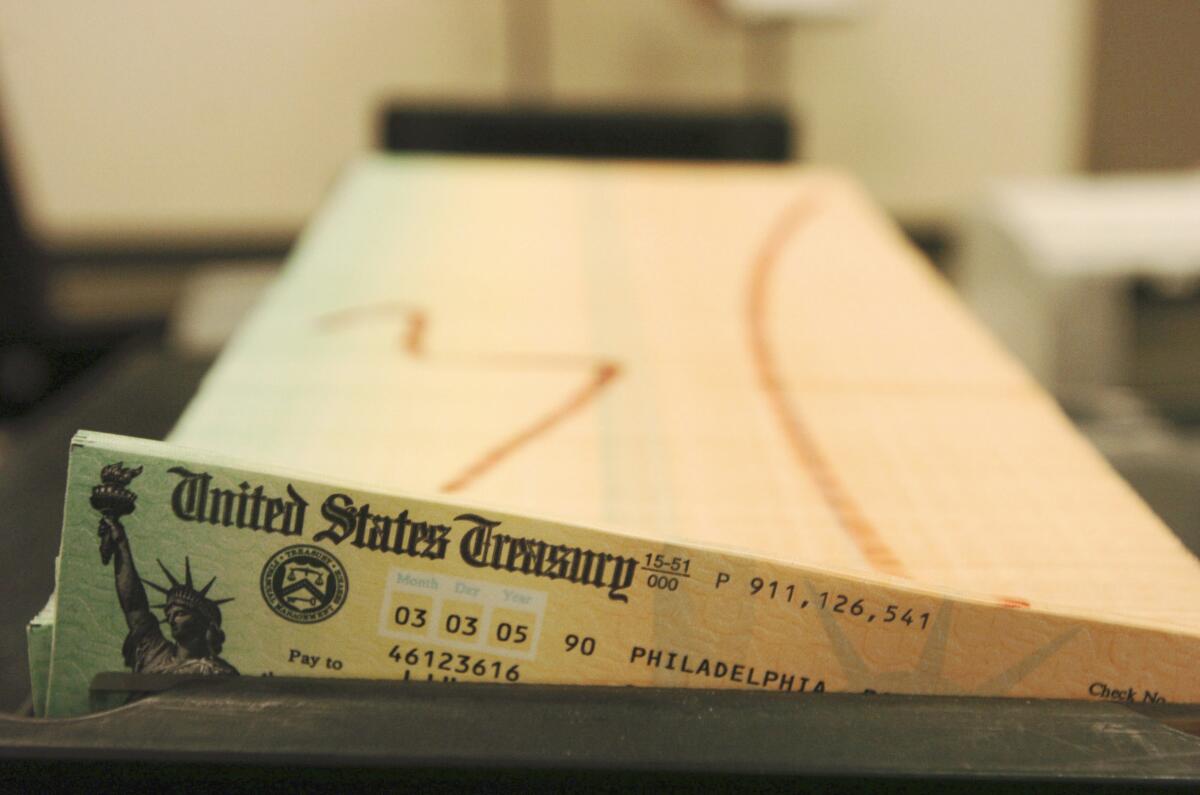

Social Security payments set to rise 1.3% in 2021

- Share via

WASHINGTON — Social Security recipients will receive a modest 1.3% cost-of living increase in 2021, but that might be small comfort amid worries about the coronavirus and its consequences for older people.

The increase amounts to $20 a month for the average retired worker, according to estimates released Tuesday by the Social Security Administration. That would follow a 1.6% increase this year in the cost-of-living adjustment, or COLA.

The government’s COLA directly affects the personal finances of about 1 in 5 Americans, including Social Security recipients, disabled veterans and federal retirees — all in all, some 70 million people.

The economic fallout from the coronavirus has reduced tax collections for Social Security and Medicare, likely worsening their long-term financial condition. But there’s been no real discussion of either program in the election contest between President Trump and Democratic nominee Joe Biden.

“It’s very difficult to talk about anything policy-wise,” said Mary Johnson, an analyst with the nonpartisan Senior Citizens League. “We are looking at a period where there are growing inadequacies in Social Security benefits, particularly for people with lower-to-middle benefits.”

With the new COLA, the estimated average monthly Social Security payment for a retired worker will be $1,543 a month next year. A typical couple’s benefits would increase $33 to $2,596 per month. The program’s automatic inflation-indexed increases are unusual, since most private pensions do not offer similar adjustments.

“The guaranteed benefits provided by Social Security and the COLA increase are more crucial than ever as millions of Americans continue to face the one-two punch of the coronavirus’s health and economic consequences,” said AARP Chief Executive Jo Ann Jenkins.

Waiting to take Social Security makes sense no matter how much you’re earning. Also: Keeping money away from creditors in retirement accounts.

But Diana LaCroix of Omaha says her COLA doesn’t keep pace with rising healthcare costs most years. And she has new responsibilities: Her eldest daughter and two grandsons moved in with her this summer after the daughter’s landlord decided to sell the house they were renting.

LaCroix, who is retired from customer-service jobs, is now buying diapers some days as she scrounges for good deals on hand sanitizer. “Something’s got to give,” she said. “Something’s got to change.”

A majority of voters 65 and older went for Trump in 2016, but some polls show Biden even with or ahead of Trump among older voters a few weeks before election day.

Trump has kept his promise not to cut Social Security benefits, but this summer he sent confusing signals with a plan to temporarily suspend collection of certain taxes that fund the program. While White House staff said it was a limited measure that would have no lasting impact, Trump kept hinting to reporters that he had much bigger tax cuts in mind. Early in the year, he told an interviewer that he wanted to tackle “entitlements,” or benefit programs, in a second term.

Social Security is complicated, so it’s not surprising that so many people get the details wrong. Those details can have a huge impact on retirement.

Biden has a Social Security plan that would revamp the COLA and peg it to an inflation index that more closely reflects changes in costs for older people, particularly healthcare. That’s been a priority for advocates. He would also increase minimum benefits for lower-income retirees, addressing financial hardship among older people.

The former vice president would raise Social Security taxes by applying the payroll tax to earnings above $400,000 a year. The 12.4% tax, equally distributed among employees and employers, currently applies to only the first $137,700 of a person’s earnings. The tax increase would pay for Biden’s proposed benefit expansions and also extend the life of the program’s trust fund by five years to 2040, according to the nonpartisan Urban Institute.

Jane Whilden lives in a household that leans heavily on Social Security. The resident of southern New Jersey retired early from a local government job to serve as the main caregiver for her family, including her mother and her husband, a retired truck driver.

The program should be top of the list for the presidential candidates, she said.

“Everybody’s getting older and we need to know what’s going on,” said Whilden. “I haven’t heard what they’re going to do. You just hear all sorts of negative things.”

The COLA is only part of the annual financial calculation for seniors. Medicare’s “Part B” premium for outpatient care usually gets announced in the fall as well. That amount generally increases, so at least some of any additional Social Security increase goes to healthcare premiums.

The Medicare monthly premium is now $144.60. The 2021 level has not been released yet, but there’s been concern that some emergency actions the government took in response to the COVID-19 pandemic could lead to a big jump. That prompted Congress to pass recent legislation that limits next year’s premium increase but gradually collects the full amount later on under a repayment mechanism.

“There’s a lot of uncertainty with regard to the effect of the coronavirus on the cost of the premium for next year,” said Casey Schwarz, a policy expert with the Medicare Rights Center advocacy group.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.