Jury convicts FTX founder Sam Bankman-Fried of fraud charges after historic cryptocurrency collapse

- Share via

FTX founder Sam Bankman-Fried’s spectacular rise and fall in the cryptocurrency industry — a journey that included his testimony before Congress, a Super Bowl advertisement and dreams of a future run for president — hit a new bottom Thursday when a jury in New York convicted him of fraud in a scheme that cheated customers and investors of at least $10 billion.

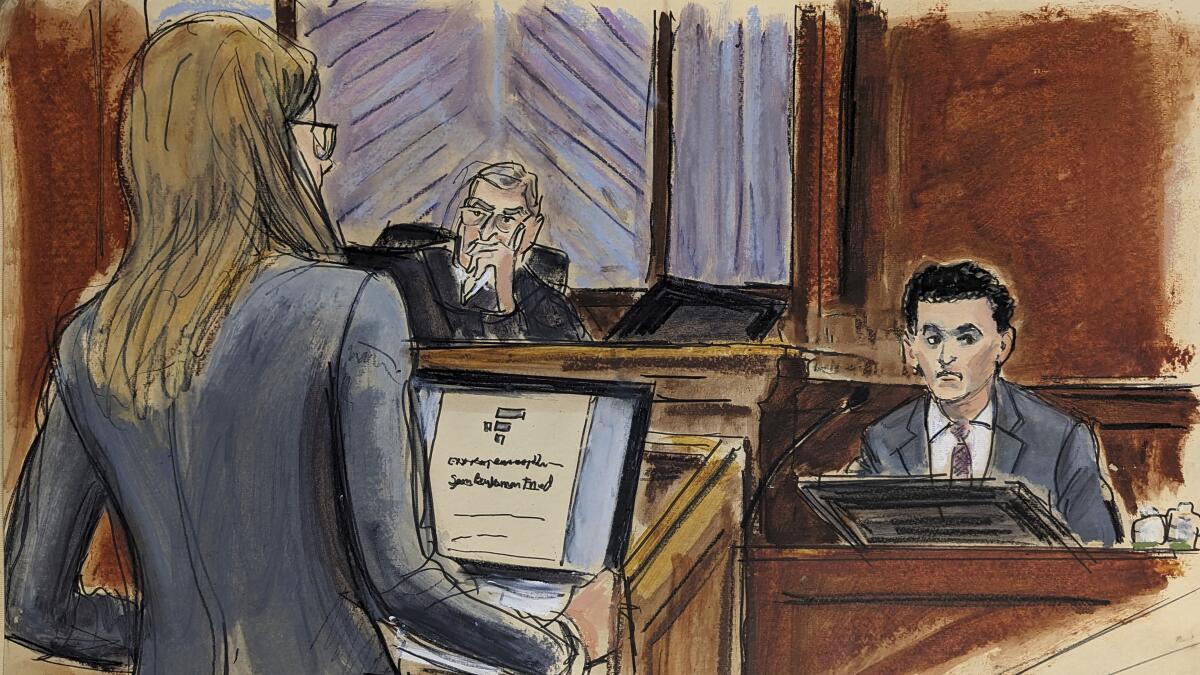

After the monthlong trial, jurors rejected Bankman-Fried’s claim on the witness stand in federal court in Manhattan that he never committed fraud or meant to cheat customers before FTX, once the world’s second-largest crypto exchange, collapsed into bankruptcy a year ago.

“His crimes caught up to him. His crimes have been exposed,” Assistant U.S. Atty. Danielle Sassoon said of the onetime billionaire just before jurors were read the law by Judge Lewis A. Kaplan and began deliberations. Sassoon said Bankman-Fried turned his customers’ accounts into his “personal piggy bank” as up to $14 billion disappeared.

She urged jurors to reject Bankman-Fried’s insistence when he testified that he never committed fraud or plotted to steal from customers, investors and lenders and didn’t realize his companies were at least $10 billion in debt until October 2022.

Indicted crypto billionaire Sam Bankman-Fried’s $250-million bail deal was the largest ever, secured with his parents’ house. But they aren’t typical homeowners.

The trial attracted intense interest with its focus on a fraud on a scale not seen since the 2009 prosecution of Bernard Madoff, whose Ponzi scheme over decades cheated thousands of investors out of about $20 billion. Madoff pleaded guilty and was sentenced to 150 years in prison, where he died in 2021.

The prosecution of Bankman-Fried, 31, put a spotlight on the emerging cryptocurrency industry and a group of young executives who lived together in a $30-million luxury apartment in the Bahamas as they dreamed of becoming the most powerful players in a new financial field.

U.S. Atty. Damian Williams said they engaged in one of the biggest frauds in U.S. history.

Prosecutors made sure jurors knew that the defendant they saw in court with short hair and a suit was not the man with big messy hair and shorts that became his trademark appearance after he started his hedge fund, Alameda Research, in 2017 and FTX, his cryptocurrency exchange, two years later.

They showed the jury pictures of Bankman-Fried sleeping on a private jet, sitting with a deck of cards and mingling at the Super Bowl with celebrities including singer Katy Perry. Assistant U.S. Atty. Nicolas Roos called Bankman-Fried someone who liked “celebrity chasing.”

In a closing argument, defense lawyer Mark Cohen said prosecutors were trying to turn “Sam into some sort of villain, some sort of monster.”

“It’s both wrong and unfair, and I hope and believe that you have seen that it’s simply not true,” he said. “According to the government, everything Sam ever touched and said was fraudulent.”

The government relied heavily on the testimony of three former members of Bankman-Fried’s inner circle, his top executives including his former girlfriend, Caroline Ellison, to explain how Bankman-Fried used Alameda Research to siphon billions of dollars from customer accounts at FTX.

With that money, prosecutors said, the MIT graduate gained influence and power through investments, donations, tens of millions of dollars in political contributions, congressional testimony and a publicity campaign that enlisted celebrities such as comedian Larry David and football quarterback Tom Brady.

The cryptocurrency billionaire employed several former regulators who aided his efforts to woo top CFTC officials, emails obtained by the Los Angeles Times show.

Ellison, 28, testified that Bankman-Fried directed her while she was chief executive of Alameda Research to commit fraud as he pursued ambitions to lead huge companies, spend money influentially and run for U.S. president someday. She said he thought he had a 5% chance of being elected.

Becoming tearful as she described the collapse of the cryptocurrency empire last November, Ellison said the revelations that caused customers collectively to demand their money back, exposing the fraud, brought a “relief that I didn’t have to lie anymore.”

FTX co-founder Gary Wang, who was FTX’s chief technology officer, revealed in his testimony that Bankman-Fried directed him to insert code into FTX’s operations so that Alameda Research could make unlimited withdrawals from FTX and have a credit line of up to $65 billion. Wang said the money came from customers.

Nishad Singh, the former head of engineering at FTX, testified that he felt “blindsided and horrified” at the result of the actions of a man he once admired when he saw the extent of the fraud, as the collapse last November left him suicidal.

Ellison, Wang and Singh all pleaded guilty to fraud charges and testified against Bankman-Fried in hopes of leniency at sentencing.

Bankman-Fried was arrested in the Bahamas last December and extradited to the United States, where he was freed on a $250-million personal recognizance bond with electronic monitoring and a requirement that he remain at the home of his parents in Palo Alto.

His communications, including hundreds of phone calls with journalists and internet influencers, along with emails and texts, eventually got him in trouble when the judge concluded he was trying to influence prospective trial witnesses and ordered him jailed in August.

During the trial, prosecutors used Bankman-Fried’s public statements, online announcements and congressional testimony against him, showing how the entrepreneur repeatedly promised customers that their deposits were safe and secure as recently as Nov. 7, 2022, when he tweeted, “FTX is fine. Assets are fine” as customers furiously tried to withdraw their money. He deleted the tweet the next day. FTX filed for bankruptcy four days later.

In his closing, Roos mocked Bankman-Fried’s testimony, saying that under questioning from his lawyer, the defendant’s words were “smooth, like it had been rehearsed a bunch of times.”

But under cross-examination, “he was a different person,” the prosecutor said. “Suddenly on cross-examination he couldn’t remember a single detail about his company or what he said publicly. It was uncomfortable to hear. He never said he couldn’t recall during his direct examination, but it happened over 140 times during his cross-examination.”

Ken Sweet of the Associated Press contributed to this report.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.