The Wide Shot: It’s March Madness time for streaming

- Share via

Get your brackets ready. March Madness is fast approaching not just for college basketball but also for the media and entertainment giants battling for streaming video dominance.

ViacomCBS on Wednesday will lay out plans for its direct-to-consumer strategy, marking the Wall Street coming-out party for Paramount+ (rebranded from CBS All Access) ahead of its March 4 launch. Paramount+ gets a big promotional push during the actual March Madness games, because CBS shares the tourney’s broadcast rights with WarnerMedia’s Turner.

For the record:

9:00 p.m. Feb. 23, 2021An earlier version of this story gave the incorrect title for Microsoft executive Brad Smith. He is president, not CEO.

On March 26, Walt Disney Co. hikes the price of Disney+ from $7 a month (or $70 a year) to $8 a month (or $80 a year). Also, the cost of the Disney bundle — Disney+, Hulu and ESPN+ — goes up to a monthly $14 from $13. On Tuesday, Disney launched its general entertainment brand Star on Disney+ in Europe, Australia and other countries.

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.

And then there’s the March 18 debut on HBO Max of “Zack Snyder’s Justice League,” the fabled “Snyder Cut” on which WarnerMedia spent an estimated $70 million to achieve the director’s original vision.

Metaphors in business are imperfect. I recall Frost & Sullivan’s Dan Rayburn, who served in the military, pushing back against the “streaming wars” terminology when we were writing about what to expect in late 2019. To me, the sports tournament framework is better, because people expect a gradual consolidation of winners.

We may see a Final Four scenario that continues for the foreseeable future.

Netflix (203 million subscribers) and Disney+ (94.9 million) are the clear consensus picks to make it into the final rounds. Digital TV Research analyst Simon Murray last week projected Disney+ would exceed Netflix’s global count by 2026 (294 million vs. 286 million by then).

Who has the best chances at the remaining slots?

Apple TV+ and Amazon Prime Video, owned by tech companies worth $3.7 trillion combined, are really in a different league. They’re like teams without salary caps (forgive the mixing of metaphors between the NBA and the NCAA). Apple paid $25 million for a Sundance movie and is bulking up with deals for content, including Skydance’s animated film and TV slate. Amazon has a new incoming CEO whose affinity for Hollywood is unknown but, as we recently reported, few expect the Seattle giant to pull back any time soon.

What happens with the newer entrants HBO Max, Peacock and Paramount+, or for that matter the niche services — the Shudders, Britboxes and Criterion Channels of the world — is still unclear. (Send your brackets to wideshot@latimes.com.)

The entry of Paramount+ into the streaming battle has the feel of the last guy showing up in “The Avengers,” even though its predecessor, CBS All Access, has been around since 2014.

Analysts most want to know how much capital ViacomCBS is putting into its streaming efforts.

“The biggest question is how much incremental investment should we expect to see,” Doug Creutz, media analyst at Cowen & Co., told me last week. “Is it a modest amount along the lines of Discovery, or more aggressive along the lines of Disney?”

Creutz is betting Paramount+ will be more on the aggressive side. Wall Street values more heavy investment these days, putting a premium on the potential for future profits rather than short-term metrics. ViacomCBS investors surely will want to see information explaining how the company’s sacrifice of short-term profits will pay off in the future. ViacomCBS declined to comment ahead of its investor day.

Many observers think an industry of dozens of services asking for $5 a month or more is unsustainable. John Mass, a veteran dealmaker who serves as executive vice president at Content Partners (owner of the Revolution Studios and FilmDistrict catalogs), expects a wave of consolidation among the midlevel streamers and media and entertainment companies.

“I do not think it’ll take three to five years for the dust to settle,” Mass said. “You’re going to see consolidation very, very soon. Some of these companies will join forces, because there’s just too much at stake. In order to survive, I think they’re going to have to combine, and it’s going to happen much faster than we thought it was going to a year ago.”

That’s a bold prediction. The counterargument is that the stocks of companies launching streaming services right now are up significantly, including ViacomCBS and Discovery, and they’ll want to give themselves some time to see whether their plans actually work before doing anything drastic.

One of the major factors in the competition will be “churn,” or the number of people quitting services. Analyst Matthew Ball’s review of data company Antenna’s churn charts is worth a look.

Ball notes that some services’ churn rates spike or dip when key shows end or return (“The Mandalorian,” “Game of Thrones”) and depending on what promotional pricing is available. His analysis of Antenna’s data, which is based on its access to consumers’ transactions, suggests a mix of content, price and plain old competition as the reasons for churn.

As Rich Greenfield noted in a tweeted response, Hulu’s churn line slowly rose as more competitors entered the market, after dipping when it was wrapped into Disney’s streaming bundle.

Another important data point: Households that signed up for Disney+ are less likely to drop Netflix than HBO Max or CBS All Access. People generally are willing to subscribe to both.

One question is, what factor drives churn the most, price or content? A new survey from software and services company Amdocs suggests that the amount and quality of content on a service is a bigger deal than cost.

In its survey of 1,000 U.S. consumers, Amdocs — parent of video technology provider Vubiquity — found that “while cost is still a factor with consumers, it’s no longer the most significant reason they stick around.” From Vubiquity CEO Darcy Antonellis’ blog post on the findings: “When asked what drives their loyalty to video streaming services, almost half said the amount of content (49%), followed by the quality of the content (45%) and pricing (38%).”

Amdocs also shared data on how much people are spending: 42% of respondents said they spend more than $25 a month on video streaming. A further breakdown: 10% spend $50-$100 (OK), 6% spend $100-$150 (yikes) and 2% spend more than $150 (seriously, how?).

If you’re one of these people spending $150 a month on video streaming, please consider a subscription to the Los Angeles Times.

Number of the week

Of the many details in The Times’ investigation of the Hollywood Foreign Press Assn. ahead of Sunday’s Golden Globe Awards, this one stands out.

The 87-person group paid nearly $2 million to members for serving on committees and performing other tasks in the fiscal year ending in June 2020, reported Stacy Perman and Josh Rottenberg. The amount was budgeted to increase to $2.15 million in the year ending in June 2021, according to financial records. The group pulled in $27.4 million from NBC, which broadcasts the Globes, last fiscal year.

The HFPA membership has long had a reputation for its willingness to accept wining and dining by studios and publicity firms, and for its questionable nominations. Paramount Network, which declined to comment for the story, put up a group of more than 30 HFPA members at a five-star French hotel so they could visit the set of “Emily in Paris” in 2019. The association’s practices have sparked turmoil, including an antitrust lawsuit from Norwegian journalist Kjersti Flaa that was dismissed in November.

The payouts to members raise potential tax questions for the trade organization, according to legal experts who spoke to The Times. “It’s unusual that all of these people are getting paid,” said Pryor Cashman partner Daniel Kurtz.

HFPA responded by saying, “Relative to the HFPA’s revenues and charitable contributions, its employment-related expenses are modest” and are “vetted by a professional nonprofit compensation consultant and outside counsel, where appropriate.”

Further reading: Who really gives out the Golden Globes? A tiny group full of quirky characters — and no Black members.

News down under

The battle between major news publishers and Big Tech came to a head in Australia, where the government is poised to enact sweeping regulations cracking down on tech giants “by forcing them to pay local news outlets for featuring and linking to their stories,” my colleague Meg James reported.

The very different reactions from Google and Facebook displayed their diverging business priorities. Google, which relies on its ability to provide links to reliable news sources, made deals with publishers including Aussie billionaire Rupert Murdoch’s News Corp., while Facebook basically told media outlets to “rack off, mate.” Facebook prevented news links from being shared on the social platform for Australian users, saying that links to news account for only 4% of content on people’s feeds, anyway.

Could something similar happen in the U.S.? Some observers, including NYU business professor Scott Galloway on his Pivot podcast with Kara Swisher, have argued that news orgs should pressure the tech firms to pay up. Microsoft President Brad Smith endorsed Australia’s move. Others argue that the proposed Australian rules are written in such a way that they could wreck the internet as we know it if adopted and interpreted broadly.

Here are some helpful links to explain the issues in Australia, and the widely varying viewpoints:

- The Guardian: Australia is making Google and Facebook pay for news: What difference will the code make?

- Kara Swisher: A New-Media Showdown in Australia

- Microsoft President Brad Smith: Microsoft’s Endorsement of Australia’s Proposal on Technology and the News

- Platformer: Google and Facebook should support journalism — but not like this

- Ben Thompson: Australia’s News Media Bargaining Code, Breaking Down the Code, Australia’s Fake News (from August, also referenced in the Platformer piece).

One clear winner from the Australia situation is Murdoch, whose company lobbied hard for the new rules.

In the U.S., meanwhile, another part of Murdoch’s empire, Fox Corp.’s Fox News, is dealing with the consequences of a different kind of disruption — Donald Trump’s departure from the White House. Trump may have left office, but his fans are a force to be reckoned with, as Fox News has learned all too well.

“Those followers now have multiple options to feed their fix for right-wing opinions — some of them far more extreme than what is delivered on Fox News,” report Stephen Battaglio and Meg James. “Satisfying those viewers while also reporting information that does not fit their worldview has become a challenge for an organization that faces vocal detractors on the political center and left, a potentially expensive lawsuit from one of Trump’s baseless voter fraud targets and an increasingly outsize role in the parent company’s financial performance.”

What we wrote

— Spotify is flexing its muscles in the podcasting space. The Swedish company on Monday announced a flurry of audio deals, including a podcast with Barack Obama and Bruce Springsteen.

— The latest in the battle for kids content: YouTube is adding nine new children’s programs to its lineup this year, Wendy Lee reports exclusively.

— Private jet travel is surging in a pandemic-beleaguered Hollywood, and it’s not just for A-listers anymore. L.A.-based veteran talent manager Larry Thompson tells Anousha Sakoui: “If a studio is making a star or makeup artist get to a certain place that requires air travel and the person wants to go, the financier-producer will make whatever accommodation they feel is appropriate.”

— Cue flashback to 2014! “Three North Korean computer programmers have been charged in Los Angeles with conspiring to steal and extort more than $1 billion in a sweeping array of cyberattacks against banks, other companies and cryptocurrency traders around the world,” and, oh yeah, also the hack of a certain Culver City-based movie studio.

— Must-read interview by Yvonne Villarreal (as a bald guy who likes cocktails, I’m biased): A negroni made Stanley Tucci a social media star. There’s more where that came from.

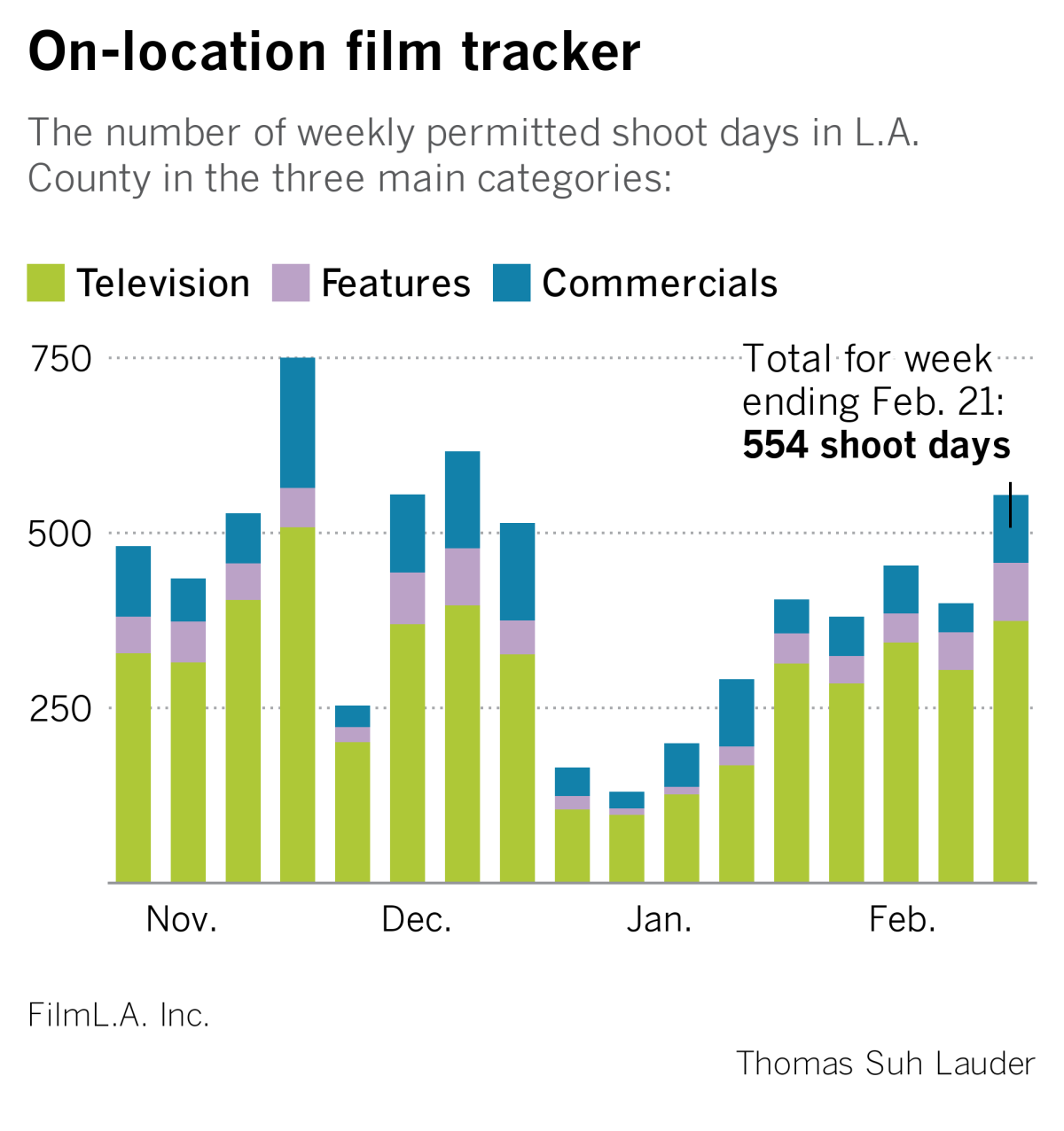

On location in L.A.

Shooting days in the Los Angeles area saw a big jump during the week that ended Sunday. Production reached its highest level in L.A. since the week that ended Dec. 13, according to FilmLA data. The jump comes as production recovers from restrictions amid an earlier surge in cases.

More top stories

— Big Hit (known for South Korean pop sensation BTS) and Universal Music will launch a new boy band together. (Rolling Stone)

— The Biggest Shot in Hollywood: Every A-lister wants a COVID vaccine, but are they willing to get canceled for it? (Vulture)

— Rush Limbaugh, highly influential conservative radio host, dies at 70. (Los Angeles Times)

—The beach bum who beat Wall Street and made millions on GameStop. (The Ringer)

On the calendar

— ViacomCBS reports earnings Wednesday.

— iHeartMedia and Live Nation report Thursday.

— AMC Networks reports Friday.

— Golden Globe Awards air Sunday on NBC.

Finally ... a chill game

If you’re looking for something to do with your thumbs other than trade crypto, try playing “Alto’s Adventure” and its sequel, “Alto’s Odyssey,” a series of 2D mobile snowboarding games. Like the 1990s computer game “SkiFree,” each round just keeps going for as long as you can avoid crashing. I promise, it’s a much more soothing way to stare at your phone than doomscrolling Twitter.

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.