Bank stocks tumble; others rise on hopes for easier rates

Bank stocks tumbled Monday on worries triggered by the second- and third-largest bank failures in U.S. history. But many other stocks rose on hopes the bloodletting will force the Federal Reserve to take it easier on the interest rate hikes that are shaking Wall Street and the economy.

The Standard & Poor’s 500 dipped 0.2% after whipsaw trading, where it careened from an early loss of 1.4% to a midday gain of nearly that much. The Dow Jones industrial average fell 90 points, or 0.3%, while the Nasdaq composite rose 0.4%.

The sharpest drops were again among banks. Investors are worried that relentless interest rate increases meant to get inflation under control are approaching a tipping point and may be cracking the banking system.

The U.S. government announced a plan late Sunday meant to shore up the banking industry after the recent collapses of Silicon Valley Bank and Signature Bank.

The most pressure is on the regional banks a couple of steps smaller than the massive, “too big to fail” banks that helped take down the economy in 2007 and 2008. Shares of First Republic fell 61.8%, even after the bank said Sunday it had strengthened its finances with cash from the Federal Reserve and JPMorgan Chase.

Huge banks, which have been repeatedly stress-tested by regulators after the 2008 financial crisis, weren’t down as much. JPMorgan Chase fell 1.8%, and Bank of America dropped 5.8%.

“So far, it seems that the potential problem banks are few, and importantly do not extend to the so-called systemically important banks,” analysts at ING said.

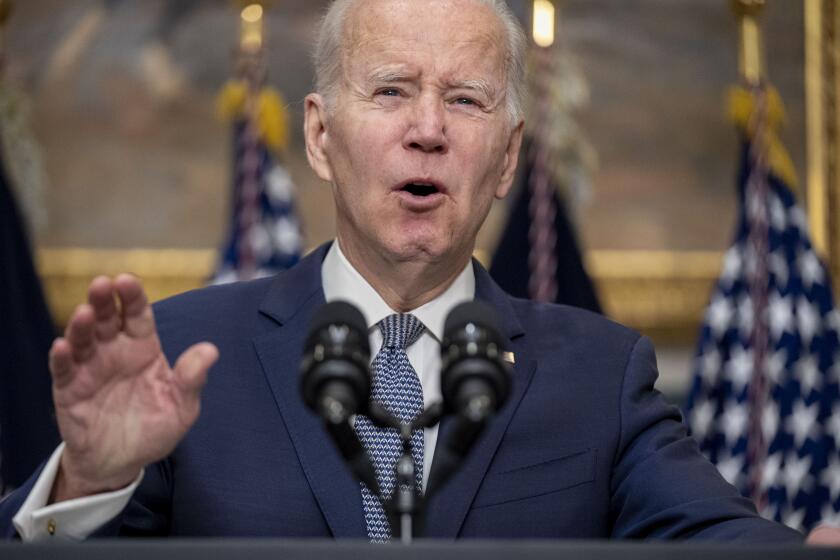

Assuring the public a crisis in the banking system was under control, President Biden blamed his predecessor for creating the conditions for the collapse of Silicon Valley Bank and Signature Bank.

The broader market flipped from losses to gains as expectations built that the furor will mean the Fed won’t reaccelerate its rate hikes, as it had been threatening to do. Such a move could give the economy and banking system more breathing space, but it could also give inflation more oxygen.

Some investors are calling for the Fed to make cuts to interest rates soon to stanch the bleeding. Rate cuts often act like steroids for the stock market.

The wider expectation, though, is that the Fed will pause or at least hold off on accelerating its rate hikes at its next meeting later this month.

That would still be a sharp turnaround from expectations just a week ago, when many traders were forecasting the Fed could go back to increasing the size of its rate hikes. The fear was that stubbornly high inflation would force the Fed to get even tougher, and investors were bracing for the Fed to keep raising rates at least a couple more times after that.

Now, “depending on reactions in financial markets and eventual fallout on the overall economy, we wouldn’t rule out that the hiking cycle could even be over and that the next move by Fed officials may be lower not higher,” said Kevin Cummins, chief U.S. economist at NatWest.

Preventing bank runs is the immediate emergency, but the underlying problem that weakened Silicon Valley Bank — and may also leave other banks susceptible — has yet to be addressed.

Higher interest rates can drag down inflation by slowing the economy, but they raise the risk of a recession later on. They also hit prices for stocks, as well as bonds sitting in investors’ portfolios.

The Fed has already hiked rates at the fastest pace in generations and made other moves to reverse its tremendous support for the economy during the pandemic. That has in effect drained cash, or liquidity, from the system.

“Restoring liquidity in the banking system is easier than restoring confidence, and today it is clearly about the latter,” said Quincy Krosby, chief global strategist for LPL Financial.

At one point during the morning, a measure of fear among stock investors on Wall Street touched its highest level since October before falling back.

Prices for Treasurys shot higher as investors sought safety and as their expectations grew for an easier Fed. That in turn sent their yields lower, and the yield on the 10-year Treasury plunged to 3.54% from 3.70% late Friday. That’s a major move for the bond market.

Silicon Valley Bank failed late last week, prompting fears of wider upheaval. Here’s what you should know about the collapse and what comes next.

The two-year yield, which moves more on expectations for the Fed, had an even more breathtaking drop. It fell to 3.99% from 4.59% on Friday. It was above 5% earlier this month.

Stock markets were mixed in Asia, but the losses deepened as trading headed westward through Europe. Germany’s DAX lost 3.3% as bank stocks across the continent sank.

In London, the government arranged the sale of Silicon Valley Bank UK Ltd., the California bank’s British arm, for the nominal sum of one British pound, or roughly $1.20.

All told, the S&P 500 slipped 5.83 points to 3,855.76. The Dow fell 90.50 points to 31,819.14, and the Nasdaq rose 49.96 points to 11,188.84.

AP business writers David McHugh, Yuri Kageyama and Matt Ott contributed to this report.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.