The company behind ‘Sound of Freedom’ is going public. What’s Angel Studios really worth?

- Share via

On July 4, 2023, a firm out of Provo, Utah, called Angel Studios released one of the biggest out-of-nowhere surprise hits and cultural flash points of the year, the child trafficking drama “Sound of Freedom.” But will investors take a leap of faith with the company’s plans to go public?

Angel Studios last week announced its intention to become a publicly traded company through a merger with a “blank check” company.

According to public filings, the deal values the upstart entertainment operation at $1.6 billion, despite posting revenue of $45 million for the first half of 2024, up 6% from the same period of time last year.

The firm combining with Angel Studios is called Southport Acquisition Corp., which is a special purpose acquisition company, or SPAC, essentially a shell corporation created for the express purpose of buying a real company and thus taking it public.

Southport’s shares currently trade on an over-the-counter marketplace, after having been de-listed from the New York Stock Exchange earlier this year. Angel is looking to list its shares on the NYSE or Nasdaq once the transaction closes.

Once obscure and sometimes controversial on Wall Street, SPACs exploded in popularity a few years ago as an attractive way for companies to raise money without having to subject themselves to the scrutiny involved in a typical initial public offering, or IPO. This was a particularly enticing option at a time when the COVID-19 pandemic had ravaged an already shaky IPO marketplace.

How it works: The blank check company goes public, raising capital typically at an arbitrary stock price of $10 a share. The firm then goes out deal-hunting, looking for something to acquire. Once the SPAC identifies an acquisition target, the people who bought into the IPO sight unseen can decide whether to stay the course. Or, if they don’t like the deal, they can pull their money out.

The strategy fell significantly out of favor in recent years as many SPAC-ified companies struggled or failed after hitting the stock market. Regulators started looking at SPACs more closely. The rap on SPACs has long been that they allowed firms to go public when they really had no business doing so, many of which were early-stage or “pre-revenue,” to use a financial analyst’s term of art (though more established companies have used SPACs as well). There’s a reason IPOs receive the kind of under-the-microscope treatment they do.

So for Angel Studios to go public through a SPAC might be an unconventional move. But then again, little about the company’s path has been conventional so far. In fact, much of its persona has been built on defying standard Hollywood wisdom.

Angel Studios describes itself as a “values-based distribution company” for stories that “amplify light.” In practice, that means it specializes in films and TV shows that either reflect a certain faith-based worldview or have an inspirational bent. “Hollywood is selling conflict, power and war, but global audiences want more faith, inspiration and morality,” according to the company’s investor presentation, included with its public filings.

There are plenty of companies that do faith-based material, but Angel Studios’ model is unusual even among that subset because of its reliance on a crowdfunding-like model.

Members of the company’s Angel Guild pay annual or monthly fees and get to influence what shows and movies are green-lighted for release, based on concepts, trailers and other materials. The Guild numbers 375,000 members, including 153,000 non-paying accounts, according to Angel. Members receive benefits including early streaming access and, at a higher-paying tier, complimentary movie tickets. The company expects to hit 1 million members next year.

The ethos of getting fans to buy in was a key component of the success of “Sound of Freedom,” which employed a pay-it-forward ticket-selling strategy that allowed moviegoers to buy passes for others after seeing the Jim Caviezel picture. The movie grossed $250 million at the global box office, an astounding success for an independent production.

Angel Studios hasn’t reached those lofty heights since, though it has put out a steady slate of theatrical releases, including “The Shift” ($12.2 million in box office), “Cabrini” ($20 million), “Sight” ($7.2 million) and “Sound of Hope: The Story of Possum Trot” ($11.6 million). Angel’s crowdfunding model has also supported the launch of shows including “The Chosen,” “Tuttle Twins” and “The Wingfeather Saga.”

While some of its innovations have won admirers, the company has also ruffled feathers. In a recent setback, Angel Studios lost its deal for “The Chosen,” a huge hit, following an arbitrator’s decision in a dispute with the show’s producers, who accused the company of breach of contract. The company in May said it would appeal.

Through a spokesman, the company declined to make executives available for interviews.

As for Angel’s finances, the company’s disclosures have been thin so far. Its investor presentation does not give any details about profitability. The company also doesn’t provide full-year revenue projections for this year, which would set it up for a difficult comparison with the gangbusters “Sound of Freedom” results. Just before announcing its SPAC, Angel said it had raised $20 million from more than 20,000 people.

The SEC document also notes that the company has 125 bitcoin on its balance sheet as a rainy day fund, which is currently worth about $7.2 million, checking off at least one box on the meme stock bingo card.

Taking on traditional Hollywood practices has long been part of the Angel Studios brand, and that has included battling directly with the media and entertainment giants.

Founded by brothers Neal, Daniel, Jeffrey and Jordan Harmon, the company began as VidAngel, which made a name for itself with a content filtering service that allowed users to censor coarse language, sex, violence and other objectionable material from hit movies such as “Deadpool.” The firm received a groundswell of support from family groups and religious leaders.

But in 2016, Walt Disney Co. and Warner Bros. sued VidAngel for copyright infringement, saying its quirky business model — which involved buying and ripping thousands of physical DVDs and Blu-rays to stream online without a license — was essentially piracy. VidAngel justified itself by citing the Family Movie Act of 2005, a law designed to cover companies that create technology to filter films while people watch at home, as well as parents who make edited versions of lawfully owned copies for personal use.

The studios won, however, and VidAngel ended up settling the dispute, which ultimately led to the Harmon brothers selling off the filtering business. They kept the remaining content production and crowdfunding operation, rebranding as Angel Studios. Neal Harmon is the company’s chief executive.

What awaits Angel Studios as a public company, assuming all goes according to plan with the SPAC? If the past is any indication, it sure as heck won’t be boring.

You’re reading the Wide Shot

Ryan Faughnder delivers the latest news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.

Stuff we wrote

Blue tongues and an exposed brain: How ‘Beetlejuice Beetlejuice’ visual effects went back to basics. As audiences get more savvy about CGI, studios are ramping up the practical, in-camera effects.

Linsey Davis held Trump’s feet to the fire. How she became ABC News’ rising star. The co-moderator of Tuesday’s presidential debate in Philadelphia has quietly becoming a rising star at ABC News.

Trump-Harris presidential debate scores 67 million viewers. The first meeting between the two 2024 presidential candidates brought in significantly more viewers than Trump’s June 27 face-off with President Biden.

The Murdoch family’s legal battle over a media empire: What you need to know. The billionaire clan will battle in court this month over patriarch Rupert Murdoch’s plan to place eldest son Lachlan in charge of its news companies.

‘A stab in the back.’ How Elon Musk’s decision to move X from San Francisco is stirring mixed emotions. The departure of the company formerly known as Twitter is another blow to a city that has been buffeted by high-profile business departures.

Number of the week

Walt Disney Co. started the weekend by resolving its carriage dispute with DirecTV, restoring ESPN, ABC stations and other channels to about 11 million households. It ended it by dominating the Emmys.

Disney’s shows earned 60 Emmy awards this season, including FX’s “Shōgun,” which took home a record-breaking 18 awards, counting its creative arts statuettes as well as those doled out in prime time during the Television Academy’s gala on ABC. Other big Disney winners included “The Bear” with 11 wins, though it unexpectedly lost best comedy series to “Hacks,” a Max original. “The Bear” rules, but it’s nice that an actual comedy won in the category.

The Burbank entertainment giant easily topped Netflix and HBO/Max. The Bob Iger-led company’s big year is a testament to the success of FX in particular, which has long been building and maintaining its reputation for high-quality programming. Despite the “Hacks” surprise, awards season stalwart HBO/Max fared poorly compared with recent years with just 14 wins.

The ceremony drew 6.87 million viewers, breaking a streak of all-time lows.

On the business side, Disney succeeded in extracting higher fees from DirecTV, which has been struggling with declining subscriber counts. Disney had the upper hand in negotiations largely because of its coverage of college football and the NFL, including “Monday Night Football,” but it was also motivated to end the dispute in time for the Emmys. DirecTV emerged with its own wins, gaining the flexibility to offer Disney channels in smaller bundles focused on genres such as sports, general entertainment and “kids & family.”

If Disney is behind it, this practice of genre-specific bundles seems to be where the pay-TV business is headed.

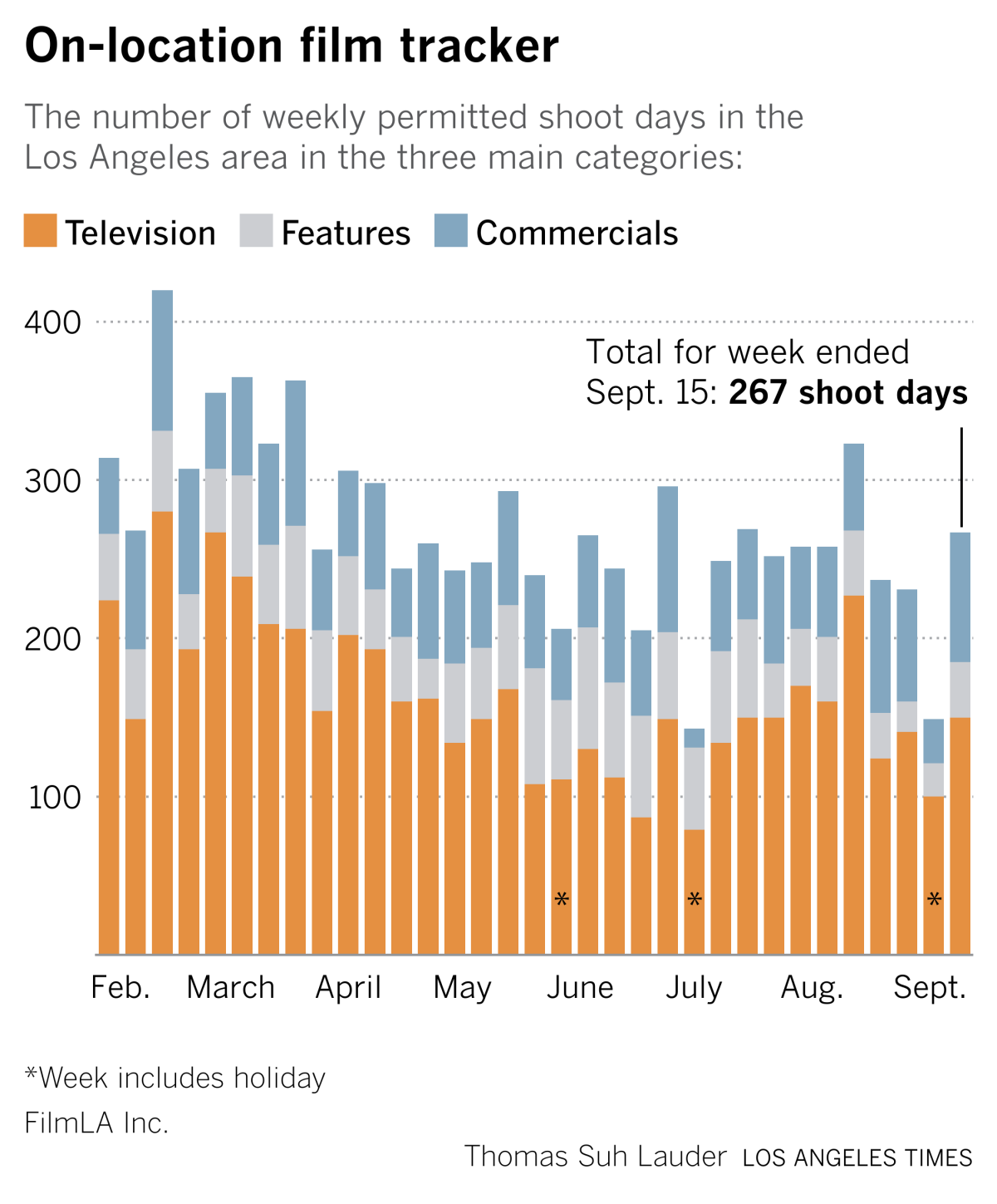

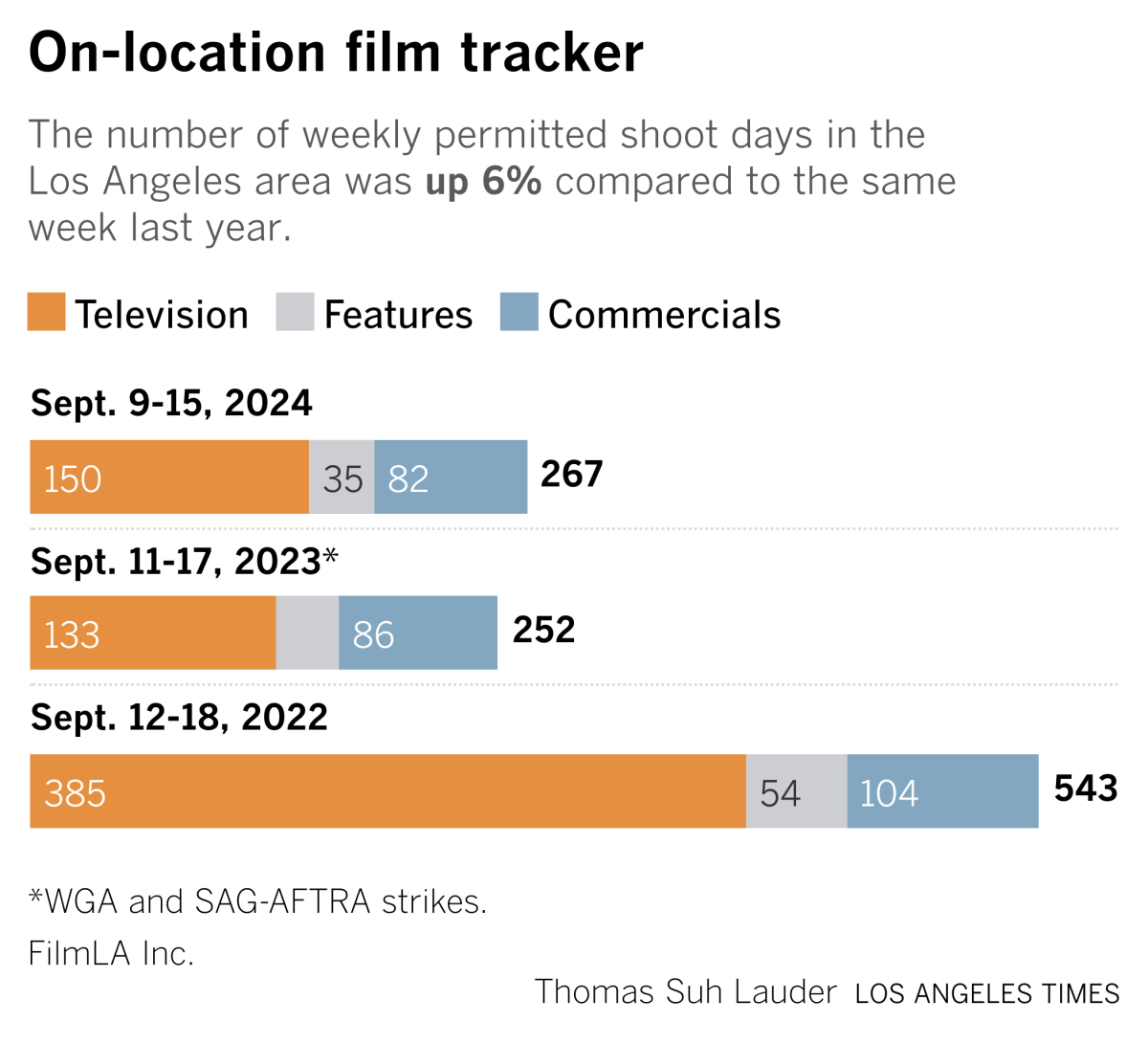

Film shoots

FilmLA data from last week shows a small uptick in on-location shooting compared with a year ago.

Finally ...

Jeremy Saulnier’s excellent new thriller “Rebel Ridge” on Netflix has some terrific needle drops, starting with Iron Maiden’s classic “Number of the Beast.” But my favorite is “Right Brigade” by Bad Brains.

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.