead to ambitious goals and impactful change over the long run. Having a roadmap to get your company there is critical to seeing the potential and staying on track to meet ESG goals.

Colvin & Grinter: Is ESG of value only to specific industries? Absolutely not. ESG is valuable across all industries because it impacts all sectors of the economy, both in the U.S. and globally. Although ESG is commonly understood to apply only to large public companies, companies of all sizes - public and private - should be thinking about developing and deploying a strong ESG profile. While it is true that a strong ESG profile is an important consideration for investors, recent research shows customers and employees of all companies are increasingly making purchasing and employment decisions based upon a company’s perceived commitment to environmental and social values. When it comes to developing a strong ESG profile, all companies should ask themselves: (1) What are the material environmental, social and governance risks to the company? (2) What can the company do to address and minimize those risks? (3) How will the company measure its progress to neutralize or minimize the identified risks? and (4) Where and how will the company report its measurable progress? The way companies answer these questions is important both to the investment community and to existing and prospective consumers, employees and other key stakeholders. Companies face increased pressure from customers, employees, ratings agencies and other stakeholder groups to develop, meet and report on ESG standards in areas such as climate impact, board and rank-and-file diversity, sustainable finance, human and labor rights, ethics and technology and social equity. Importantly, ESG considerations are limited not only to corporate social responsibility but also to new regulatory requirements and compliance enforcement. As a result, although relevant ESG-related risks may differ across industries and economic sectors, all companies across all industries should be working to develop a strong ESG profile.

Q: In what way are corporate ESG disclosures beneficial?

Tressel: Transparency helps companies to build loyalty with their employees, their customer base, their regulators, and their communities. Companies can build greater employee loyalty as an employer by offering a view into their ESG efforts, demonstrating their continued commitment to success and holding themselves accountable for their actions. Investors are also drawn to these disclosures, as they provide metrics and a clear picture of long-term sustainability and the potential for stable finances down the line.

Colvin & Grinter: ESG disclosures are becoming the norm as companies recognize that their performance on ESG-related issues provides essential information to their investors, customers, employees and governing bodies. This is driven partly by regulatory requirements. For example, depending on the particular facts and circumstances surrounding a company’s business, legal proceedings, risk factors and financial conditions, compliance with SEC disclosure requirements may require disclosure related to climate change risks and opportunities. Beyond legal and regulatory obligations, investors and consumers have led the initiative to demand greater transparency and accountability from industry players. Improvements in sustainability reporting standards have accelerated demand for greater commitment to ESG values. Corporate ESG disclosures are beneficial for many reasons. One major reason is financial --agrowing body of evidence shows that firms with higher ESG ratings tend to outperform their competitors. Demonstrating a commitment to financial indicators of ESG performance is good for the bottom line. Consider also the costs of not having an ESG disclosure and how that reflects on a company’s values and market presence. It’s critically important to make accurate and measurable ESG disclosures to maintain credibility and demonstrate the achievement of ESG goals. Standardization of ESG disclosure guidelines is helping companies realize these benefits and find innovative ways to achieve ESG goals and reduce risks. While some ESG standards focus on identifying financially material ESG factors, increased attention is being placed onnon-financial ESG information. Demonstrating a commitment to diversity at all levels of the company, as well as social justice and equity, can enhance a company’s competitiveness among investors, consumers and employees. In addition, identification and disclosure of non-financial indicators can evolve into financial gains by identifying risk factors and creating sustainable long-term returns. Non-financial ESG metrics should be viewed as essential components of a successful ESG program.

Q: Have other attempts to make companies report how their activities affect societal outcomes worked?

Tressel: While corporate social responsibility (CSR) became a major focus in the ‘80s and ‘90s, it was the foundation for what we know as ESG today. Our current emphasis on ESG builds upon past focus on community involvement, environmental friendliness and sustainability. With CSR, we made steps forward that have led us to this moment where ESG is a societal imperative. The exciting part about ESG today is how much the public desires it, and there will continue to be progress. The environmental movements of the ‘60s and ‘70s led to some of the benefits we enjoy today.

Q: How concerned are the boards of U.S. companies about climate issues today and which climate issues are topping the list?

Lichtenstein & Littenberg: Climate is an increasing area of focus for boards. The level of concern and specific concerns are somewhat industry- and geography-specific. But, at a high level, boards are most focused on the transition and physical risks of climate change. For example, in California, this includes the physical risks of fire and water scarcity and the transition risks posed by policy and regulatory developments. Boards are rapidly increasing their fluency on climate risks to more effectively exercise their oversight responsibility. At many companies, this includes taking into account, as part of oversight, strategy and risk management, the recommendations of the Task Force on Climate-Related Financial Disclosures. Boards also are taking into account the expectations of stewardship teams at leading institutional investors as well as initiatives such as Climate Action 100+. In addition, boards are closely monitoring climate risk disclosure initiatives across several jurisdictions.

Colvin & Grinter: Corporate boards are increasingly concerned about climate-related issues, particularly as boards become more fluent with how the company’s operations impact the environment and vice versa (e.g., if the company has operations in an area that is susceptible to weather-related disasters). In rejoining the Paris Agreement, the U.S. has committed to an economy-wide target of reducing net greenhouse gas emissions to 50-52% below 2005 emission levels and corporate boards are taking note. “Net zero” carbon pledges seem to be made every day - and from some pleasantly surprising places (looking at you, airline industry). But what matters more than an environmentally friendly, aspirational pledge is whether the company has a plan in place to get there. Corporate boards should require management to identify all climate-related risks faced by the company and report regularly on how the company plans to address and minimize those risks. Corporate boards should be concerned with the SEC’s creation of a new climate-focused enforcement task force (which will aim to identify material gaps or misstatements in climate-related disclosures) and potential regulatory enforcement actions arising from climate-related disclosures. To minimize the risk created by climate-related disclosures, the board should mandate that the company’s climate risks are properly documented and that all climate-related goals and objectives are regularly measured, reported, and adjusted, as necessary and appropriate. Boards should exercise active oversight over the company’s implementation of climate-related policies and procedures, as well as the measuring and reporting of the company’s climate-related goals and objectives. Corporate boards should be concerned with the SEC’s new climate-related disclosure requirements, which could be announced before the end of 2021. These new climate-related disclosure requirements could impose a significant burden on companies and create additional legal and regulatory risk. The climate-related questions that we are hearing most frequently relate to net zero carbon pledges and identifying new sources of renewable energy.

Q: Are climate issues seen primarily as risk-related or are there other drivers?

Lichtenstein & Littenberg: At the current time, we see climate issues playing a big role in diligence and risk processes for asset managers. This is true for ESG factors generally, not just climate, but climate risks are uniquely suited to longer-term risk assessments. While some types of investment risk are more focused on short-term risks and costs, climate change risk can be assessed in terms of near-term and much longer-term risks, like the risk of coastal erosion on beachfront real estate.

As governments create more requirements and incentive programs for carbon mitigation and other environmental goals, we expect that more investment managers will shift from only evaluating environmental risks and using restriction lists to seeking out environmental investments as affirmative opportunities for value creation.

Q: What’s one thing you hope readers will take away from this discussion?

Tressel: The organizations that are genuine in their commitment to building businesses based on ESG principles will derive the greatest benefit. Businesses can meet multiple business strategic objectives by focusing on ESG, and there is measurable ROI for the time, talent and money invested in ESG.

Lichtenstein & Littenberg: We think that the market is at an inflection point now, where ESG is transitioning from more of a niche consideration to a key aspect of how investment funds operate and market themselves. Increasing investor interest and new laws and regulations are driving demand among many institutional investors, and we expect that to continue as governments provide more clarity on how ESG impacts should be assessed and reported. Long-term, we think that considering ESG factors will become a baseline feature of most investment products.