Uber keeps burning through money and its sales growth slows as it prepares for IPO

- Share via

Uber Technologies Inc., the ride-hailing giant that’s preparing for an initial public offering this year, released its fourth-quarter financial results Friday, showing slowing revenue growth and persistent losses.

For full-year 2018, those losses were down 15% compared with the year before, but they reached an adjusted $1.8 billion. That could pose a challenge to investors trying to figure out Uber’s value in the public markets. Last year, bankers vying to lead the San Francisco company’s IPO told Uber that the market could value it at $120 billion. News that the company is still burning through more than $1 billion annually may give some investors pause.

Like many other unicorns — that is, privately held start-ups with a value of $1 billion or more — San Francisco-based Uber is emphasizing growth over profits. The company is investing aggressively in food delivery, logistics, electric bikes and self-driving cars. Last year, Uber bought Jump Bikes to help with its new mobility efforts, and it has a $1-billion budget for such projects this year.

Despite those investments, sales didn’t grow as fast in the fourth quarter as they have in the past. Of the $11.4 billion in net revenue the company generated in 2018, $3 billion came in the last three months of the year, up only 2% from the previous quarter. That puts the company’s year-over-year quarterly growth rate at 25%. That’s high by many standards, but significantly lower than Uber’s third-quarter rate of 38% — which itself was only about half the rate of six months prior.

As it released the numbers, Uber touted the rising use of its app around the world. “Last year was our strongest yet, and [the fourth quarter] set another record for engagement on our platform,” Uber chief financial officer Nelson Chai said in a statement. “In 2018, our ridesharing business maintained category leadership in all regions we serve.”

Chai also said the company’s trucking business, Uber Freight, had “gained exciting traction in the U.S.” and that its fast-growing food service, Uber Eats, “became the largest online food delivery business outside of China, based on gross bookings.”

Although the data provide a window into Uber’s operations, there are still plenty of ways to look at Uber’s massive cash burn, and some financial details are still opaque. For example, Uber had a tax windfall in the fourth quarter that it didn’t explain, but that was responsible for reducing its fourth-quarter losses to $865 million from $1.2 billion, according to generally accepted accounting standards.

A worrying sign for investors scrutinizing the company’s financials is that Uber’s share of money from customer payments has been shrinking. Uber generated $50.2 billion in gross bookings in 2018. But in Latin America, the company is dropping its fees on drivers in order to fend off competitors. And rides in the United States have been less profitable than Uber expected because of sustained competition with competitor Lyft Inc. (Lyft is also planning an IPO.) Of course, Uber’s margins would improve if it begins to take a larger share of fares.

Because the company is private, it’s not required to release financial information. However, Uber started releasing some numbers in April 2017, after years of leaks. It was an unusual move for a startup, even one that tends to do things its own way. Uber provided the unaudited financials to Bloomberg and other reporters this quarter.

Uber privately filed for a public offering with the Securities and Exchange Commission in November, people familiar with the matter have said. More recently, Uber received initial feedback from the SEC on its confidential prospectus, one person said.

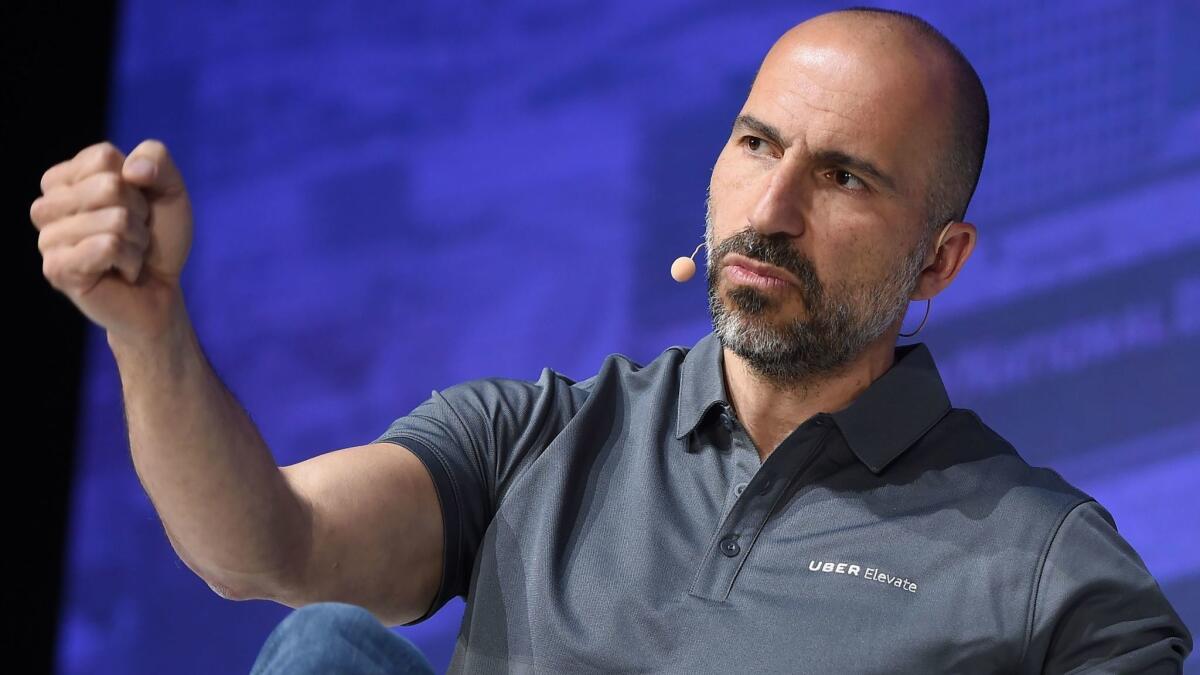

Steep losses are nothing new for the company. Chief Executive Dara Khosrowshahi stepped into the top job more than 17 months ago as Uber was tearing through money. At the time, investors expected Khosrowshahi would focus on stemming losses. Instead, he has prioritized fending off rivals such as Lyft and investing in areas of growth such as food delivery.

On the public markets, Uber investors will have to try to break down Uber’s financials to estimate when its various business units can become profitable. Uber didn’t separate its business units in the numbers provided to Bloomberg. Uber adjusted for the sale of its Russian and South East Asian operations in some of its financials to reflect the current state of its business, though the impact was minor.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.