Investing app Acorns doesn’t want savings to be a ‘bummer,’ so just give it your spare change

- Share via

It’s a common refrain: If you want to save money for retirement or a down payment for a house, stop buying pricey coffee. Or there’s the more recent admonition: Lay off the avocado toast.

Fat chance on that. For most people, the link between long-term financial health and a few bucks spent here or there just isn’t strong enough — even though every little bit socked away can help.

So instead of urging customers not to buy stuff, Irvine start-up Acorns has a different suggestion: Save a little bit every time you spend.

The company, through its app, rounds off customers’ credit or debit card purchases to the nearest dollar and invests the difference into stocks and bonds.

The notion is to make saving and investing not only simple but virtually invisible.

“We're not trying to preach austerity to the client, because that’s a bummer,” said Manning Field, the company’s chief commercial officer. “Some people will say, ‘Don't have the cup of coffee.’ We'll tell you to have the cup of coffee and invest along the way.”

That pitch has been appealing, with the number of accounts growing from 1.1 million at the end of last year to 1.8 million this month. Most accounts are small, though — about $230 on average as of last year, the last time the company released such a figure.

Now Acorns has released an update of its app with features aimed at boosting how much customers save. And it’s looking ahead to offering more than just its saving and investing tool amid stiffening competition in the emerging business of automated money management.

Big “robo advisors,” which position themselves as online alternatives to traditional brokerage and wealth management firms, have amassed billions in client assets — much more than the $257 million that Acorns managed at the end of last year — though they have fewer and wealthier customers. New York-based Betterment, for instance, manages more than $9 billion but has just 330,000 accounts.

There are also a growing number of apps aimed, like Acorns, at small savers and investors. Investment app Stash has a similar offering, but without the save-the-change feature; Digit and Qapital both offer automated savings, but put customers’ cash into a savings account.

Noah Kerner, who has been Acorns’ chief executive since last spring, said he’s not concerned about competing apps — “I don’t believe people want to app hop.” But Kerner does acknowledge that he wants the company to offer a broader range of financial services.

“If you can tackle someone’s core financial challenges with the simplest product and the most automated solution, I think that ultimately wins the day,” he said.

For now, though, Acorns remains focused on finding ways to encourage customers to put away a bit more cash.

To that end, the company in April added Shlomo Benartzi, a prominent UCLA behavioral economist, to its board of directors. Benartzi’s research has focused on finding ways to increase savings and on how to influence online behavior. Acorns’ updated app incorporates some of his insights.

Benartzi said if customers don’t save enough, they might abandon the app and stop saving altogether.

“You want to make sure people don’t get frustrated because the amounts don’t add up as fast as they wanted,” he said. “If you save up for a year and don’t even have enough for a new iPhone, it’s easy to get discouraged.”

New saving tricks

Acorns was founded in 2012 by Jeffrey Cruttenden and his father, Walter, a longtime Orange County businessman who founded an investment bank now known as Roth Capital Partners.

The firm — whose name makes the obvious allusion to how a small stashed-away acorn can grow into a giant tree — launched its app two years later.

Acorns investment accounts themselves are quite basic, giving customers a limited menu of options. Customers can choose one of five portfolios, ranging from conservative — mostly government and corporate bonds — to aggressive — all stocks, no bonds. The money is parked in a handful of index funds managed by big-name firms including Vanguard and BlackRock.

Most customers link a bank account and a debit or credit card to their Acorns account. The firm monitors spending and, once the spare change from purchases adds up to $5 or more, it takes that amount from the bank account and invests it. (There are transaction costs, which is why the firm doesn’t take out a few cents after every purchase.)

The company charges a flat fee of $1 a month for accounts of less than $5,000 and an annual 0.25% fee for accounts larger than that.

Acorns isn’t profitable, but it has attracted some big-name investors, including Silicon Valley payments giant PayPal and Point72 Asset Management, a firm led by billionaire hedge fund manager Steven A. Cohen.

Though Acorns was built to encourage passive saving and investing, it turns out that Acorns’ customers look at the app every other day, on average.

Benartzi said that the company’s customer base and the frequency with which users open the app provides an opportunity to determine what motivates people to save.

“You can run a lot of tests, and we do,” he said. “The ability to learn is unbelievable.”

For instance, along with investing spare change from purchases, Acorns encourages customers to make a recurring investment of as little as $5 a month. Benartzi said a recent test asked customers to make recurring investments of either $5 a day, $35 a week or $150 a month.

Any of the options, of course, would result in the same total savings, but customers reacted quite differently. Benartzi said $5 a day was by far the most popular, chosen about four times as often as $150 a month.

Benartzi said he wants to see what other tricks — including personalized suggestions — can help customers build a meaningful nest egg.

“When you’re saving the change, you’re talking about maybe a few hundred bucks a year,” he said. “You’re not going to accumulate wealth by doing just that. I do not think there will one single trick — you need different mechanisms for different people.”

Seeing more potential

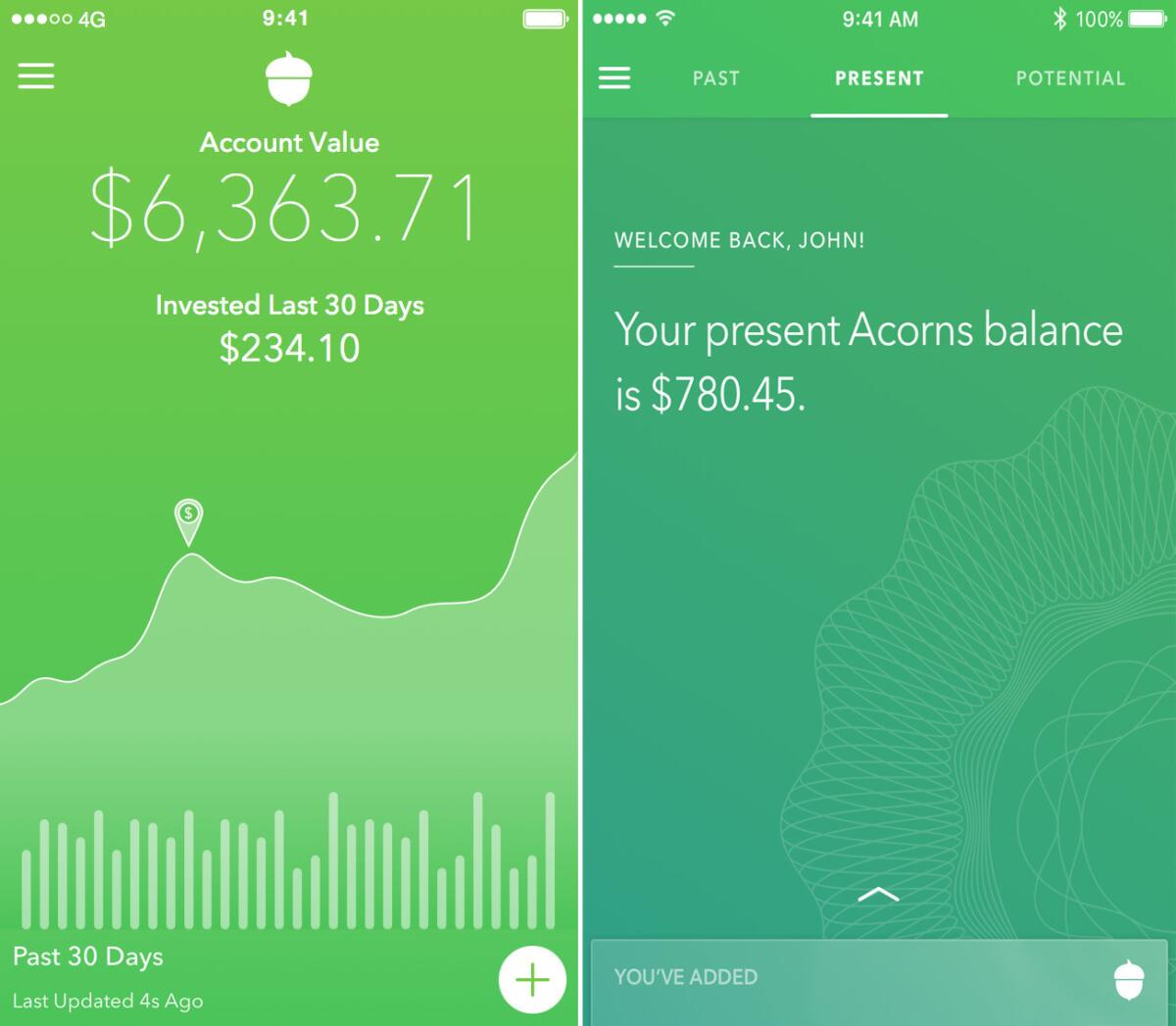

One of those mechanisms in the updated app is a tool that enables users to more easily see the benefits of an additional daily, weekly or monthly investment.

A new screen labeled “potential” includes a chart showing how an account would grow, assuming steady investments and an annual return that ranges up to 6%. Users also can see how their balance might differ in 10 or 20 or 40 years if they boost a recurring investment.

This feature, Benartzi said, is designed to show, in very simple terms, the big difference that can come from a relatively small change.

“It helps you link action to outcome,” he said. “If I do $5 a day instead of $3, how does that change the end result? It’s difficult for people to imagine how that small amount accumulates in the long run. It’s not easy math.”

And it’s working. Acorns has been testing the new version of the app for about a month with about 5% of users. In that time, 17% of users who went to the new “potential” screen either added a recurring investment for the first time or increased their existing one.

Cents on top of cents

Another new feature, the round-up multiplier, lets customers put aside more cash after making purchases. Instead of investing 25 cents after a $3.75 purchase, users can multiply that spare change by two, three or 10.

In early testing, 30% of Acorns users have turned on the multiplier feature, most of them doubling the spare change.

Benartzi said he wants Acorns to experiment with other ways to encourage more spending-linked investment, such as rounding up purchases to the nearest $5 increment or investing a percentage of each purchase.

“If you’re buying coffee for $3.10 and save 90 cents, you might not want to save more than that. But what if you buy something for $98?” he said. “Wouldn’t you want to save more when you buy that big item? Over time, we’ll learn what works best.”

No more fever chart

One thing that was dropped in the update was a home screen graphic that looked like a stock chart, showing the change in an account balance over the last month due to investments, withdrawals and market gains or losses.

For a company focused on passive investing and the benefits of thinking long term, showing a 30-day fever chart sent the wrong message.

“Anything that gets our customers focused on the short term and hyper tuned in to market fluctuations is not good,” CEO Kerner said.

As Acorns continues to tweak its investment tools, Kerner said the company may next focus on responsible spending.

That means Acorns might eventually offer some kind of checking account, a move that could make the company an integrated spending, saving and investing service that would rival many basic bank functions.

“Helping people spend responsibly is a huge part of living a better financial life,” Kerner said. “We will be solving that problem.”

Follow me: @jrkoren

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.