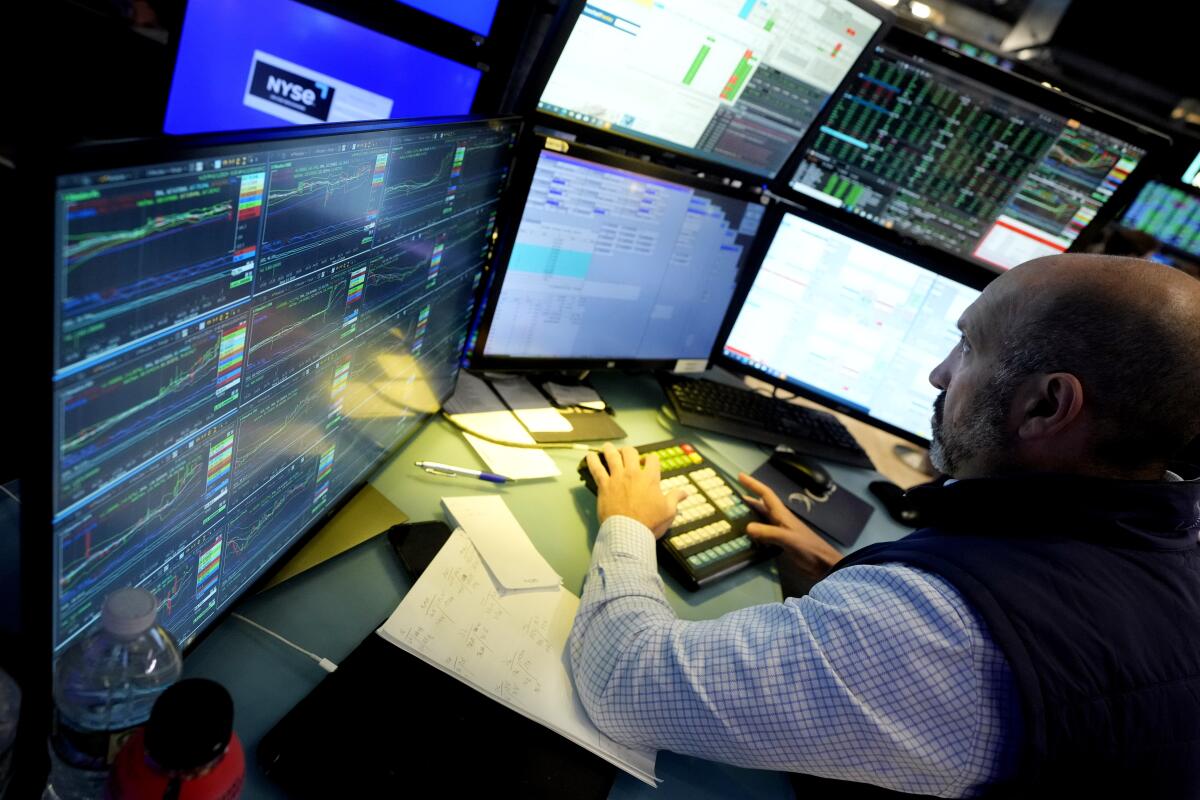

Wall Street hangs around its records after European stocks slump

- Share via

NEW YORK — U.S. stocks hung around their record levels Friday as Wall Street remained relatively quiet after another slide in Europe.

The Standard & Poor’s 500 edged down by less than 0.1%, marking the first time this week when it did not set an all-time high. The Dow Jones industrial average dipped 0.1%, while the Nasdaq composite added 0.1% to its record set a day before on the back of gains for technology stocks.

Losses were sharper across the Atlantic, where markets have been rocked by the results of recent elections in Europe. Wins by far-right parties have raised the pressure on France’s president in particular, and investors worry it could weaken the European Union, stall fiscal plans and ultimately hurt France’s ability to pay its debt. Recent elections have also shaken markets in Mexico, India and elsewhere.

France’s CAC 40 fell 2.7% to bring its loss for the week to 6.2%, its worst in more than two years. Germany’s DAX lost 1.4%.

On Wall Street, RH fell 17.1% after reporting a worse loss for the latest quarter than financial analysts expected. The seller of home furnishings called this “the most challenging housing market in three decades.”

High mortgage rates have hurt the housing market, as the Federal Reserve has kept its main interest rate at the highest level in more than two decades. The central bank is intentionally slowing the economy through high rates in hopes of starving high inflation of its fuel.

Cruise-ship operators were among the market’s biggest losers after analysts at Bank of America flagged softening price trends for trips. Norwegian Cruise Line dropped 7.5% for the worst loss in the S&P 500, and Carnival fell 7.1%.

Stocks have nevertheless set records as hopes rise that inflation is slowing enough to convince the Federal Reserve to cut interest rates later this year. Big technology stocks, meanwhile, continue to race ahead almost regardless of what the economy and interest rates are doing.

Adobe jumped 14.5% after reporting stronger profit for the latest quarter than analysts expected.

Broadcom rose 3.3% for a second straight day of gains after reporting better-than-expected profit and a 10-for-one stock split to make its price more affordable. Nvidia gained 1.8% as the poster child of the rush into artificial-intelligence technology sees its total market value climb even higher above $3 trillion.

Nvidia was the strongest single force pushing upward on the S&P 500, as has become almost routine recently. Adobe and Broadcom were close behind.

All told, the S&P 500 dipped 2.14 points to 5,431.60. The Dow fell 57.94 points to 38,589.16, and the Nasdaq composite added 21.32 points to close at 17,688.88.

In the bond market, U.S. Treasury yields ticked lower after a preliminary report from the University of Michigan suggested sentiment among U.S. consumers failed to improve this month, against economists’ expectations.

Solid spending by U.S. households has been one of the main engines keeping the economy out of a recession, but “assessments of personal finances dipped, due to modestly rising concerns over high prices as well as weakening incomes,” said Joanne Hsu, director of the Surveys of Consumers.

Perhaps more importantly for financial markets, expectations for upcoming inflation among U.S. consumers don’t seem to be moving much, even if they are relatively high. That’s an encouraging signal that the economy could avoid a self-fulfilling cycle in which expectations for higher inflation drive behavior that creates more of it.

The yield on the 10-year Treasury fell to 4.21% from 4.25% late Thursday. It had been as high as 4.60% late last month, before a couple of encouraging reports on inflation.

In stock markets abroad, indexes were mixed in Asia. Japan’s Nikkei 225 rose 0.2% after the country’s central bank held steady on interest rates.

Choe writes for the Associated Press.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.