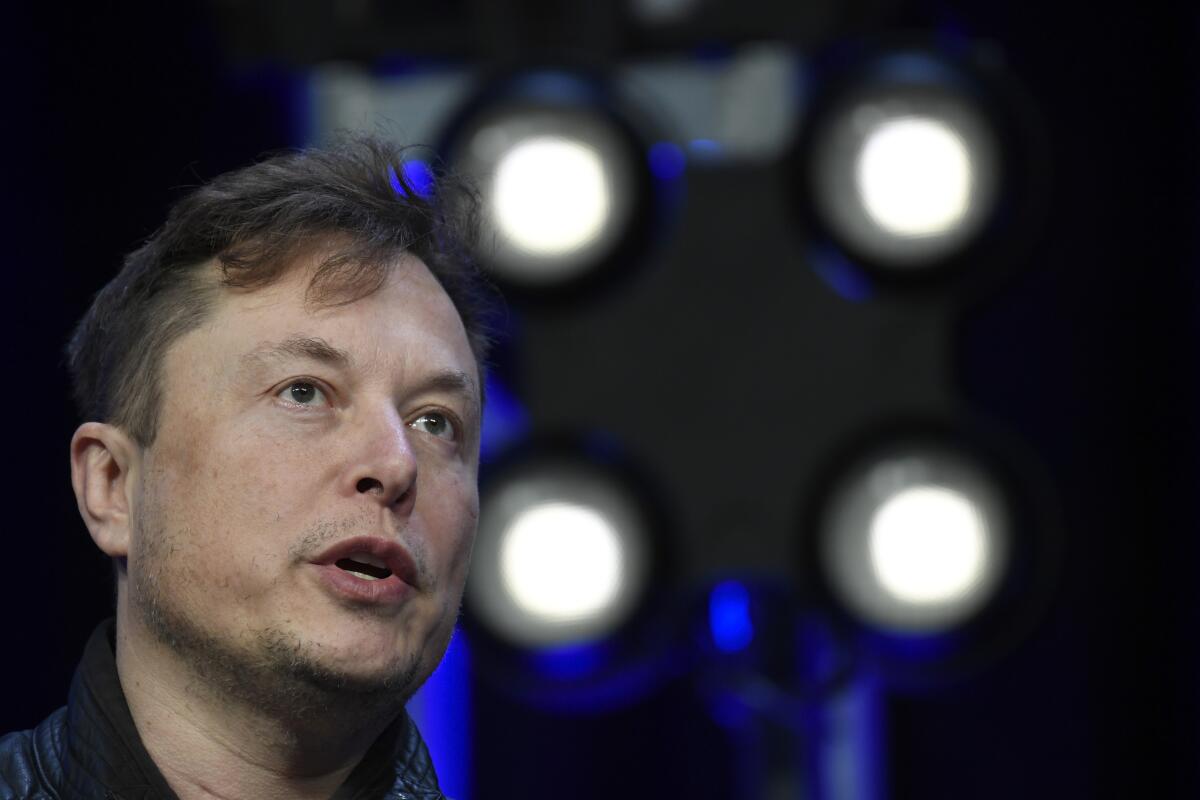

Elon Musk sells nearly $4 billion in Tesla stock after buying Twitter

- Share via

Twitter’s new owner and Tesla CEO Elon Musk has sold nearly $4 billion in Tesla shares, according to regulatory filings.

Musk, who bought Twitter for $44 billion, sold 19.5 million shares of the electric car company from Friday to Tuesday, according to Tuesday’s filings with the Securities and Exchange Commission.

He sold $7 billion of his Tesla stock in August as he worked to finance the Twitter purchase that he was trying to get out of at the time. In all, Musk has sold more than $19 billion worth of Tesla stock since April, including those in Tuesday’s filings, probably to fund his share of the Twitter purchase.

The takeover of Twitter has not been smooth, and the social media platform has seen the exodus of some big advertisers in recent weeks, including United Airlines, General Motors, REI, General Mills and Audi.

Musk acknowledged “a massive drop in revenue” at Twitter, which relies heavily on advertising to make money.

Musk had signaled that he was done selling Tesla shares, and the revelation that those sales continued left some industry analysts exasperated.

The tech giant, which is now concentrating on building the ‘metaverse,’ has been contending with faltering revenue and broader woes in the industry.

“Our fear heading into the final days of the deal was that Musk was going to be forced to sell more Tesla stock to fund the disaster Twitter deal and ultimately those fears came true which speaks to some of the massive selling pressures on the stock of late,” wrote Daniel Ives at Wedbush Securities. “For Musk who multiple times over the past year has said he is ‘done selling Tesla stock’ yet again loses more credibility with investors and his loyalists in a boy who cried wolf moment.”

Most of Musk’s wealth is tied up in shares of Tesla. On Tuesday, his personal net worth dropped below $200 billion, according to Forbes, but he is still the world’s richest person.

Musk had lined up banks, including Morgan Stanley, to help finance the Twitter deal. His original share of the deal was about $15.5 billion, Ives estimated . But if equity investors dropped out, Musk would be on the hook to replace them or throw in more of his own money.

“The Twitter circus show has been an absolute debacle from all angles since Musk bought the platform for all the world to see: from the 50% layoffs and then bringing back some workers, to the head scratching verification roll-out to users which many are pushing back on, to the constant tweeting in this political firestorm backdrop, and now ... selling more TSLA stock,” Ives wrote. “When does it end?”

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.