Stocks surge on optimism about U.S.-China trade

Stocks on Wall Street jumped Friday, lifting the Standard & Poor’s 500 index to its first weekly gain in four weeks, as investors welcomed a thaw in the U.S.-China trade war.

After two days of negotiations in Washington, the United States agreed to suspend a planned hike in tariffs on $250 billion worth of Chinese goods that had been set to kick in Tuesday. China, meanwhile, agreed to buy $40 billion to $50 billion worth of U.S. farm products.

Word of the trade concessions filtered out in the last half an hour of trading.

“The market is welcoming any progress here, because [trade] has been the biggest overhang on growth,” said Ben Phillips, chief investment officer at EventShares. ”Any sort of deal, even if it’s a super light, mini-deal, still gets the market constructive and saying, ‘OK, we’re moving in the right direction.’”

The S&P 500 index rose 32.14 points, or 1.1%, at 2,970.27 — its third up day in a row. The Dow Jones industrial average rose 319.92 points, or 1.2%, to 26,816.59.

After two days of high-level trade talks, Trump agreed to a mini-deal with China that includes more Chinese farm purchases in exchange for tariff relief.

The Nasdaq advanced 106.26 points, or 1.3%, to 8,057.04. The Russell 2000 index of smaller-company stocks outpaced the broader market, climbing 26.54, or 1.8%, to 1,511.90.

The indexes all notched gains for the week.

Treasury yields rose as investors, feeling less need for safety, dumped bonds. The yield on the 10-year Treasury, a benchmark for mortgages and many other kinds of loans, jumped to 1.73% from 1.65%.

The rally got going early in the day, reflecting optimism among investors that Washington and Beijing would reach at least a limited deal on trade. The U.S.-China trade war has been a drag on economic growth and slowed manufacturing around the world.

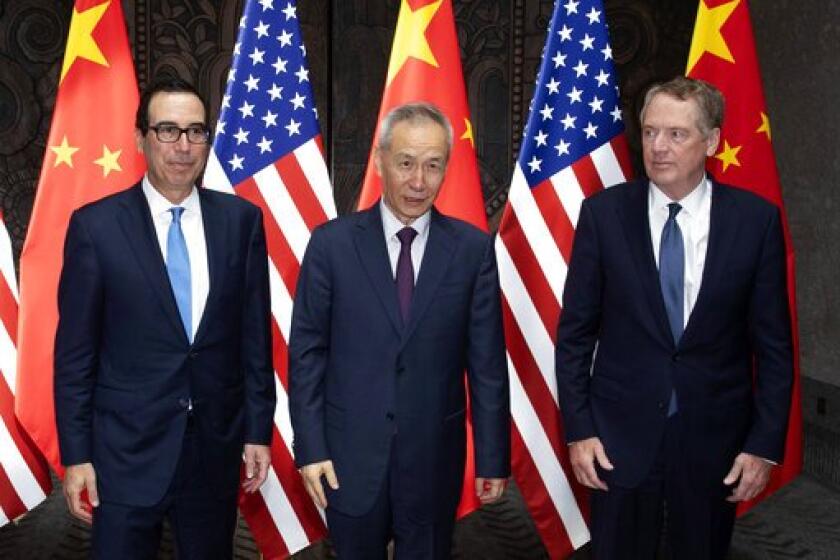

Investors got encouragement from President Trump, who said, “Good things are happening,” before he met with Chinese Vice Premier Liu He for trade talks at the White House.

Later in the day, after emerging from the meeting to announce the partial trade deal, Trump told the Chinese delegation, ”You’re very tough negotiators.”

The White House said the two sides made some progress on the thornier issues, including China’s lax protection of foreign intellectual property. But more progress on key differences must be made in later negotiations, including U.S. allegations that China forces foreign companies to hand over trade secrets if they want access to the Chinese market.

Markets around the world have swung sharply on every note of progress or dissonance in the U.S.-China trade war.

The concessions agreed upon by the U.S. and China on Friday mark a sharp turnaround after expectations were lowered earlier in the week when the U.S. blacklisted a group of Chinese technology companies over alleged human rights violations.

The Trump administration has already raised tariffs on more than $360 billion worth of Chinese imports, but the stakes were about to rise. The U.S. had planned to raise tariffs on $250 billion in Chinese imports from 25% to 30%, set to take effect Tuesday. Those are now suspended. But the two sides did not mention tariffs on $160 billion of goods, scheduled to kick in Dec. 15.

Technology companies, which often do lots of business with China, helped power stock indexes higher Friday. Apple climbed 2.7%, edging ahead of Microsoft as the most valuable company in the S&P 500. Broadcom gained 2.4%.

Industrial stocks also notched solid gains. Caterpillar climbed 4.7%. Farm equipment maker Deere rose 1.9%.

The jump in bond yields helped lift bank stocks. JPMorgan Chase rose 1.7%. Bank of America gained 1.6%.

A missile strike on an Iranian tanker revived concerns about oil supplies, pushing up energy prices. The explosion follows other attacks this year on tankers in the Persian Gulf, through which about 20% of all oil traded worldwide passes.

Benchmark crude oil rose $1.15 to settle at $54.70 a barrel. Brent crude oil, the international standard, rose $1.41 to close at $60.51 a barrel. Oil and energy-services companies’ stocks gained too. Exxon shares rose 1.1%. Schlumberger shares climbed 4.5%.

Fastenal surged 17.2% after the maker of fasteners and other industrial products reported surprisingly good quarterly profit and revenue. The company reported solid growth from its industrial vending and onsite services businesses.

Newmont Goldcorp slid 3.4% — making it one of the biggest decliners in the S&P 500 — as gold prices fell. Gold declined $12.10, or 0.8%, to $1,482.70 an ounce as investors shifted to more risky holdings.

Investors will focus on the health of corporate America next week as companies begin reporting their third-quarter results. Expectations are generally low, with analysts forecasting a drop of 4.1% from a year earlier. The results, plus what chief executives say about their spending and revenue forecasts, should give a better picture of the economy’s potential direction.

“You’re going to see a little soft earnings [results] this quarter, is our expectation, largely on the manufacturing and global companies, but also a little softness on services,” Phillips said.

In commodities trading Friday, wholesale gasoline rose 2 cents to $1.64 a gallon. Heating oil climbed 4 cents to $1.96 a gallon. Natural gas fell 1 cent to $2.21 per 1,000 cubic feet.

Silver fell 6 cents to $17.46 an ounce. Copper rose 1 cent to $2.62 a pound.

Stocks in Europe jumped on hopes that the United Kingdom and European Union can reach a trade deal before the UK’s exit from the bloc, set for Oct. 31.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.