This hilarious lawsuit by the NFL Players Assn. against DraftKings shows the dark underside of sports betting

- Share via

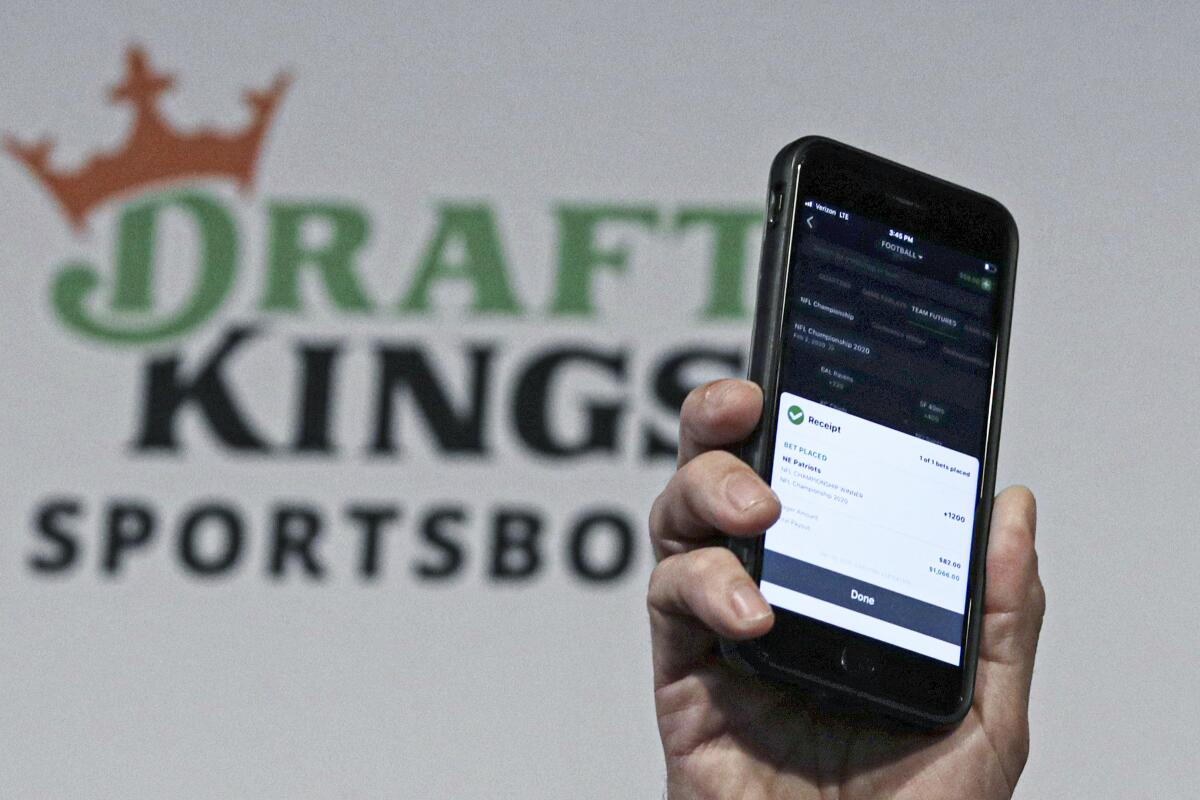

It’s always amusing to see a business suffer from the turnabout-is-fair-play principle, so we owe props to the National Football League Players Assn., which has delivered a stinging hit on DraftKings in a lawsuit over the gambling firm’s attempt to slink out of its payments on a licensing deal.

DraftKings, the NFLPA asserts in the lawsuit filed a couple of weeks ago in New York federal court, collects billions of dollars in revenue “based on a simple premise: if a DraftKings customer places a losing bet, that customer must still pay up.”

In this case, the lawsuit says, “DraftKings has refused to play by its own rules.”

DraftKings was stricken with buyer’s remorse.

— NFL Players Assn.

After cutting a lavish deal to license NFL players’ names, images and likenesses for non-fungible tokens in 2021, DraftKings recognized that the market for NFTs had evaporated. It abruptly shut down its NFT marketplace this past July 30 and has refused to pay the NFLPA the money it still owes on the 2021 agreement — a sum the NFLPA estimates at about $65 million.

At least, that’s the players association’s allegation. DraftKings found grounds to cancel the deal deep within the contract’s escape clauses; the NFLPA says they don’t apply. Boston-based DraftKings hasn’t yet filed a response to the lawsuit and didn’t reply to my multiple requests for comment.

Get the latest from Michael Hiltzik

Commentary on economics and more from a Pulitzer Prize winner.

You may occasionally receive promotional content from the Los Angeles Times.

Regardless of how this case turns out, it opens a window on the sheer skeeviness of both the online sports betting world and the ludicrous marketing of NFTs — which indeed have fallen in value from the millions of dollars each a year or so ago to pretty much zero today.

Before we delve further into the NFLPA’s case, a few words about NFTs and sports betting are in order.

The market for NFTs was one of several financial bubbles that got pumped up during the pandemic. Housebound plungers were deprived of access to movies, live sports and other forms of collective entertainment, so they played at investing in meme stocks such as GameStop and dogecoins and other weird cryptocurrencies instead.

NFTs are digital representations that are pitched as unique and therefore supposedly have the virtue of scarcity. But they confer no ownership to anything but the digital file, which may be an image of an object that is actually owned by someone else.

Hiltzik: Bitcoin, NFTs, SPACs, meme stocks — all those pandemic investment darlings are crashing

The carnage in investing fads is getting bloodier.

The NFT market rode atop a wave of febrile claims that it would remake the market for creative objects and bring riches to starving musicians and artists.

That never happened, and the market inevitably crashed. A prototypical NFT of Twitter founder Jack Dorsey’s first tweet was purchased by a cryptocurrency entrepreneur for $2.9 million in 2021. He dreamed of reselling it for $50 million at the peak of the NFT frenzy but found no takers; by July last year the token was quoted at $3.77.

Online sports betting and the pandemic were made for each other. After 2018, when the Supreme Court overturned a nationwide ban on the practice that had permitted only Nevada to host sports books, it was legalized by 38 states and the District of Columbia; 30 of those states allow online sports gambling. Stay-at-homes got a new source of entertainment.

The major sports leagues, which had shunned gambling for a century, saw an opportunity to juice interest in their product. In-game proposition bets kept viewers in their seats through to the end of crummy blowout games, which meant higher advertising rates for telecasts, so the networks were happy too. The leading online gaming firm, FanDuel, became the official gaming partner of the National Football League, Major League Baseball and the National Basketball Assn.; DraftKings, the No. 2 provider, made deals with the NFL and the NBA.

The predatory character of the online sports betting model soon became evident. Earlier this year, researchers at UCLA and USC reported that the credit scores of consumers in states that have legalized sports betting have deteriorated by an average 0.3%; in states that legalized online sports betting, the decline is an average 1%.

“We find a substantial increase in bankruptcy rates, debt collections, debt consolidation loans, and auto loan delinquencies” in those states, they wrote, consonant with an increase in excessive debt among players.

Has any era given birth to more dubious investment mechanisms than today?

In New Jersey, which legalized sports betting within weeks of the Supreme Court ruling, authorities found that sports bettors were more likely than other gamblers “to have high rates of problem gambling and problems with drugs or alcohol, and to experience mental health problems like anxiety and depression,” according to Lia Nower, director of the Center for Gambling Studies at Rutgers University. “About 14% of sports bettors reported thoughts of suicide, and 10% said they had made a suicide attempt.”

The fastest-growing group of sports gamblers are young adults aged 21 to 24, Nower reported. Most favor in-game bets, which play on “emotions and impulsive spending.” These are also favored by the gambling companies, because in-game bettors lose money at a ferocious pace. Accordingly, the gambling firms’ online apps feed these players with the prospect of instant thrills.

For all that, the leading companies and others have spent lavishly to acquire customers, so profits have been hard to come by. DraftKings has lost $5.01 billion on revenue of $10.1 billion from 2020 through the first half of this year. (The company eked out a $63.8-million profit in the second quarter of 2024 ended June 30 in part through a baroque tax gain.) FanDuel’s parent company, Ireland-based Flutter Entertainment, reported losses totaling $2.6 billion on revenue of $36.6 billion from 2021 through the first half of this year.

That brings us back to DraftKings’ deal with the NFLPA. In mid-2021, DraftKings sought to “bolster its revenue by incorporating sports-themed alternative assets into its slate of offerings,” the lawsuit states. Eyeing the market for “digital sports-themed collectibles,” the firm initially partnered with Autograph, a marketer of sports NFTs part-owned by Tom Brady.

The first issue of 10,000 NFTs featuring Brady carrying his digital signature and priced at up to $100 each instantly sold out, DraftKings announced. Sales in the trading market, on which DraftKings collected a transaction fee, amounted to $1 million.

Hiltzik: It’s not just Shohei — a massive scandal involving sports betting is just around the corner

The controversy surrounding Shohei Otani is just a hint of the potential scandals arising from legalized sports betting.

Its appetite whetted, DraftKings moved to incorporate NFTs into its fantasy sports contest business by securing exclusive rights to all NFL players’ names, images and likenesses — together known as NIL rights. The idea was for customers to use “NFL collectibles,” which were NFTs of players, to gain entry to DraftKings-sponsored fantasy contests.

That led to the licensing deal with the NFLPA, which gave the company exclusive rights to NFTs of its members for use in the contests. The license was to expire on Feb. 28, 2027, with DraftKings making a guaranteed minimum payout in five installments. The money was to be forked over, the license agreement says, “regardless of how many sales occur or how much revenue is generated.”

Holders of NFTs were eligible to participate in fantasy tournaments, with those holding NFTs that were designed to be scarce gaining entry to elite tournaments. At first the scheme was a hit, generating tens of millions of dollars in sales during fiscal 2022, according to the lawsuit. (DraftKings hasn’t broken out its NFT sales in its financial disclosures.)

But the NFT market had collapsed by early 2023. “DraftKings was stricken with buyer’s remorse,” the NFLPA says. The company missed a license payment due April 29, 2023. It threatened to shut down the NFT marketplace, which it said would allow it to terminate the license agreement.

The NFLPA says that’s untrue. It says the agreement would allow DraftKings to bail out only if it or the NFLPA is declared bankrupt, if any provision of the agreement is found to violate the law, or if the Securities and Exchange Commission or state regulators declare NFTs to be securities. (Another termination provision is redacted in the lawsuit and the copy of the license agreement attached as an exhibit.) The NFLPA says none of those conditions has been met.

What did happen, however, was that a federal judge in Massachusetts refused to dismiss a class-action lawsuit against DraftKings over the NFT marketplace, ruling that the plaintiff had “plausibly alleged” that the NFTs are securities. DraftKings claims that triggered the termination clause.

Proposition 27 is being sold through a spectacularly misleading advertising campaign.

On July 29, a few weeks after that ruling and about a month before the opening of the 2024 NFL season, DraftKings shut down the NFT marketplace and told the NFLPA that it wouldn’t make any further license payments.

The shutdown has provoked an uproar among the company’s NFT holders, some of whom had paid tens of thousands of dollars for the NFL-branded NFTs in the hopes of entering and winning the elite fantasy contests; one user posting on Reddit claimed to have assembled a collection worth $100,000. That user labeled DraftKings’ action a “rug pull,” a term in the alternative investment world denoting schemes in which promoters collect millions of dollars from their marks and then abscond without delivering anything of value in return.

The NFLPA says that the Massachusetts judge’s ruling is nothing like a regulatory finding by the SEC or a state that the NFTs are “securities,” that the judge merely has given the plaintiff the green light to try to make that case at trial. It observes that DraftKings, in its legal filings in that case, denied that its NFTs are securities. It’s true that the SEC believes that NFTs, along with cryptocurrencies and other weird investment assets, are securities, but it hasn’t made a final determination that would stand up in court.

The NFLPA’s lawsuit doesn’t say outright how much it’s still owed by DraftKings. But, rather mischievously, it notes that the company’s top five executives have collected a total of $261.1 million in compensation since 2021, which it says is “approximately quadruple of what DraftKings owes to the NFLPA.” That would put the unpaid bill at about $65 million.

The NFLPA’s underlying point is what makes this legal contest so amusing. As it says, DraftKings wouldn’t allow any of its bettors to sleaze out of their obligations just because the game turned against them. So why should the players allow DraftKings to wriggle off the hook?

More to Read

Get the latest from Michael Hiltzik

Commentary on economics and more from a Pulitzer Prize winner.

You may occasionally receive promotional content from the Los Angeles Times.