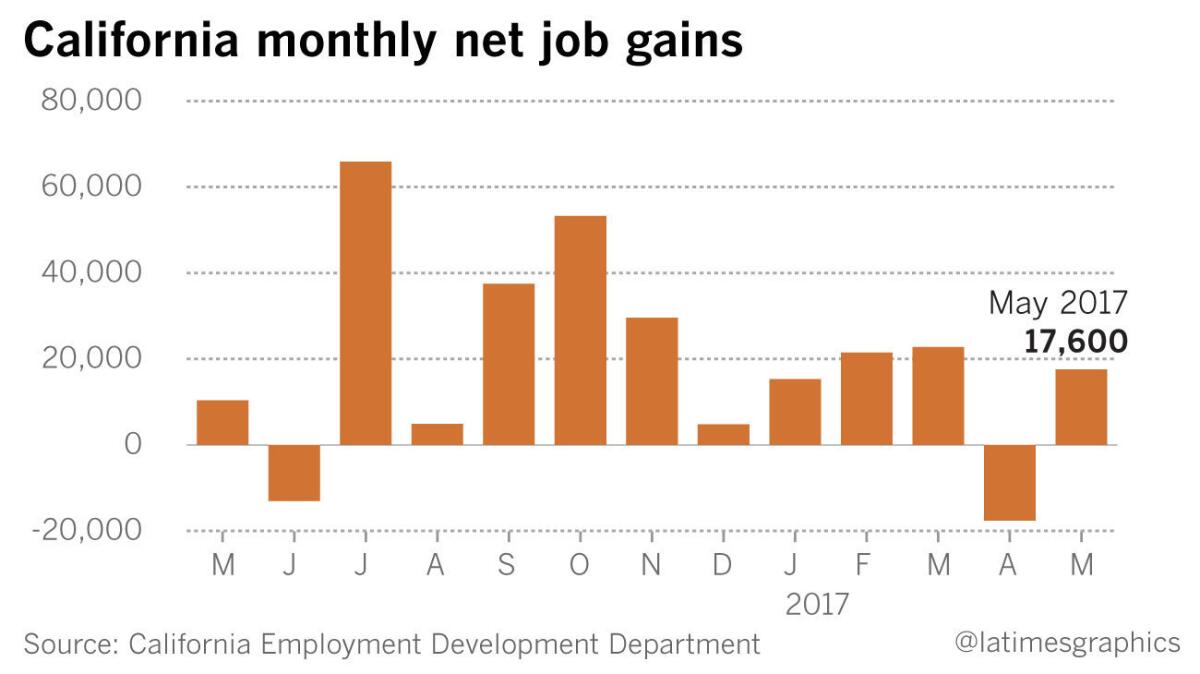

As labor market tightens, California unemployment rate sinks to 4.7% in May

California businesses added a net 17,600 new jobs in May, dropping the unemployment rate to 4.7%, according to data released Friday by the state’s Employment Development Department.

The jobless rate tied a record low reached in November 2000, the agency said.”This is positive news for the state of California in terms of its pace as a steady rebound from sluggish growth,” said Dave Smith, an economist at the Pepperdine Graziadio School of Business and Management.

The report follows a disappointing April, when the state lost jobs for the first time in several months. The May unemployment rate dropped from 4.8% in April, but it still hovers above the national rate of 4.3%.“That’s to be expected. We were hit much harder by the recession and so we had a much longer way to go in terms of recovery,” Smith said.

For the second month in a row, the state economy’s year-over-year growth was slower in May than the overall U.S. economy.

Nationally, jobs grew by 1.6% since last May, compared with 1.5% in California. The state was lifted by the information sector and government employers, which posted a combined gain of 21,900 jobs.

Last month’s losers included leisure and hospitality, and professional and business services, which cut 11,400 jobs in total. Manufacturing and mining operations have eliminated 10,600 people from their payrolls over the year.

Los Angeles rebounds

More Los Angeles County residents joined the workforce in May, and employers were ready for them. The county added a net 20,300 jobs in May, more than the uptick in the state as a whole, meaning the rest of the state lost jobs overall. The county had weathered a rough April, when it lost 7,300 jobs.

Last month, 11,000 new workers entered the local labor market — i.e., they got a job or started looking for one — a sign of their confidence that businesses are still hiring. The county’s jobless rate ticked lower, to 4.4%, from 4.5% in April.

Leisure and hospitality was the most impressive sector last month, posting an increase of 6,600 jobs. Food and accommodation businesses did the most hiring within that sector.

Motion picture and sound recording — the Hollywood contingent — had a surprisingly good month, adding 4,600 jobs in the county. The sector had been lagging and remains the worst performing industry over the last 12 months.

Few available workers

The last two months marked the first time that the state has lagged behind the nation in job creation since 2012. As the labor market tightens everywhere — unemployment in the nation hit a 16-year low last month — economists expect that employers nationwide will have to scrounge to find workers.

Of course, two months does not spell an economic trend, and it is too early to label California an underachiever. But economists say the state may be dragging behind the nation because it is so hard to find housing in big California cities.

“The slowing was inevitable, because we can’t build housing. You can’t grow your labor force if you can’t build housing,” said Chris Thornberg, co-founder of Beacon Economics, a Los Angeles-based consulting firm. “There’s no more labor force available.”

There were 23,000 fewer people in the state’s labor force in May compared with April.

Retail slump hits

It is no secret that America’s malls and storefronts are cratering. Since January, retail trade businesses have laid off more than 80,000 people nationwide.

Big-box retailers are wiping themselves off the map, and the list of companies that will close stores this year is long, including Sears, J.C. Penney, Guess, Gymboree and Abercombie & Fitch.

California, home to 11% of the country’s retail workers, is starting to feel that pain. Over the last two months, retailers in the state cut 3,500 jobs. Year-over-year, employment in the sector is only down slightly. But that’s a radical change from the prior 12-month period, from May 2015 to May 2016, when retailers added 23,200 jobs, a 14% increase.

“We are seeing some pretty dramatic changes in the way that consumers purchase goods and services,” said Smith, the Pepperdine economist. “The way that younger people behave is different than baby boomers, who are very brick and mortar focused.”

In other words, the retail slump isn’t a blip — it’s a sign of an economic shift that has momentum on its side.

UPDATES:

12:45 p.m.: This article was updated with analysis of the retail slump.

11 a.m.: This article was updated with analysis of the tightening job market.

10:10 a.m.: This article was updated with Los Angeles County data.

The article was originally published at 9:10 a.m.