Inflation, supply chains, COVID: The global economy has a lot of worries

- Share via

The global economy is entering the final quarter of 2021 with a mounting number of head winds threatening to slow the recovery from the pandemic recession and prove policymakers’ benign views on inflation wrong.

The spreading Delta variant continues to disrupt schools and workplaces. U.S. lawmakers are wrangling over the debt ceiling and spending plans. China is suffering an energy crunch and pursuing a regulatory crackdown, while markets remain on edge as Chinese company Evergrande Group struggles to survive.

Fuel and food costs are soaring worldwide, combining with congested ports and strained supply chains to elevate price pressures. Labor shortages continue to plague some employers.

Although the expansion seems intact, such a backdrop is fanning fears of a mix of weaker growth and faster inflation to come, threatening to complicate nascent efforts by central banks to dial back stimulus without rattling markets.

“Expectations of a swift exit from the pandemic were always misplaced,” said Frederic Neumann, co-head of Asian economic research at HSBC Holdings in Hong Kong. “Full recovery will be measured in years, not quarters.”

Here’s a breakdown of the major risks:

China crunched

China’s energy travails have forced manufacturers to curb production and prompted economists to cut their growth forecasts. Bloomberg Economics expects the power shortages to have the biggest effect on expansion since a nationwide lockdown when the pandemic first erupted.

Regions affected by the curbs represent about two-thirds of the economy and include the top five provinces in terms of gross domestic product — Guangdong, Jiangsu, Shandong, Zhejiang and Henan. In a sign of what’s to come, factory activity contracted in September for the first time since the pandemic began.

That’s compounding a drag from the crisis engulfing Evergrande, the world’s most indebted developer, and a broader slowdown in the all-important housing sector. President Xi Jinping’s push for tighter regulations of industries including technology is also unnerving investors.

Costlier food and energy

China’s energy problems also risk triggering a renewed surge in world agriculture and food prices as it means the country is set for a difficult harvest season for such items as corn, soy, peanuts and cotton. Over the last year, Beijing imported a record amount of agricultural products due to a domestic shortage, driving prices and global food costs to multiyear highs.

A United Nations index is up 33% over the last 12 months. At the same time, some gas, coal, carbon and electricity benchmarks are hitting records.

The price of oil rose above $80 a barrel for the first time in three years and natural gas is the costliest in seven, helping to push the Bloomberg Commodity Spot Index to its highest level in a year. TotalEnergies Chief Executive Patrick Pouyanne said the gas crisis that’s affecting Europe is likely to last all winter.

It could get even worse. Bank of America analysts are telling clients there is a chance of oil reaching $100, spurring an economic crisis.

Supply squeezed

With the Northern Hemisphere’s winter approaching, the Delta variant remains another worry.

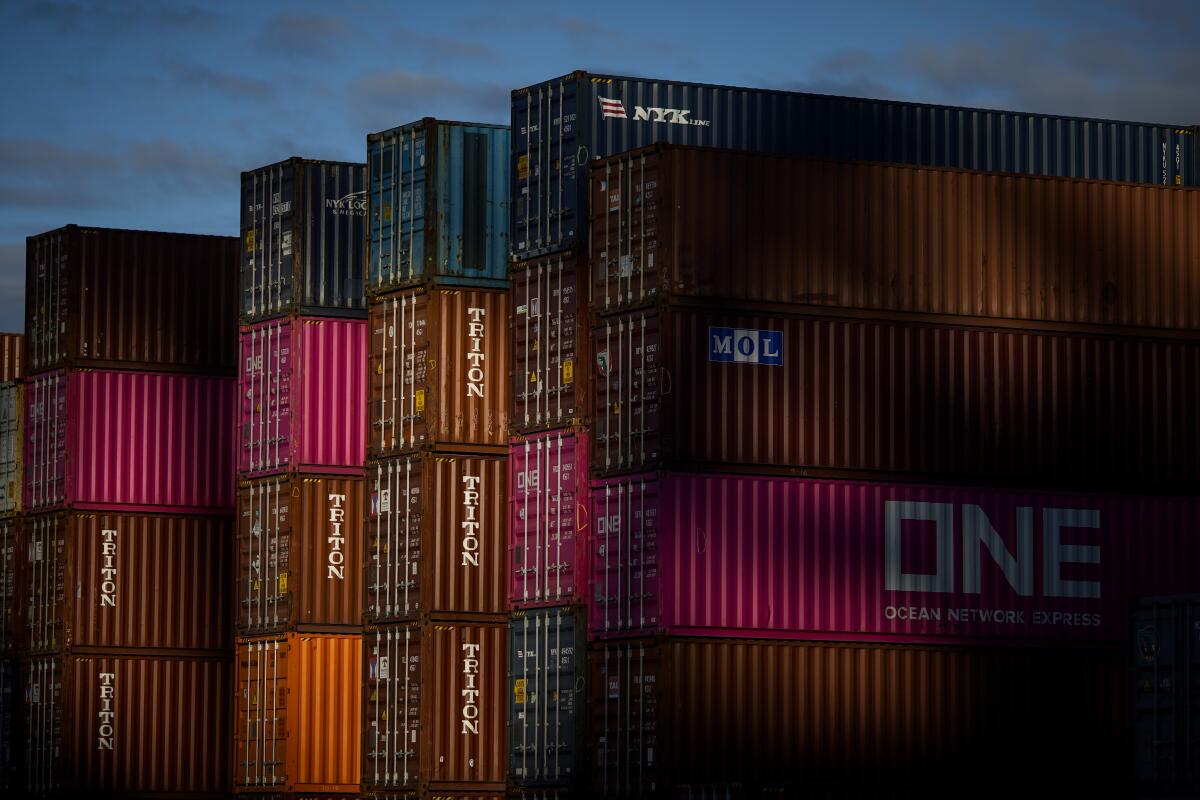

That helps explain why congestion is building at key crossroads for international commerce, including at ports in Shanghai and Los Angeles, rail yards in Chicago and warehouses in the United Kingdom.

Many items destined for retailer shelves this holiday season are hopelessly snarled in the global supply chain. What does that mean for shoppers?

Retailers including Costco Wholesale Corp. in the U.S. are ordering everything possible to ensure shelves are stocked, particularly for the late-year boost of holiday shopping.

Manufacturers, meanwhile, are having trouble sourcing key parts such as semiconductors, chemicals and glass.

Dubai’s DP World, one of the biggest global port operators, expects bottlenecks that have rattled global trade flows will continue at least for two more years.

There is also a shortage of labor in some industries with the coming week’s U.S. payrolls report providing an insight into how much of a problem that was for firms in September.

Policy problems

The shine is also coming off U.S. economic policy as a locomotive for the global recovery. Though President Biden swerved a disruptive shutdown of the federal government for now through a stopgap funding bill, fractured talks continue on his $4-trillion economic agenda with deep divisions among his Democrats on the way forward.

Compromise on the shutdown came after Treasury Secretary Janet L. Yellen warned that her department will in effect run out of cash around Oct. 18 unless Congress suspends or increases the federal debt limit. Failure to do so would trigger both a recession and financial crisis, Yellen said.

Globally, fiscal policy support is set to slow into 2022 after governments ran up the biggest debts since the 1970s.

Monetary policy

Biden and Yellen must also decide whether to hand a second term to Federal Reserve Chairman Jerome H. Powell, a decision which could also roil markets.

For Powell and his international counterparts, the combination of slowing growth and stubborn inflation is a challenge.

Friday alone saw news of the fastest euro-area inflation in 13 years, and a U.S. gauge rose the most on an annual basis since 1991.

For now, Powell and European Central Bank President Christine Lagarde are voicing cautious optimism that inflation will ease. But economists are asking at what point transitory becomes more persistent.

And that makes plans to reduce bond purchases or raise interest rates a risky proposition. Many Latin American central banks and some in Eastern Europe have already hiked borrowing costs. Norway just became the first developed nation to do so and the Fed is signaling it will pare its bond-buying program as soon as November.

Deutsche Bank strategist Jim Reid reckons the world economy may be facing its most hawkish period for monetary policy in a decade.

“Central banks are playing with fire by tapering to avert inflationary pressures without being fully sure of where we stand in the cycle,” said Alicia Garcia Herrero, chief economist for Asia Pacific at Natixis.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.