No, folks, Harris isn’t planning to tax your unrealized capital gains — but a wealth tax is still a good idea

- Share via

That fetid gust of hot air you may have detected wafting from Republican and conservative social media postings over the last day or two was a fabricated claim that Kamala Harris is plotting to tax everyone’s unrealized capital gains if she becomes president.

That would be a departure from current law, which taxes capital gains only when the underlying assets are sold, or “realized.”

That it’s a mythical allegation hasn’t stopped right-wingers and GOP functionaries from hand-wringing over the economic implications of any such change, and over the purportedly horrible impact on average Americans.

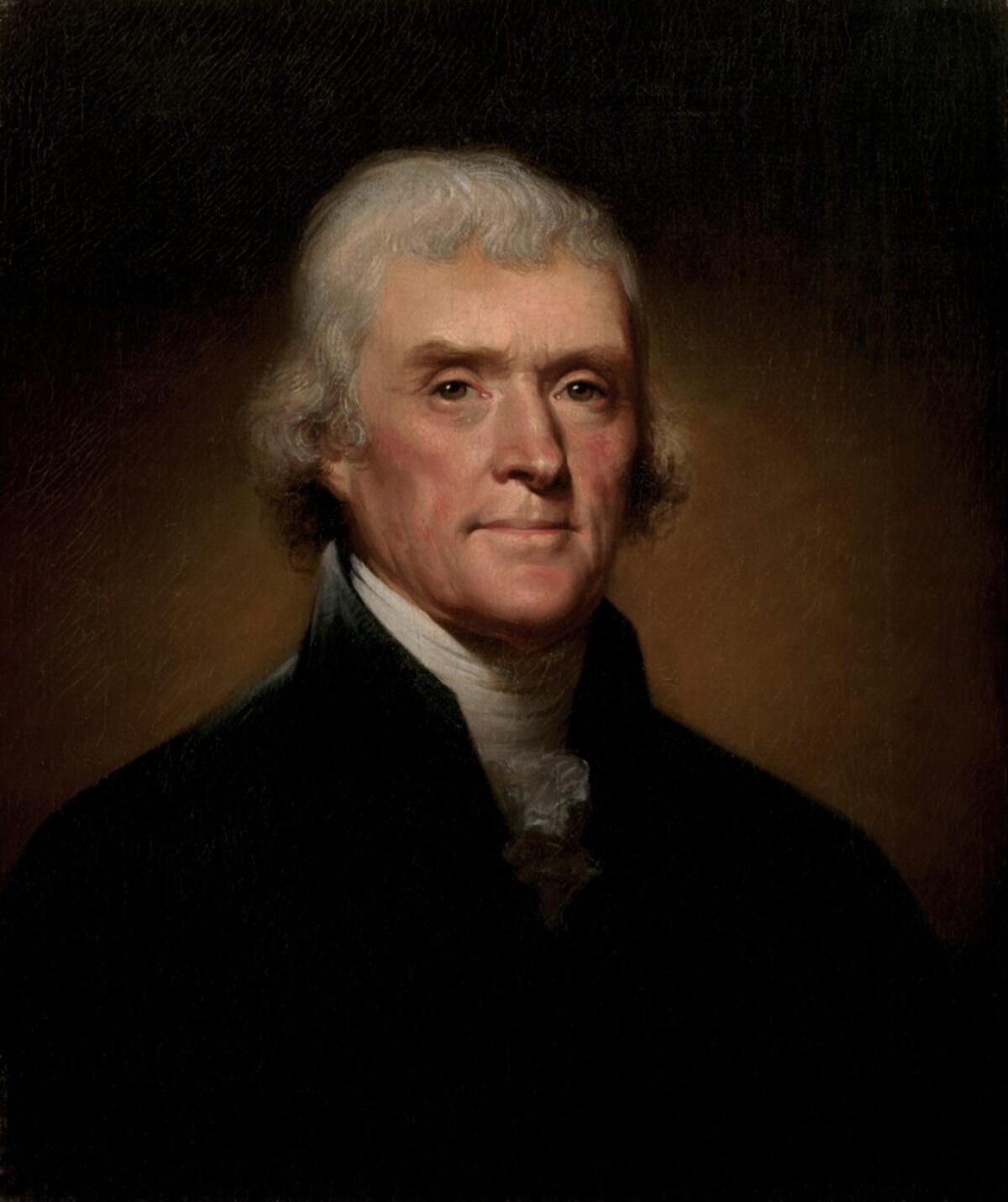

Whenever there is in any country, uncultivated lands and unemployed poor, it is clear that the laws of property have been so far extended as to violate natural right.

— Thomas Jefferson

Here, for instance, is the far-right blowhard Mike Cernovich, tweeting Tuesday on X: “If you own a house, subtract what you paid for it from the Zillow estimate. Be prepared to pay 25% of that in a check to the IRS. That’s your unrealized capital gains taxed owed under the Kamala Harris proposal.”

And Chicago venture investor Robert Nelson: “Taxing unrealized gains is truly the most insane, economy destroying, innovation killing, market crashing, retirement fund decimating, unconstitutional idea, which was probably planted by Russia or China to destroy the economy. Dems need to run away from this wildly stupid idea.”

Get the latest from Michael Hiltzik

Commentary on economics and more from a Pulitzer Prize winner.

You may occasionally receive promotional content from the Los Angeles Times.

All right, guys, take a deep breath. Harris hasn’t proposed taxing your unrealized capital gains, or mine. What she has said, as the Harris campaign told me, is that she “supports the revenue raisers in the FY25 Biden-Harris [administration] budget. Nothing beyond that.”

So what’s in that Biden-Harris administration budget for fiscal year 2025?

The budget plan does indeed call for taxation of unrealized capital gains held by the country’s uber-rich. That’s part of its proposal for a 25% minimum tax on the annual income of taxpayers with wealth of more than $100 million — a wealth tax. If you’re a member of that cohort, lucky you. But at that level of affluence you don’t have grounds to complain about paying a minimum 25% of your annual income.

Anyway, there aren’t very many of you “centi-millionaires,” as the category is known—10,660 in the U.S., according to a 2023 estimate. That includes a handful of centi-billionaires such as Elon Musk ($249 billion, according to Forbes), Jeff Bezos ($198.5 billion) and Mark Zuckerberg ($185.3 billion). It’s doubtful that anyone in this category is poring over Zillow estimates to calculate the sale value of his or her house (or houses).

Republicans criticizing Biden’s student debt relief plan took millions of dollars in pandemic relief loans and never paid them back. But they say that’s different.

Several other proposals in the budget plan are relevant to taxes on the wealthy. One would restore the top income tax rate of 39.6%, which was cut to 37% in the Republicans’ 2017 Tax Cut and Jobs Act; Biden proposed to allow that cut to expire as scheduled next year. The restored top rate would apply to income over $731,200 for couples, $609,350 for singles, starting with this year’s income.

Another provision would raise the tax rate on capital gains and dividends to the same rate charged on ordinary income — but only on annual income exceeding $1 million for couples ($500,000 for single filers). Under current law, capital gains and dividends get a huge break: The top rate is 20%, though it’s zero for couples with income of $89,250 or less ($44,625 for singles), and 15% for those with income more than that but less than $553,850 ($492,300 for singles).

The preferential rates on cap gains “disproportionately benefit high-income taxpayers and provide many high-income taxpayers with a lower tax rate than many low- and middle-income taxpayers,” the White House explains. They also “disproportionately benefit White taxpayers, who receive the overwhelming majority of the benefits of the reduced rates.”

The proposal would also eliminate the notorious step-up in basis enjoyed by heirs. Currently, if those inheriting stocks, bonds, real estate or other capital assets sell those assets, they’re taxed only on the difference between what they were worth at the time of the original owner’s death and their value upon the subsequent sale — not the difference between what they cost when purchased (the “basis”) and what they were worth when ultimately sold.

This process turns the capital gains tax into what the late Ed Kleinbard, the tax expert at USC, called America’s only voluntary tax. Since owners of capital assets don’t pay tax on their appreciation in value until they’re sold, they can defer the tax indefinitely by simply not selling. When they die, the step-up in basis extinguishes the prior capital gains liability forever, leaving only a tax on any gains the heirs reaped starting from the date of their inheritance.

And rich families can enjoy the benefits of their capital portfolio by borrowing against it, never having to sell. That’s an option seldom available to the ordinary taxpayer, who may have to sell to make ends meet. This is how those families perpetuate their fortunes without paying their fair share of income tax.

The Biden plan would repeal the step-up for heirs by levying the capital gains tax on the bequeathed asset, calculated from the original purchase and charged to the decedent’s estate. Inheritances by spouses would be exempt, and the existing exemption of $250,000 in gains per person on the transfer of a principal residence would remain in effect.

Biden’s budget infusion for the IRS produced a bounty of revenue from audits of the rich — about $6 in revenue for every $1 spent. It’s hard to find a better bargain.

Biden’s plan also would increase the net investment income tax and Medicare tax rates to 5% each from the current 3.8% on income over $400,000. That would bring the top capital gains rate to 44.6%.

Is that a lot? Too much? Not enough? It’s true that the capital gains tax has typically been lower than the tax on ordinary income, reaching as high as 40% only briefly in the 1970s. Overall, however, it’s a relative pittance in postwar terms: The top tax rate on ordinary income was 90% or higher from 1944 through 1963, 70% from 1965 through 1981, and 50% from 1981 through 1986. Americans enjoyed unexampled prosperity throughout most of that time span.

That brings us back to the wealth tax idea, which terrifies the rich and their water-carriers in the press and punditocracy. Noah Rothman of the right-wing National Review, for example, got especially exercised over Michelle Obama’s critique of “the affirmative action of generational wealth” in her speech at the Democratic convention Tuesday night.

“The idea that accumulating material wealth and bequeathing it to your offspring with the hope that they build on it and do the same for their children is one of the fundaments of the American social compact,” Rothman grumbled. “Trying to make that sense of industry into a source of shame is absurd.”

The idea that the offspring of millionaires and billionaires are building on their inherited wealth is pretty, but in practice rare. As the wealth management firm UBS reported, last year for the first time in the nine years that it had been tracking extreme wealth, billionaires “accumulated more wealth through inheritance than entrepreneurship.” This “great wealth transfer,” it added, “is gaining momentum.”

As I’ve written before, the concentration of wealth in America has reached levels that make the gilt of the 19th century Gilded Age look like dross. In the U.S. there were 66 billionaires in 1990, and about 750 in 2023.

Hiltzik: Is America cheating its children to subsidize old people? Refuting a common falsehood

Fiscal hawks love to claim that America is shortchanging its youth by spending so much to support its seniors. But the real economic war is between the rich and everyone else -- and the rich are winning.

Critics of a wealth tax often assert that it’s unworkable because it’s hard to value non-tradable assets — think artworks, or almost anything other than stocks, bonds and real estate, which can be valued at a market price. The Biden plan has an answer to that. Non-tradable assets would be valued at their purchase price or their value the last time they were borrowed against or invested in, with an annual increase based on Treasury interest rates.

As for those who think there’s something un-American in a wealth tax, they can take up the issue with the Founding Fathers, who considered generationally accumulated wealth to be inimical to a free republic.

“Whenever there is in any country, uncultivated lands and unemployed poor,” Thomas Jefferson wrote to James Madison in October 1785, “it is clear that the laws of property have been so far extended as to violate natural right.”

Madison in 1792 viewed the duty of political parties as acting to combat “the inequality of property, by an immoderate, and especially an unmerited, accumulation of riches.” Benjamin Franklin urged the Constitutional Convention in Philadelphia, albeit unsuccessfully, to declare that “the state has the right to discourage large concentrations of property as a danger to the happiness of mankind.”

They didn’t seem concerned that fighting the immoderate accumulation of riches would be complicated or unnecessary. Quite the opposite: They would appear to agree, were they with us today, with the line beloved of equality advocates that “every billionaire is a policy failure.”

Put it all together, and it sounds almost as if Michelle Obama was channeling the Founders. And if Kamala Harris supports the provisions in the Biden budget plan aimed at requiring the super-rich to pay their fair share of taxes — as her campaign confirms — she’s channeling them too.

More to Read

Get the latest from Michael Hiltzik

Commentary on economics and more from a Pulitzer Prize winner.

You may occasionally receive promotional content from the Los Angeles Times.