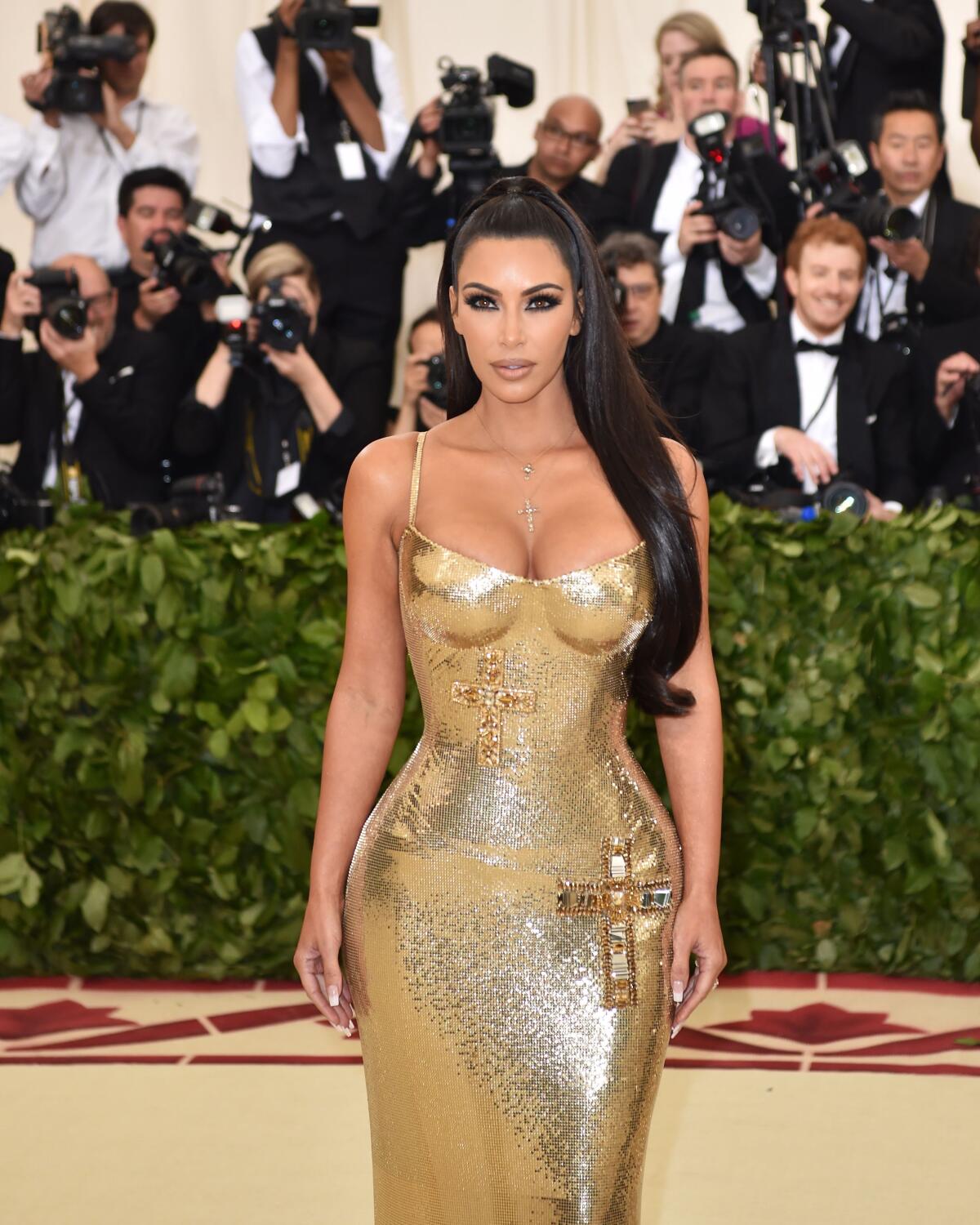

Does Kim Kardashian’s SEC fine mark the end of the crypto-celebrity gold rush?

- Share via

Kim Kardashian just got fined over a million dollars for boosting a cryptocurrency online — but she’s not the only celeb with ties to the world of crypto.

For the many other A-listers who’ve thrown their weight behind cryptocurrencies, crypto companies and nonfungible tokens, or NFTs, Kardashian’s $1.26-million settlement with the Securities and Exchange Commission could mark a turning point in how Hollywood’s biggest names think about this still relatively unregulated online economy.

“The SEC aims to bring enforcement actions … that will get widespread attention and influence market participants’ conduct going forward,” said Philip Moustakis, counsel at the law firm Seward & Kissel. “Naturally, an action against Kim Kardashian is ideal for these purposes.”

In short, he continued via email, the SEC is hoping that Kardashian — a media personality both on- and offline — “will serve as an influencer of a different kind.”

Cryptocurrency exchanges got the red-carpet treatment during the Super Bowl. Why is Hollywood so into everything blockchain?

Kardashian was fined for not disclosing that she had been paid for an Instagram post promoting EthereumMax crypto tokens, but she’s not the first big name to land in regulatory hot water over crypto deals.

Floyd Mayweather Jr. and DJ Khaled both were charged in 2018 for not disclosing that they’d been paid to promote various crypto investments, and in 2020, the same thing happened to Steven Seagal.

According to one former SEC official, a warning about celebrity-endorsed cryptocurrencies that the agency put out in 2017 was largely prompted by Mayweather, Jamie Foxx and Paris Hilton touting crypto assets.

As such, the ex-official said, Kardashian’s fine doesn’t necessarily signal a change in direction for the SEC but does mark a stronger stance than the one the agency took five years ago.

“By bringing this case, [the SEC] has basically said, ‘Look, you all got fair warning. Now we’re bringing a case,’” the former official, who asked to remain anonymous to protect their relationship with former colleagues, told The Times. “It definitely puts celebrities on notice.”

It can be hard to talk about crypto without mentioning the sometimes-bizarre overlap that the still relatively niche financial technology has with the entertainment industry. In January, Hilton spoke with late-night TV host Jimmy Fallon about the anthropomorphic monkey tokens they both own. Less than a month later, marquee names including Larry David and LeBron James starred in cryptocurrency ads during the Super Bowl. Matt Damon has promoted crypto investing as an act of world-historical bravery, and last year the crypto company MoonPay made a not-so-subtle cameo in a music video starring Post Malone and the Weeknd.

Questions still abound about why, exactly, so many celebs have hopped aboard the crypto hype train — and what financial incentives they may have for doing so.

As the crypto market entered a period of prolonged downturn — some celebrities, including Fallon, have removed NFTs from their Twitter profile pictures — Kardashian’s fine indicates that regulators, at least, are still watching the space with interest.

“The SEC, and regulators globally, often key in on what they call asymmetric information — when one person knows something others don’t, and which makes an otherwise fair transaction a case of potential manipulation,” Mike Castiglione, the director of regulatory affairs for digital assets at the regulatory compliance company Eventus, said via email. “This week’s enforcement action means celebrities, or anyone else, should think about whether there could be a perception of withholding information when they do crypto sponsorship deals.”

Celebrity endorsements “done openly and transparently” can make a crypto asset more credible by tying it to a public figure’s reputation, said Castiglione, whose company counts several cryptocurrency trading platforms among its clients. But “they can also be abused for pump-and-dump schemes” just like with other types of assets, he added.

It’s not the first time A-listers have been subject to regulatory scrutiny for their crypto inclinations.

“The SEC has been pursuing other celebrities for promoting tokens that the SEC believes are securities for a while now,” attorney Jason Gottlieb, a partner at Morrison Cohen and its chair of white-collar and regulatory enforcement, said in an email. “The new point in the [Kardashian] settlement is that the token in question was labeled to be a security” — although, he added, “There hasn’t been any action against that token finding that it is.”

The case could also be a sign of more systemic issues.

Rep. Brad Sherman (D-Northridge), perhaps Congress’ foremost crypto skeptic, called Kardashian’s lack of reporting an “obvious violation” of SEC law but said that her high-profile promotion of the cryptocurrency also hints at a larger business of using influencers to inflate crypto prices.

“The very fact that you’re being paid to tout it means that there is an ongoing business enterprise pushing the price up,” said Sherman, adding that he wants higher fines and not just for Kardashian. “I believe that Kardashian is either a constituent or lives just outside my district, so I wish her well,” he said. “But in this case, she should have gotten some better legal advice.”

Times staff writer Freddy Brewster contributed to this report.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.