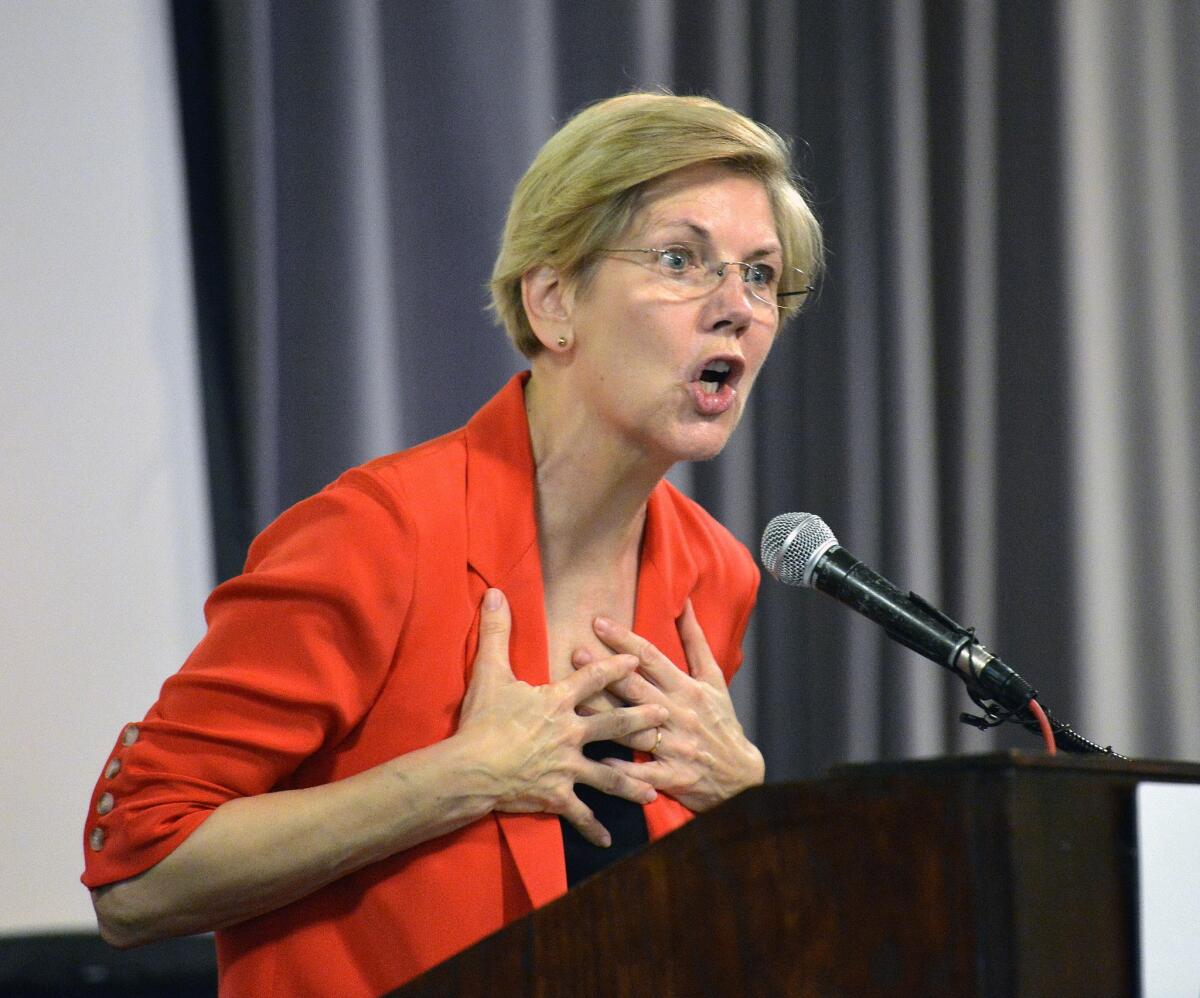

Prison industry deal drags L.A. billionaire into Elizabeth Warren’s campaign

- Share via

Los Angeles billionaire Tom Gores has been the target of activists since his private equity firm bought a prison telephone company accused of ripping off inmates and their families. The controversy was enough to lose him a prospective $100-million pension fund investment — and now he’s found himself dragged into the Democratic presidential campaign.

Sen. Elizabeth Warren is requesting that five private equity firms with portfolio companies that provide telecom, healthcare and other services to jails and prisons provide detailed disclosures about such holdings, including profits, the identities of other private equity co-investors and any legal or regulatory issues.

For the record:

4:06 p.m. Oct. 11, 2019A previous version of this article said the board of the Pennsylvania State Employees’ Retirement System declined to make a $150-million investment in Platinum Equity’s latest fund. In fact, the board’s investment committee declined to make a $100-million investment.

The letters, dated Sept. 30 and co-signed by progressive Reps. Alexandria Ocasio-Cortez (D-N.Y.) and Mark Pocan (D-Wis.), are an extension of Warren’s effort to rein in private equity’s role in the economy and her stance on doing away with private prisons. The letters were sent by Warren in her capacity as a U.S. senator, but she has made reforming Wall Street a central theme of her campaign.

Gores’ Platinum Equity acquired Securus Technologies, the nation’s second-largest provider of telecommunications services to prisons and jails, for $1.6 billion in 2017. The Detroit Pistons owner and his Beverly Hills private equity firm have since been the target of activists who claim providers of prison services are making big profits off disproportionately poor and minority inmates and their families.

“What is important about the step Sen. Warren and the others took is that it expanded the conversation beyond just private prisons into this conversation about the prison-industrial complex,” said Bianca Tylek, founder of Worth Rises, a New York nonprofit that wants to eliminate private companies from correctional facilities.

Securus, which serves about 3,400 facilities, has been accused of charging some of the highest rates in the nation, with costs approaching $25 for a 15-minute call at a handful of jails. The suburban Dallas company says it has reduced the cost of an average call by 14% to 15 cents a minute in the last year, and is working with jail operators to further cut costs, which are negotiated and fixed in contracts.

Last month, the Pennsylvania State Employees’ Retirement System declined to make a $100-million investment in Platinum’s latest fund after a campaign by activists, who have been pressuring pension funds, saying that increased scrutiny of private equity firms with prison industry holdings makes them risky investments. They also cited Platinum’s stake in a student debt collector.

“We were heartened by the fact that they took those issues seriously in both asking hard questions and ultimately in their decision-making,” said Jim Baker, executive director of the Private Equity Stakeholder Project, a labor-backed group.

However, Platinum Equity’s overall fundraising has gone well and its latest fund could close at $10 billion by the end of the year, according to a report in the Wall Street Journal that cites an anonymous source. Platinum Equity declined to comment on its fundraising, citing securities regulations.

Warren introduced legislation in July that would make investments into private equity firms less attractive, accusing the firms of gobbling up some $5.8 trillion in capital globally since the end of the Great Recession by being able to capture the returns on their investments while being insulated from risks.

Her bill, which attracted Democratic co-sponsors, would require private equity firms to share responsibility for their portfolio companies’ debt, legal judgments and pension obligations, while banning investors from taking dividends for the first two years after an acquisition. It also would prioritize worker pay in the bankruptcy process, an issue that drew attention during the bankruptcy of Toys R Us.

Since then, Warren and Pocan sent letters to six private equity firms seeking information about their investments in for-profit colleges before they turned their attention to the prison services industry.

Warren and other Democratic presidential candidates have made free telephone calls and abolishing private prisons part of their platform after years of growth in the prison population. The U.S. now has some 2.2 million people incarcerated, more than any other country. The issue has been a liability for former Vice President Joe Biden, who sponsored tough-on-crime legislation decades ago that critics say contributed to the problem.

The letters to Platinum Equity and the other firms ask that they provide a significant amount of information, including the revenue and net income of the prison company investments and, if they own a telecom, a breakdown of call and fee revenue, which can jack up total costs.

The other firms that received letters were American Securities, which owns GTL, the largest prison telecom; BlueMountain Capital and H.I.G. Capital, which own prison healthcare companies; and Apax Partners, which owns an electronic-monitoring company. The letters ask for responses by Monday.

Mark Barnhill, a Platinum partner, said the company planned to provide as much information as possible to Warren but could not guarantee it could do so in its initial response because of the quantity of material requested. He also reiterated previous statements that the private equity firm is committed to reforming Securus and lowering rates. “We’re proud of the work we’re doing there to transform the company into a responsible — and responsibly run — market leader,” he wrote in an email.

On Thursday, amid the swirl of events, Securus announced a corporate reorganization that it said would reflect its transformation “from a traditional corrections telecommunications service provider to a diversified technology company providing innovative solutions to customers across multiple sectors.”

Platinum created a new corporate parent called Aventiv Technologies that will focus on research and development. The prison telecom subsidiary retains the name Securus Technologies, while a second subsidiary called JPay will provide money transfer services to the corrections industry, and a third called AllPaid, formerly known as GovPayNet, will focus on government payments outside of corrections.

Tylek called the restructuring a blatant move to “create layers” that will insulate Platinum from its investment and allow it to not list Securus by name as one of its portfolio companies. She said none of the subsidiaries was offering a service not already provided by Securus, which had previously acquired JPay and GovPayNet.

Barnhill disputed that characterization and said the move had been in the works for some time, reflecting Platinum’s long-standing plans to broaden the scope of Securus’ business. “Our investment thesis from Day One has been to transform Securus from a telecommunications provider to a more expansive technology company, and this reorganization is a fundamental part of that,” he said.

Gores, who stood up for Colin Kaepernick’s right to kneel during the national anthem and has cast himself as a progressive NBA owner, offered last month to meet with Tylek and other activists, who have threatened to involve players in their campaign against his Securus acquisition.

Barnhill and Tylek both said they were continuing to try to schedule a face-to-face meeting.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.