KPMG ex-partner on insider-trading plea: ‘Worst day of my life’

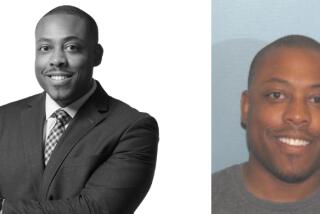

Moments after pleading guilty to an insider-trading charge, former KPMG partner Scott London struggled to explain the conduct that ruined his career and is very likely to send him to federal prison.

“It was probably the worst day of my life,” London said in an interview in the hallway outside the courtroom of U.S. District Judge George H. Wu, who is scheduled to sentence London on Oct. 21.

“Imagine what you do, you do it for 30 years, you go to school for it and in a matter of weeks it’s all gone,” London said. “It’s my fault.”

London, 50, was a senior partner at accounting giant KPMG, overseeing audits of public companies Herbalife Ltd. and Skechers USA Inc. He admitted in court Monday that he gave inside information about those companies to a friend, Bryan Shaw, who used it to make profitable stock trades. He said London paid him about $50,000 in cash, plus a Rolex watch and jewelry, after the trades, made between 2010 and 2012.

“I didn’t do it for money,” London said. “I did it to help out someone whose business was struggling. It was a bad, bad mistake.”

He said he had assumed that Shaw made about $200,000 on the trades, not the nearly $1.3 million that Shaw ultimately acknowledged to law enforcement officials.

“When I saw the amount … I about threw up,” London said. “He never told me what he purchased and how much he made.”

He said Shaw paid him $50,000 cash and told him that was about one-third of the profits, leaving him with the impression that he made no more than $200,000.

“When the FBI confronted me, my thought was I needed to confess to protect the clients and the firm. They had no involvement in what I had done,” London said. “The FBI felt that what they saw between Mr. Shaw and myself was more pervasive. It was just me and Mr. Shaw and no one else was involved.”

London, 50, said thinking about the next part of his life has helped him deal with the shame of his actions. He said he’ll need to find a new way to make money because he has two children, a son and a daughter, in college.

“The only thing I’m thinking about is the future. I need to look forward,” he said. “I think I’m relatively young. I need to provide for my family. I need to earn a living. I’ll do whatever it takes. I have a lot to offer companies. I just need a second chance.”

London’s attorney, Harland Braun, said London’s cooperation and early admission of guilt should be a consideration at sentencing. By disclosing all he had done, he helped calm concerns that it could have been a broader scandal involving more traders and more companies.

“He may have prevented a stock-market catastrophe,” Braun said.

ALSO:

Kaiser’s exchange rates surprise analysts

Healthcare law’s renewal loophole divides health insurers

California bill would fine big firms whose workers get Medi-Cal

Follow Stuart Pfeifer on Twitter

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.