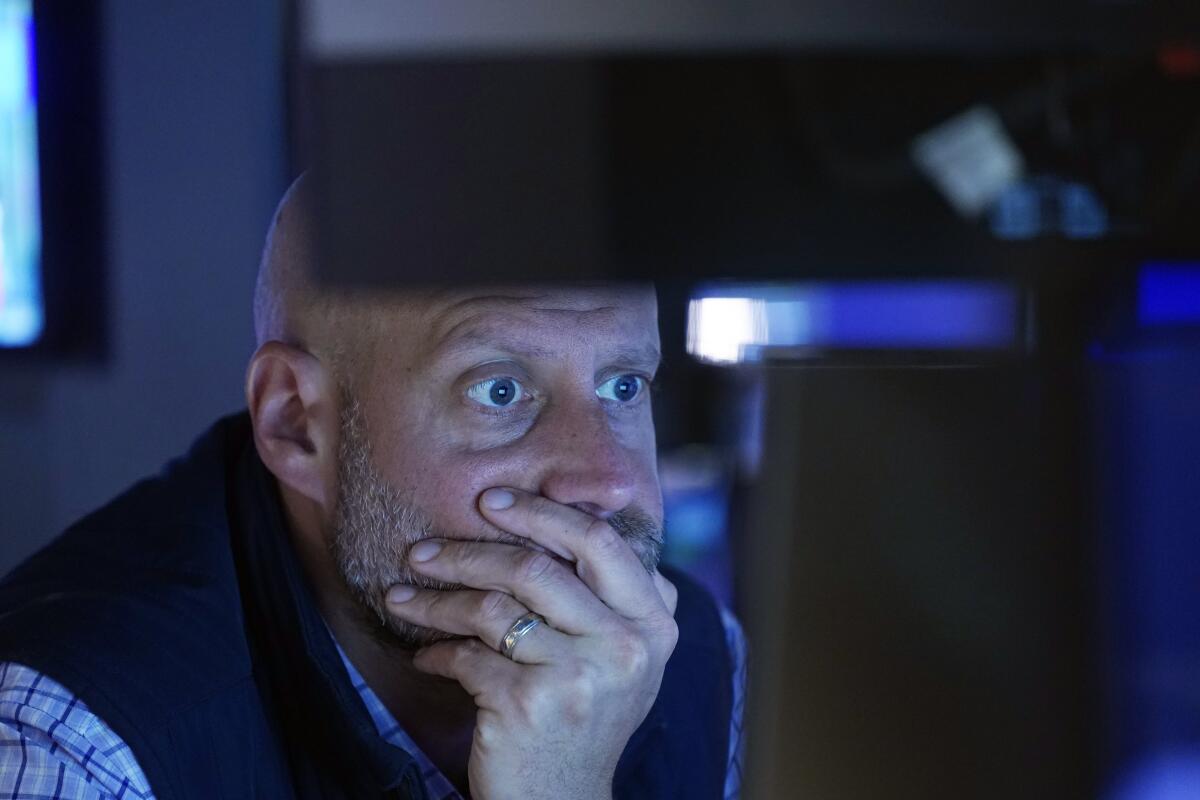

Wall Street rallies to close out a bloom-filled May

An already verdant May for Wall Street finished with another push higher as stocks rallied Friday after a report showed that inflation is at least not worsening.

The Standard & Poor’s 500 rose 0.8% to close its sixth winning month of the last seven. The main measure of the U.S. stock market’s health set an all-time high late in the month after clawing back all its losses from a rough April.

The Dow Jones industrial average jumped nearly 575 points, or 1.5%. Sagging prices for some big technology stocks held back the Nasdaq composite, which slipped by less than 0.1%.

Gap soared to one of the market’s biggest gains, 28.6%, after delivering stronger profit and revenue for the latest quarter than analysts expected. The parent company of Old Navy and Banana Republic reported growth across its brands, reversing earlier declines at most of them. The retailer raised its forecasts for sales and profitability this year despite saying the outlook for the economy remains uncertain.

Stocks broadly got a boost from easing Treasury yields in the bond market after the latest reading on inflation came in roughly as expected. That left open the question of when Wall Street will get the lower interest rates it craves.

The report showed that a key measure of inflation remained at 2.7% last month, exactly as forecast. Some underlying trends improved by a touch more than expected. That could bolster confidence at the Federal Reserve that inflation is sustainably heading toward the target of 2%, which it says it needs before it will cut its main interest rate.

The Fed has been keeping the federal funds rate at the highest level in more than 20 years in hopes of slowing the economy enough to stifle high inflation. But if it holds rates too high for too long, it could choke off the economy’s growth and cause a recession that throws workers out of jobs and craters profits for companies.

“The pickle for the Fed is whether growth will slow faster than inflation,” said Brian Jacobsen, chief economist at Annex Wealth Management. “We’ve gone from great growth to slower growth pretty quickly. The road to lower inflation has been like a joyride so far, but the last mile will be more challenging.”

Friday’s report from the U.S. government showed that growth in spending by consumers weakened by more than economists expected. Growth in incomes for Americans also slowed last month.

Such numbers show that businesses “need to prepare for an environment where consumers are not splurging like they were last year,” according to Jeffrey Roach, chief economist for LPL Financial.

After the report, the yield on the 10-year Treasury fell to 4.5% from 4.55% late Thursday. It had topped 4.6% earlier in the week amid worries about tepid demand following some auctions for Treasurys, a move that had hurt stocks.

The two-year Treasury yield, which more closely tracks expectations for Fed action, slipped to 4.87% from 4.93% late Thursday.

Virtually no one expects the Federal Reserve to cut interest rates at its next meeting in a week and a half. But traders are betting on a nearly 85% probability that the Fed will cut at least once by the end of the year, according to data from CME Group.

Stocks in industries that tend to benefit the most from easier interest rates helped lead the market Friday. Real-estate stocks in the S&P 500 jumped 1.9%, for one of the biggest gains among the 11 sectors that make up the index. Boston Properties rose 4.3%.

On the losing end of Wall Street were several tech stocks.

Dell tumbled 17.9%, even though it matched analysts’ forecasts for profit in the latest quarter. Its stock had soared 122% in 2024 ahead of the report, meaning expectations were very high, and analysts pointed to concerns about how much profit Dell is squeezing out of each $1 in revenue.

Nvidia fell for a second straight day, losing 0.8%, as its momentum finally slows after soaring more than 20% since its blowout profit report last week. The chip company was one of the heaviest weights on the S&P 500 Friday. But its soaring profits and ability to keep a frenzy going on Wall Street for the entire artificial-intelligence technology industry were also huge reasons for the index’s 4.8% gain for May.

Trump Media & Technology Group slumped 5.3% in its first trading following Thursday’s conviction of Donald Trump on felony charges. The company, which runs the Truth Social platform, had warned in filings with U.S. securities regulators that a conviction could hurt it.

MongoDB dropped 23.9% despite topping forecasts for profit and revenue. The database company for developers gave forecasts for profit in the current quarter and for this full year that fell short of analysts’ expectations.

All told, the S&P 500 rose 42.03 points to 5,277.51. The Dow leaped 574.84 points to 38,686.32, and the Nasdaq slipped 2.06 to 16,735.02.

Indexes were mixed across Asia and Europe.

Choe writes for the Associated Press.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.