- Share via

Hiring is challenging for every industry, but especially tech.

The workforce is highly skilled and hard to recruit. Companies must develop and improve employees’ capabilities to stay ahead of the competition. Keeping experienced and talented workers requires high salaries and perks.

“Competition for highly skilled personnel is intense,” Twitter said in its 2014 annual report, shortly after the company went public. “Our growth strategy depends in part on our ability to retain our existing personnel and add additional highly skilled employees.”

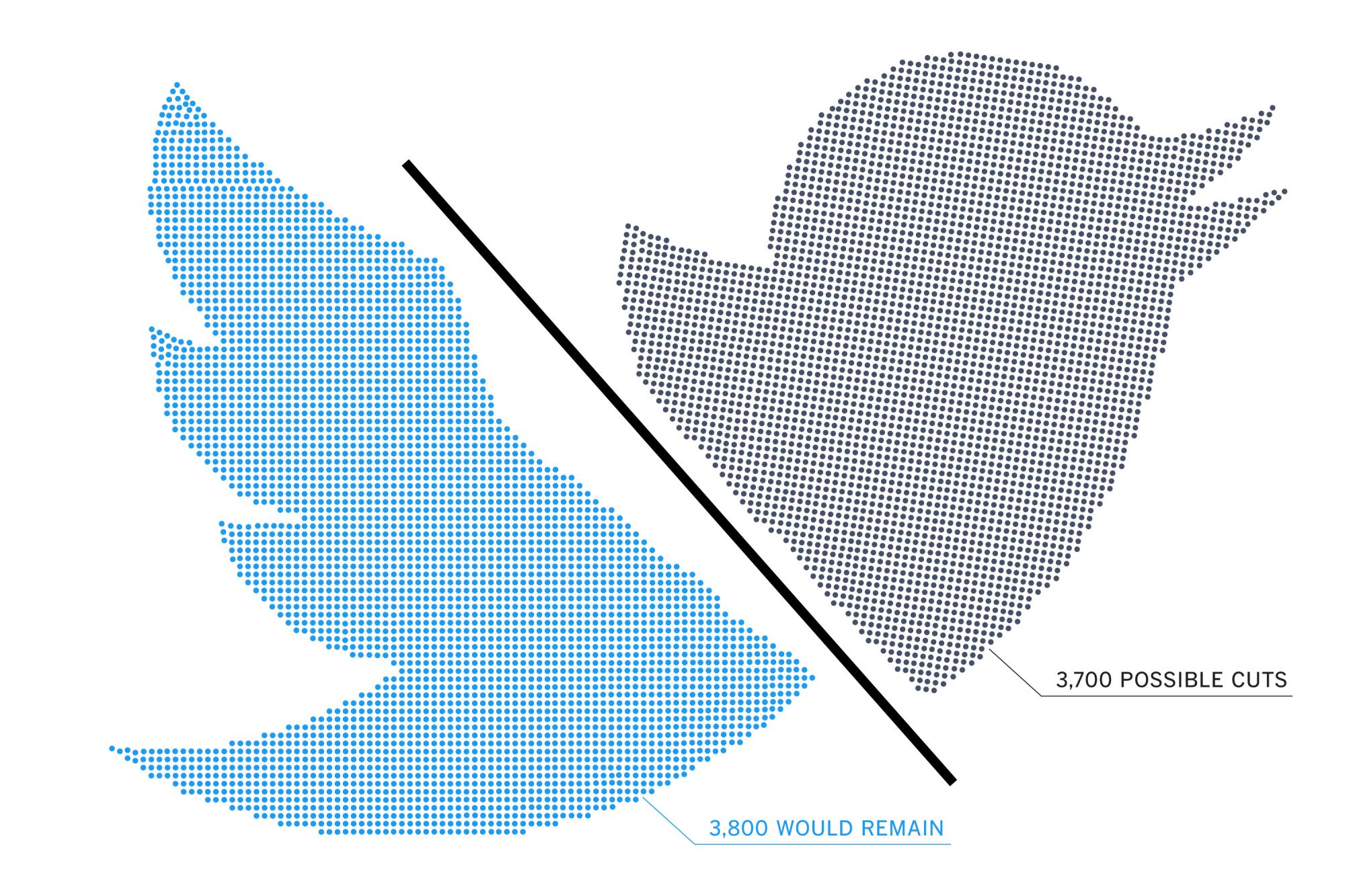

In 2013, Twitter employed a little more than 2,700 people. By 2021, the company had grown to more than 7,500 full-time employees.

But days after Elon Musk acquired the social media platform, the world’s wealthiest man slashed a reported 50% of Twitter’s workforce, or about 3,700 jobs. Employees were notified Friday if they still had a job.

Already, some former employees have filed a lawsuit against the company, alleging violations of federal and state laws that govern mass layoffs.

‘A potential backbreaker’

This year has been a tough one for the tech industry — amid the economic turmoil, there have been hiring freezes at major companies such as Google and Meta and layoffs at companies as diverse as Coinbase and Netflix. But laying off 50% of a company’s workforce is “out of any norm,” Anat Lechner, business professor at the New York University Stern School of Business, said Thursday before news of the layoffs became official.

“I don’t recall any instance that is of that magnitude,” she said. “I’ve been in this space since the late ’80s. I just do not recall something like this.”

Even historically large cuts, like the 2012 layoffs of 2,000 Yahoo employees in a turnaround attempt, made up only 14% of the company’s workforce.

For tech companies that matured after the dot-com crash, it’s even more unusual. The industry has been a hotbed of hiring for years, even more so during the pandemic when stay-at-home regulations boosted demand for home entertainment, digital technology and e-commerce.

A cut this dramatic would upend the lives of thousands and undo years of work in recruitment, employee development and institutional knowledge at the company.

Musk also intends to reverse the company’s existing work-from-anywhere policy, asking remaining employees to report to offices — though some exceptions could be made, sources said.

The layoffs of so many employees could also present serious concerns about cybersecurity, IT and the overall stability of the platform, said Dan Ives, managing director at Wedbush Securities.

“Fifty percent layoffs is a potential backbreaker for Twitter,” he said. “Cuts were going to come. 50% is a jaw-dropping number.”

The albatross around Twitter’s neck

The key to understanding the scale of the rumored cuts is the mechanism Musk used to purchase Twitter.

To fund his $44-billion acquisition, the chief executive of Tesla Inc. and SpaceX financed the deal with debt borrowed from banks. In this kind of leveraged buyout, it is the company — not Musk — that is loaded up with the debt.

That means Twitter is on the hook to pay massive amounts of interest, as well as the loans themselves.

With a whopping $13 billion of new debt hanging over the social media company, Musk needs Twitter to turn a profit — quickly.

“The debt component is an albatross around the Twitter story,” Ives said. “The cash flow now needs to come from Twitter, and there’s only one way that that’s going to happen, which is through head count costs. It’s put a huge pressure from a cost perspective on the Twitter story that was not there before this deal.”

How to monetize

Twitter’s business was not necessarily thriving before the acquisition. The firm has been largely unprofitable for most of its existence as a public company, posting a $270-million loss in its last quarterly report in June after bringing in a disappointing $1.18 billion in revenue.

Getting out from under so much debt as a mature company in a competitive sector will be difficult, Ives said.

“For Musk, the easy part was buying Twitter,” he said.

Aside from layoffs, Musk has floated a number of proposals to try to increase revenue, including making users pay $8 a month to get their accounts verified with a check mark.

“Monetization remains an uphill battle,” Ives said. “And Musk could continue to cut, but that’s not going to facilitate revenue growth.”

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.