How a South Korean entrepreneur plans to take on American and Chinese gaming giants

Netmarble Games Corp. estimates it will bring in $1.6 billion in revenue this year, making the South Korean company one of the most lucrative mobile app firms in the world.

But to hold onto that claim, it needs to attract more smartphone gamers in the U.S.

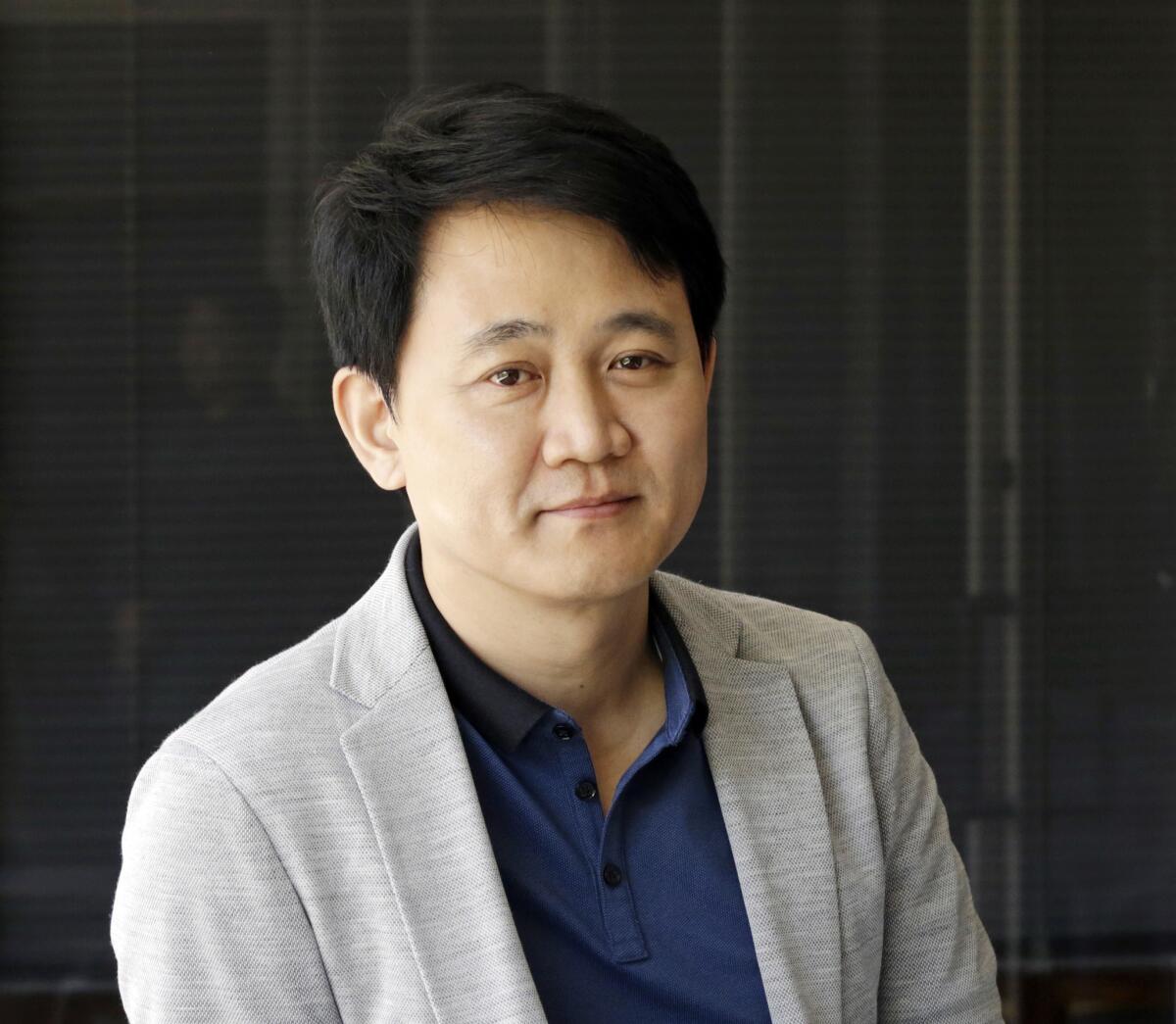

Jun-hyuk Bang, Netmarble’s founder and chairman, is betting on role-playing games.

These games, in which players direct a character through a virtual world and fight or transact with computer-controlled creatures along the way, are popular in Asia. Netmarble games such as “Seven Knights" and “Marvel Future Fight” have been downloaded tens of millions of times.

Still, the company reports that just 1.1 million of its nearly 12 million daily active users live outside Asia.

See the most-read stories in Business this hour >>

That’s one of the biggest challenges facing the Seoul company, which has offices in Buena Park and holds majority ownership of Culver City mobile game maker SGN. Netmarble plans to spend aggressively this year to fortify its portfolio of games as it tries to edge in on a market controlled by Chinese and American firms.

For the Record

June 21, 11 a.m.: An earlier version of this article stated that Netmarble has offices in Santa Monica. They are in Buena Park.

Last year, Santa Monica’s Activision Blizzard Inc. instantly gained a big share of the market by purchasing “Candy Crush”-maker King Digital Entertainment. And China’s Tencent is reportedly in the midst of consolidating its foothold by taking a larger stake in Supercell, which produces a quartet of exceptionally profitable games including “Clash of Clans.” Tencent also owns about one-quarter of Netmarble after making a $500-million investment in 2014.

To counter, Bang wants to take Netmarble public in the coming months, raising cash to buy game development firms and to build up the popularity of certain genres in key countries such as the U.S. In Bang’s view, anything but that strategy would mean leaving money on the table as he expects worldwide mobile gaming revenue to double by 2020, with analysts estimating to upward of $60 billion.

“Only a few major companies will lead the market," Bang said through his translator during an interview last week. “Not only does size matter, you have to understand the players and really react fast.”

The company hasn’t filed paperwork for an initial public offering, but the company is still moving toward that option because it’s faster compared to financing alternatives, Bang said. Seeking money from venture capitalists and funds takes “too much energy and time,” Bang said.

“The games market is going to change in two years, and I didn’t want to lose this time to grow,” Bang said.

Though he’s in talks with other gaming companies, no transactions are imminent, he said while in Los Angeles for the gaming industry's Electronic Entertainment Expo.

Some start-ups are betting on e-sports, or turning gaming into competition with money on the line, to fuel excitement about their games. But Bang isn't a believer just yet in that strategy. He said simple, tap-based mobile games are at least a year away from having the quick-fire, precision controls that – in computer and console games – can separate the elite from the rest.

Rather than e-sports, Bang is directing attention toward the development of artificial intelligence software that would assist players. Players who keep crashing at a certain turn in a driving game would automatically get an alert warning them about the difficult maneuver. The hope is that by helping people get better, they’ll stay interested for many more months or years.

Netmarble launched in 2000, funded with $88,000 from Bang and investors. Bang, who grew up playing arcade games, left the company because of health reasons in 2006. He returned in 2011, steering Netmarble toward mobile games and helping it hit the $1-billion revenue mark last year.

Music manager Troy Carter and ad agency Havas form innovation consulting firm

Many of the world’s biggest corporations are getting into buying, investing in or launching technology start-ups to find opportunities in smartphone-based commerce.

But they don’t necessarily have the digital expertise to pull it off.

Some turn to strategy consultants for help. Others go through venture capitalists for guidance. A few even tap sci-fi writers to dream up innovations.

Culver City entertainment and investment company Atom Factory and the well-known ad agency Havas Group say they can attract clients by offering a slate of the options.

The Smashd Group joint venture launching Tuesday expects to pull from Atom’s start-up mentorship program, online publication and roster of stars including singers Meghan Trainor and Charlie Puth. Atom Factory founder Troy Carter, who recently took an executive position at Spotify, is an investor in tech companies such as Uber Technologies and eyewear-seller Warby Parker. Meanwhile, Havas has the suit-and-tie consultants and the access to major advertisers.

“No one has all those assets put together,” said Andrew Benett, global chief executive of Havas Creative Group.

Smashd Group already has explored ideas for consumer goods business Reckitt Benckiser and a handful of others. A year’s worth of work from Smashd could cost eight figures.

“We’re envisioning what the world of tomorrow looks like for them, like how their brands become services,” Benett said.

Two L.A. start-ups join Target program

Branch Messenger and Makerskit are among 10 start-ups that will relocate to the headquarters of Target Corp. in Minneapolis for the summer.

The retailer and start-up development program Techstars plan to shower the companies with advice from Target executives and local technology and retail experts. The companies also receive an investment from Techstars.

More than 500 start-ups vied for the opportunity, as similar Techstars programs like one hosted the last two years at entertainment conglomerate Walt Disney Co. have proved valuable for start-ups.

Branch develops a shift scheduling and chat app for employees, and it lists Wendy's and Gap as users. Makerskit sells artisan home goods like soap and produces do-it-yourself packages for gardening and other hobbies.

Elsewhere on the Web

Snapchat now rents or owns more than 200,000 square feet of Westside real estate, after scooping up office space and apartments for interns to live in, according to the Los Angeles Business Journal.

Snapchat is fully funding an online publication launched by one of its employees, but the company declined to comment on what it hoped to get out of the investment. The ad-free Real Life website is expected to feature essays “about living with technology,” Snapchat researcher and social media theorist Nathan Jurgenson wrote.

Snapchat said it was taking “appropriate action” with people at the company who allegedly copied artwork found online for use in a popular feature, according to the Ringer. Artists said they hadn’t given Snapchat permission to turn their designs into Lenses, or virtual masks that decorate photos of faces.

Glendale start-up Gamblit Gaming develops slot machines that require skill – not just luck – to win, and regulatory changes mean the gambling-based video games will be coming to Nevada casinos soon, according to the Wall Street Journal.

Bridesmaid dress rental online service Vow to be Chic, located in Santa Monica, announced the receipt of $5 million from investors, including the Women’s Venture Capital Fund, according to L.A. Biz.

A marketing agency is opening a co-working space in Santa Monica for YouTube stars and other people who have large, loyal followings on social media, according to the Wall Street Journal.

Virtual reality software company Vrse rebranded as Within and announced a $12.5-million investment from 21st Century Fox and the venture capital firm Andreessen Horowitz, co-founder Chris Milk wrote.

In case you missed it

The insurance industry, regulators and consumer advocates caution that myriad questions have to be answered before it’s known exactly how driverless cars will be insured.

Thirty-thousand fans, creators and industry officials are expected to attend the sold-out VidCon event in Anaheim, about 10,000 more than last year. That’s raised the stakes for organizers who scrambled after twin tragedies in Orlando, Fla., to beef up security.

Waze announced it will begin directing Los Angeles users away from intersections that are difficult to navigate. But avoiding those potential moments of angst comes at a cost: The new feature could lengthen some drives, Waze said.

The first production from Activision Blizzard’s new TV and film studio will debut on Netflix this fall.

Prime Surgeons has launched a beta test of its concierge surgery business in L.A. County.

Twitter: @peard33

MORE FROM BUSINESS

Twitter and Vine loosen limits to hold on to users

PG&E to close Diablo Canyon, California's last nuclear power plant