Here’s why emergency savings funds never go out of style

Dear Liz: I was a fortunate individual and able to save enough money to cover my expenses for at least six months in case I became unemployed. Now I am retired with a fair amount of guaranteed monthly income through my Social Security and pension benefits. Any suggestion on what to do with that savings account now that it has served its purpose?

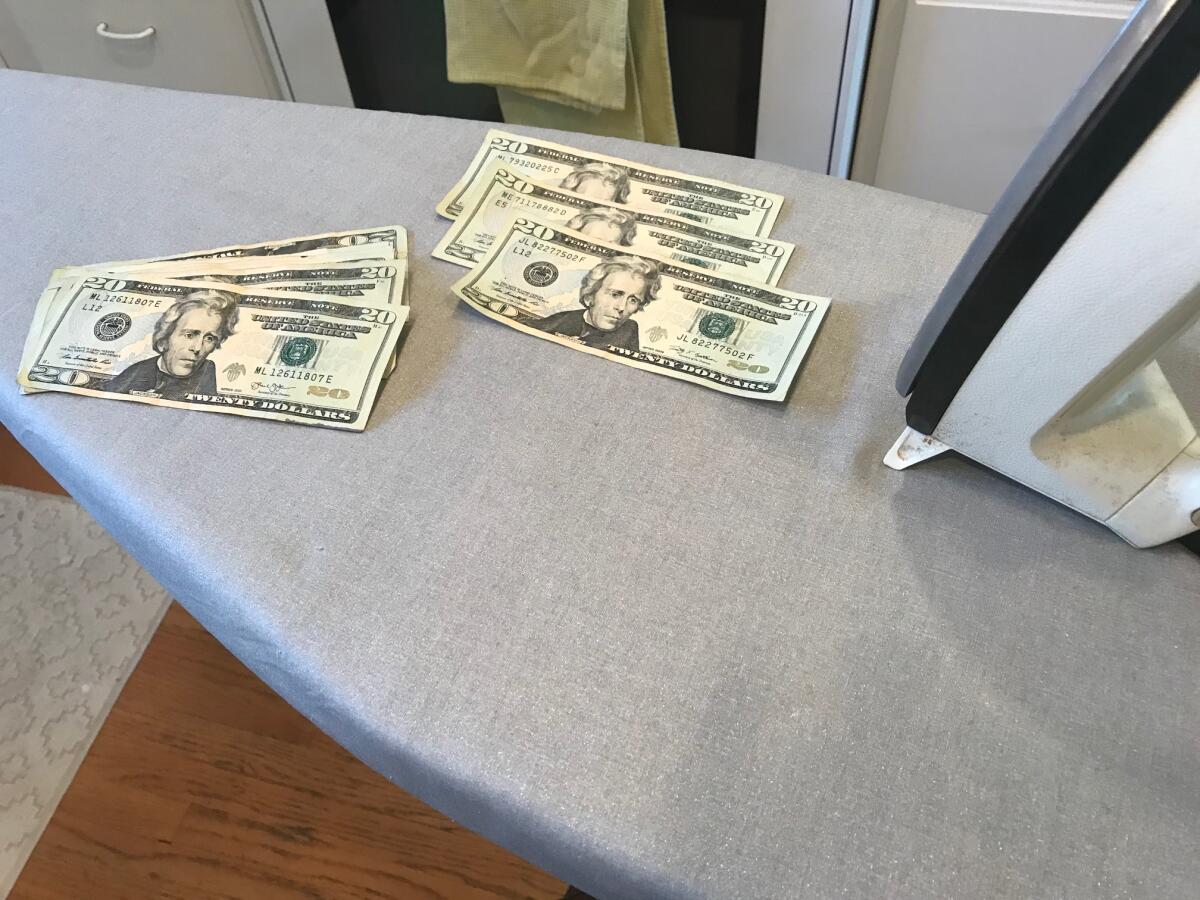

Answer: Emergency funds aren’t just for job loss. They’re also meant to cushion you against unexpected expenses. If you own a home, a car or a body, you’re likely to experience those in retirement, since all three tend to need repairs as they age.

If you’re new to Medicare or relatively healthy, you may not know that Medicare doesn’t cover all the medical expenses you’re likely to face. Medicare also doesn’t cover long-term care, which can be quite expensive if you eventually need help with daily living activities such as eating, bathing, dressing, getting around and using the bathroom. A study by Vanguard Research and Mercer Health and Benefits found that half of people over 65 will incur long-term care costs, and 15% will incur more than $250,000 in costs.

Seller financing and credit reporting

Dear Liz: I bought a home and the seller financed the sale. I have made all payments on time, but that’s not reflected on my reports at the three credit bureaus. What can I do to get my mortgage payments acknowledged on my credit reports?

Answer: One of the advantages of seller financing — where the person selling the home is your lender — is that getting a mortgage can be easier than if you were to apply to a bank or business. Individuals, however, typically can’t report payments to the credit bureaus, so your payments won’t show up on credit reports.

If you’re trying to improve troubled credit, you can use other methods such as being added as an authorized user to someone’s credit card, getting a secured credit card or applying for a credit-builder loan from a credit bureau or online lender. If you were a renter, you also could subscribe to a rent-reporting service that would transmit your rent payment history to the bureaus for inclusion in your credit reports.

California on Monday opened applications for a rent relief program that aims to help those most affected by the pandemic. Funds from the program could wipe away rent debt accumulated by low-income tenants through the end of March.

IRAs and tax considerations

Dear Liz: I’ve been researching the backdoor Roth IRA and I am finding some conflicting information regarding taxes owed on the conversions. I have two sizable rollover IRAs and one small ($1,600) traditional IRA. Can I make an after-tax contribution to the traditional IRA and convert that to a Roth and pay tax only on that IRA or do I have to consider all three IRAs?

Answer: Sorry, but you have to consider all three. The tax on your conversion will be based on the pre-tax portion of all your IRAs combined, not just the IRA where you make your contribution.

Backdoor Roths allow people to get money into a Roth when their incomes are too high to make a direct contribution. Instead, they contribute to a traditional IRA and convert that to a Roth because conversions don’t have income limits. Conversions require paying taxes proportionately on your pre-tax contributions and earnings, however, so the technique may not be advisable when you have sizable pre-tax IRAs that will trigger a large tax bill.

Social Security and spousal benefits

Dear Liz: My wife and I are both 66 and have not yet filed for Social Security. I don’t plan on filing until I am 70. Is my wife able to file for her own retirement benefit now, which is much lower than mine? And then when I file at 70 years, can she switch to the spousal benefit rate, without any type of penalty?

Answer: Yes and yes. This is one of the few instances in which people can still switch from one benefit to the other.

If you had already applied, your wife’s retirement benefit would be compared to her spousal benefit and she would get the larger of the two amounts. Since you haven’t applied, however, no spousal benefit is available. Your wife could receive her own benefit and then switch to the larger spousal amount once you apply at 70, when your own benefit has maxed out.

Also, as long as your wife has reached her full retirement age (66 years and two months, if she was born in 1955), she won’t face the earnings test if she continues to work. That test otherwise reduces benefits by $1 for each $2 earned over a certain amount, which in 2021 is $18,960.

Liz Weston, Certified Financial Planner, is a personal finance columnist for NerdWallet. Questions may be sent to her at 3940 Laurel Canyon, No. 238, Studio City, CA 91604, or by using the “Contact” form at asklizweston.com.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.