Your health insurance says, ‘Claim denied.’ How to fight back

- Share via

A letter arrives in the mail. Oh, great: It’s from your health insurance company. It contains some variation on the phrase “Your claim has been denied” and possibly “You may file an appeal to challenge this decision.” There’s probably also an alarmingly large dollar amount with “patient responsibility” next to it.

Take a deep breath. You are not on the hook for this bill just yet, and you probably didn’t do anything wrong to make this happen. There is a process to get your insurer to look into this again before you have to pay anything.

It may all sound too daunting to deal with, or it may not be clear what steps you need to take.

“Health plans are not consumer friendly, and plan documents are often filled with fine print and legalese, which is intimidating for many people,” Ashira Vantrees, a staff attorney for Aimed Alliance, a nonprofit organization that advocates on behalf of healthcare consumers and providers, wrote in an email. “Further, while most benefit denial letters should include information on an appeals process, not all do; therefore, many people may not even know they have a right to appeal.”

A Kaiser Family Foundation study in 2019 found that people who get their coverage through the Affordable Care Act’s healthcare.gov had appealed less than 0.2% of in-network denials.

But if you do make an appeal, your odds of getting that claim covered are decent: The same study showed 40% of people who entered into the appeals process with their insurer emerged victorious. A 2014 analysis of California data showed patients who appealed through a third party won about half the time.

People — including this reporter — rarely get into a bureaucratic dispute with their health insurance provider and describe the process as “straightforward” or “easy to understand” or “quickly resolved.” So it’s easy to see why some people just accept the denial.

“Fighting an insurance company can be exhausting. Health insurers often make appeals and reimbursement processes difficult,” Vantress wrote. “For many people, it may be less taxing to give up and accept a different treatment or medication, pay out of pocket, or go without treatment altogether, than to expend the energy fighting with their health plan.”

Still, fighting back can be worth doing. Sometimes, it’s a simple paperwork issue that can be resolved by your doctor’s office — a matter of a multi-digit billing code entered incorrectly, a tax ID typed into the wrong box, a standard lab procedure that could be coded a different way that would get it covered.

It’s your money they’re trying to keep. Defend it. Here’s how.

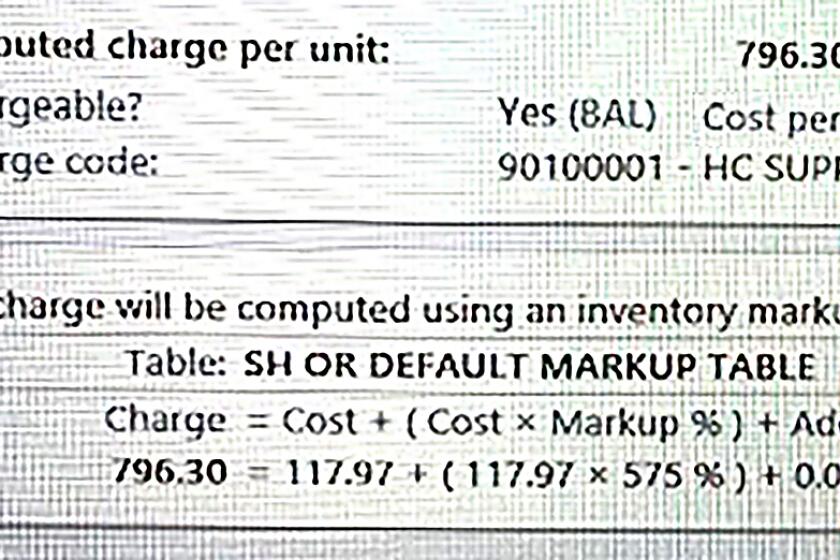

Screenshots of a system used by Scripps Memorial Hospital show markups of as much as 675% being imposed automatically during treatment.

The appeal process

“Appeal process” sounds like you need to hire a lawyer who will mount a Supreme Court case in your defense. What you’re actually doing is telling your insurer, “Hey, I think this should have been covered, and I want you to look into it again.”

You may be wondering why you have to be involved at all. Your doctor sent a bill to your insurer for something they decided you need. You had nothing to do with the paperwork. Why is it your job to chase down corrected billing codes? Surely your insurance company could get in touch with your doctor’s office directly and get this figured out?

Yes, they could. But “that would cost them a little bit more money,” said Libby Watson, who writes the Substack newsletter Sick Note about the various indignities of the American healthcare system. “It’s much easier for them to just deny it and hope the person doesn’t appeal it.”

Your first step will be what’s called an internal appeal.

Internal appeal: You have the legal right to compel your insurer to review your claim again. This is called an internal appeal. Again: This sounds intimidating. But really, all you’re doing is figuring out why your claim was denied, reaching out to your doctor for help, and sending the information your insurer needs to get the claim processed correctly. That’s all.

“A lot of the time, it is going to be a lot easier than you think,” Watson said.

Review the letter saying your claim was denied and figure out why they’re denying it. It may also include instructions for how to appeal the decision or have the claim reviewed. This could involve providing more information to the insurer — and that could mean calling your doctor’s office and asking them to resubmit forms, correct a billing code, or offer a more detailed justification of why a procedure, drug or test was medically necessary.

If the letter you received doesn’t outline the appeal process, call customer support for your insurer — the phone number on your health insurance card — and ask. You can also look on your insurance company’s website, or try searching “(insurance company) appeal process” for more information. Aimed Alliance runs CoverageRights.org, which contains state-by-state information on how to challenge your insurer’s decision and escalate complaints about the process.

It’s a good idea to take detailed notes. Write down the date you received the letter, the date you filed your appeal, the date and time you called your insurer and the name of the representative you spoke to. You may need to refer to these details later on.

Your doctor’s office should be your ally in this process. Reach out to them and let them know your claim was denied. They will likely be able to help. For instance, if your insurer deemed that the medication or procedure was not medically necessary, your doctor’s office should be able to submit whatever additional information is needed to demonstrate why it is.

Once you’ve gathered all the information the letter from your insurer is asking for, submit it as your appeal. You may also need to include a letter explaining the grounds for your appeal. The National Assn. of Insurance Commissioners has an example of what that can look like.

If your life, health, or ability to function could be in jeopardy because of a denial, you can request that your appeal receive an expedited review.

The No Surprises Act, which took effect this month, makes it illegal for hospitals to slap patients with sky-high charges for out-of-network care.

External appeal: If, after your internal appeal, your insurer says, “Nope, we are still denying this,” you can ask an independent organization to take a look. Usually, that will be your state’s insurance regulatory agency. The internal appeal denial should explain how to begin that process.

The external appeal can include new information in your defense, so reach out to your doctor again and let them know what’s going on. They may have more information for you to include.

Within a set amount of time, an external review will take place. If the reviewer decides the claim has to be covered, your health insurer must comply.

Do I need a lawyer? Not necessarily. There are lawyers who specialize in insurance claim denials, but like all lawyers, they cost money. If you are going to lose your home if you have to pay this bill, it’s probably worth a one-hour legal consultation to see how they can help; if it’s a few hundred dollars in lab fees, it probably isn’t.

I’m still having a problem. What can I do? If you think the process is not being handled fairly, you can file a complaint with your state insurance commissioner or the federal Department of Labor. Aimed Alliance’s CoverageRights.org has state-specific information on filing complaints. If your health insurance is through your work, reach out to your HR representative and let them know what’s going on. Your employer hired this insurer to provide this service and should be able to help move things along.

It’s hard to know where this new year will take us, but here’s one thing we can control: Let’s resolve to thrive this year, and start enjoying life again — safely, of course.

Why denials happen

Your doctor decides you need something. Why does your insurance get to say otherwise?

“Health plan coverage denials happen because health plans are trying to save money, which increases their profits,” Vantrees wrote.

“It’s a ridiculous cycle that increases the cost of healthcare overall, and it’s a waste of everybody’s time, and I don’t think even really reduces insurance costs all that much anyway,” Watson said.

I posed the question to a spokesperson for the Centers for Medicare and Medicaid Services, who had a more circumspect written answer: “When a consumer submits a claim for coverage of an item or service, the group health plan or individual market issuer may deny coverage in whole or in part for the claim because the plan or issuer decides that, according to the terms of the plan or coverage, the item or service is not covered.”

So they can deny covering something because they decided it’s not covered. OK.

Even getting preauthorization for a service or medication isn’t necessarily enough to prevent a so-called “retrospective denial” later on, as demonstrated by a 2020 Kaiser Health News investigation.

Is anything being done about this? A bill called the No Surprises Act went into effect this year. Does that mean no more “claim denied” surprises? No. In a recent edition of Sick Note, Watson pointed out that it could be more accurately called the “fewer surprises act.” The bill aims to eliminate a very specific type of healthcare surprise, which is when you visit an in-network hospital but get a separate bill from an out-of-network provider you did not choose, like an anesthesiologist.

So individual claims can still be denied. But with knowledge, patience, and the willingness to make a few phone calls, you’ve got at least a chance of keeping some or all of your money.

Online eyewear sites are pushing prices for glasses down. But the markups for most frames and lenses remain exorbitant.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.