Wide Shot: Chris Rock’s Netflix flex. What your favorite songs are worth

- Share via

Welcome to the Wide Shot, a newsletter about the business of entertainment. Sign up here to get it in your inbox.

I made a joke on Twitter not too long ago that Chris Rock isn’t hosting the Oscars because he’s going to be too busy selling out stand-up shows until the end of time. Rock is playing the post-slap public relations game expertly, with the latest example being this deal to headline Netflix’s first live-streamed comedy event, expected to air in early 2023. The funniest thing Netflix could do would be to schedule the show for the week of the Academy Awards. It would be an interesting ratings contest, if nothing else.

In the business of entertainment, Walt Disney Co. is showing Disney+’s “Andor” on its traditional TV channels, Dave Chappelle did “Saturday Night Live” and “Black Panther: Wakanda Forever” hit its box office targets. On with the newsletter...

The music catalog sales no one’s talkin’ about

The market for music catalogs isn’t dead. It’s just getting more hipster cred.

Yesterday we reported that BMG — the music company owned by German conglomerate Bertelsmann — has acquired the song catalog and other rights from the estate of Harry Nilsson, the influential singer-songwriter known for tunes including “Everybody’s Talkin’” and “Coconut.”

Even if you don’t know the name, you probably know the music. An L.A. transplant and Beatles associate, Nilsson’s melodic pop has been featured in iconic films and shows like “Midnight Cowboy,” “Reservoir Dogs,” “Russian Doll” and “Goodfellas.” He recorded his share of successful albums (1971’s “Nilsson Schmilsson” and 1972’s “Son of Schmilsson”) and composed soundtracks to movies including “Popeye.” The hard-drinking Nilsson died of heart failure in 1994 at age 52, leaving his family with a messy financial situation.

BMG isn’t really doing so many of the blockbuster deals that generated headlines during the last couple years, though it did score pacts with ZZ Top and John Legend by teaming up with private equity giant KKR. On its own, the company has closed more than 30 deals this year, with more to come, mostly of the relatively obscure or unlikely variety. Think John Lee Hooker, E-40 and Gucci Mane or Five Finger Death Punch, rather than the artists dominating classic rock radio playlists.

The idea is often to bring more attention to these artists through books, film projects, special events and stage productions, the way BMG put together a series of initiatives to highlight the bluesy Peter Green era of Fleetwood Mac. “There’s a large number of absolutely fascinating, culture-defining artists that don’t get that attention, and that’s attractive for us,” BMG Chief Executive Hartwig Masuch told me at the company’s Los Angeles offices last week. “There’s a bigger upside there than in going in the direction where everybody goes.”

Roughly a year ago, it seemed as if every musician with a giant Baby Boomer fanbase was selling his or her song catalog at a mind-blowing valuation. Bruce Springsteen’s publishing and masters sold to Sony Music for $500 million. David Bowie’s rights went to Warner Chappell Music for $250 million.

The gold rush was fueled by easy credit, a streaming-fueled music business recovery and a desire among aging artists to secure financial stability for their heirs. The era of unlimited access to songs, brought on by subscription services like Spotify and Apple Music, proved that people primarily prefer to listen to older music — the stuff of their youth — rather than seek out trendy new artists. That was probably true before Spotify, but streaming gave artists and record companies a way to monetize the repeated consumption of the classics.

The market has cooled thanks to the uncertain economic climate, and the industry is fielding fewer blockbuster deals as of late. Seriously, how many $100-million catalogs remain unclaimed? Not many.

Some of those who are still looking for a buyer are struggling to secure a sale at the price they want, as Bloomberg discussed this week. In the specific case of Pink Floyd, it might help if the key band members could stand each other and if Roger Waters wasn’t so busy dabbling in bizarre geopolitics. After all, Phil Collins and Genesis managed to fetch $300 million for their catalog in September (Peter Gabriel songs not included).

BMG’s deal with Nilsson’s estate shows that there are still deals to be made, especially if buyers are willing to lower their sights and work with more artists who are not household names. The company increased its investments by 40% this year, spending more than $500 million on music rights during the last 18 months. For BMG, which is not in the business of creating new hits for the Billboard charts, it makes sense to quietly establish a portfolio of rights from smaller catalogs. Put that lime in the coconut and drink it up.

Stuff we wrote

— Capt. Hollywood: The ex-LAPD boss who tipped off CBS to Les Moonves assault claim. The actions of former Cmdr. Cory Palka, a 34-year veteran of the LAPD who mingled with celebrities, are under scrutiny, write Richard Winton and Meg James.

— How ‘Wakanda Forever’ producer Nate Moore pushed for Black heroes in the MCU. I profiled the 12-year Marvel Studios vet who helped get Falcon and Black Panther to the big screen.

— How Netflix sells the dream of royalty to ‘Bridgerton’ fans. Netflix has thrown more than 800 balls inspired by its popular show. For fans, it’s their chance to reimagine themselves as characters on the show, writes Wendy Lee.

— Another twist in the ‘Rust’ legal saga. Alec Baldwin sues the armorer, weapons supplier, assistant director and prop master of the movie “Rust.”

— ICYMI. MSNBC’s election coverage finishes ahead of CNN’s for the first time. Budd Friedman, founder of the Improv comedy club, dies at 90. Explaining Hollywood: How to become a composer for film and TV. Why music supervisors are clashing with Netflix.

Number(s) of the week

It was a week of highs and lows for the Walt Disney Co.

Let’s start with the good news. “Black Panther: Wakanda Forever” is a huge hit at the box office, with a global opening weekend of $330 million in ticket sales. That includes more than $180 million from the U.S. and Canada, marking the second biggest domestic debut of the year, coming in behind the $187 million launch of Marvel’s “Doctor Strange in the Multiverse of Madness.”

This movie had to carry a huge load, serving as an emotional tribute to the late Chadwick Boseman while also telling an epic story and serving the corporate needs of the rest of the franchise by setting up a Disney+ spinoff. With an “A” CinemaScore from audiences, this film has a good chance of reaching $1 billion globally, even without China. Those looking for evidence of Marvel fatigue will have a hard time finding it here.

Now, the bad news.

Disney revealed that its direct-to-consumer business — including streaming services Disney+, Hulu and ESPN+ — lost $1.5 billion in the fourth quarter and $4 billion for the full fiscal year.

Chief Executive Bob Chapek framed the numbers as representing the peak of streaming losses for the company, with Disney+ still on track for profitability sometime in 2024, provided the economy doesn’t experience a major downturn. That’s a big “if.” The deficit hurt Disney’s bottom line, and investors sent the stock tumbling.

Disney is not alone, of course. We’ve written extensively about the direct-to-consumer business’ wave of red ink. Warner Bros. Discovery’s stock hit a new low the week after it posted heavy streaming losses while promising fiscal responsibility as a corrective to what David Zaslav sees as an era of profligate investment.

Still, you’ll find no shortage of defenses for the streaming business burning billions of dollars. After all, Disney+ added 12.1 million subscribers during the quarter, bringing its total to 164 million, so at least it has that going for it. Streaming services are hemorrhaging cash, but that’s a short-term sacrifice to keep companies like Disney relevant for the coming decades, bulls say.

Maybe so, but that’s of little comfort for those whose jobs are now on the line thanks to the industry’s big gamble. Chapek on Friday acknowledged what he’d hinted at during the earnings call: Cost-cutting is coming, and that means a hiring freeze and layoffs.

Best of the web

— What it’s like working for Elon Musk. (L.A. Times)

— Steven Spielberg gets personal. (New York Times)

— How Sarah Aubrey is taking Warner Bros. Discovery I.P. to HBO Max. (Variety)

— The flat era of fashion. (Dirt)

— How FTX’s Sam Bankman-Fried went from crypto golden boy to villain (Wall Street Journal)

— For church leaders, ditching Kanye West is not that simple. (L.A. Times)

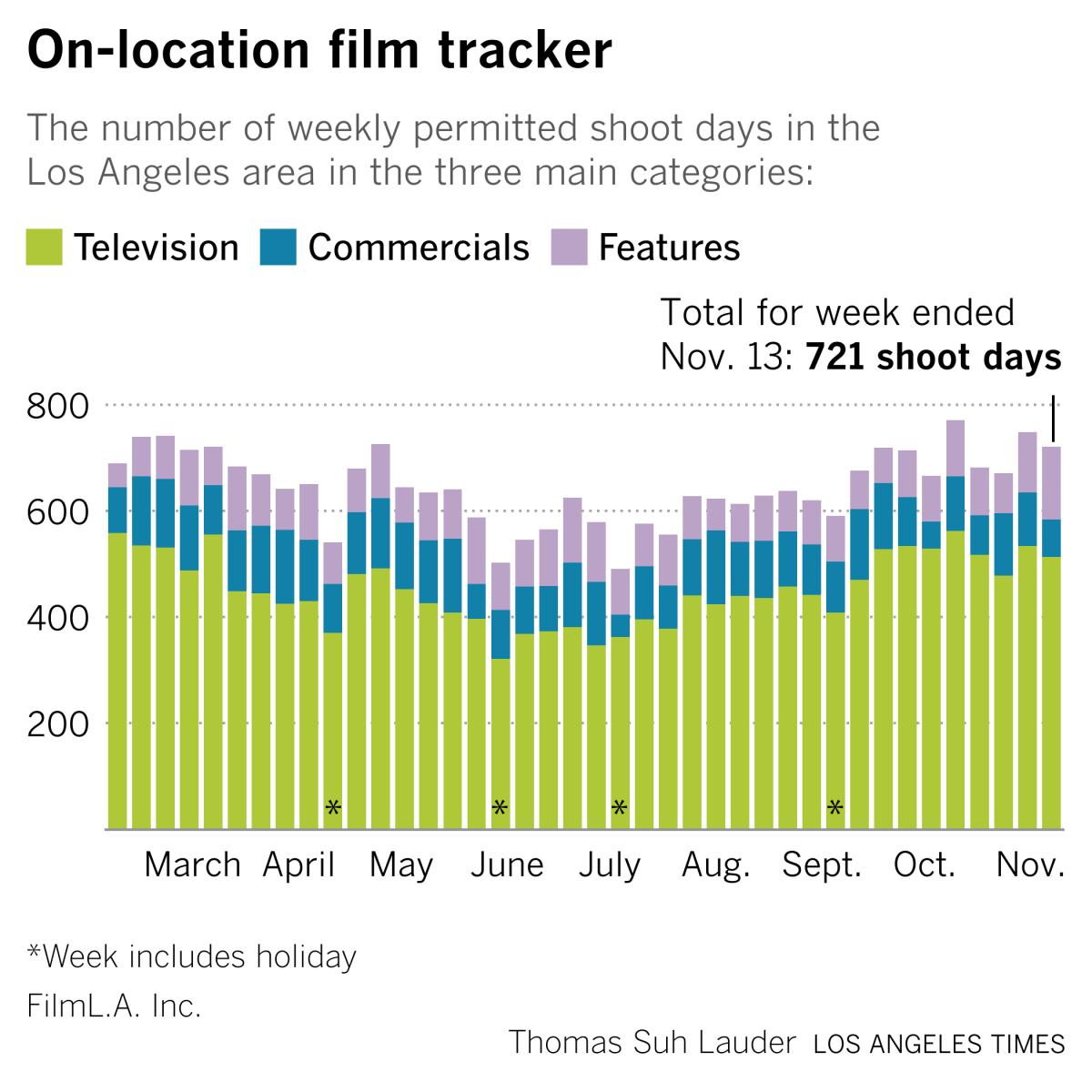

Films shoots

This week’s production chart, featuring data from FilmLA.

Finally ...

One of the underappreciated things about Disney+ is its library of excellent documentaries from National Geographic, including “Free Solo” and “The Rescue.” I missed the critically acclaimed “Fire of Love,” about a French couple that hunted volcanos, when it was in theaters, but it’s available for streaming now. Here’s Justin Chang’s July review, which has one of the silliest pun headlines in recent memory. I mean that as a compliment, Justin.

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.