Paramount Global sale collapses after Shari Redstone pulls support for David Ellison deal

- Share via

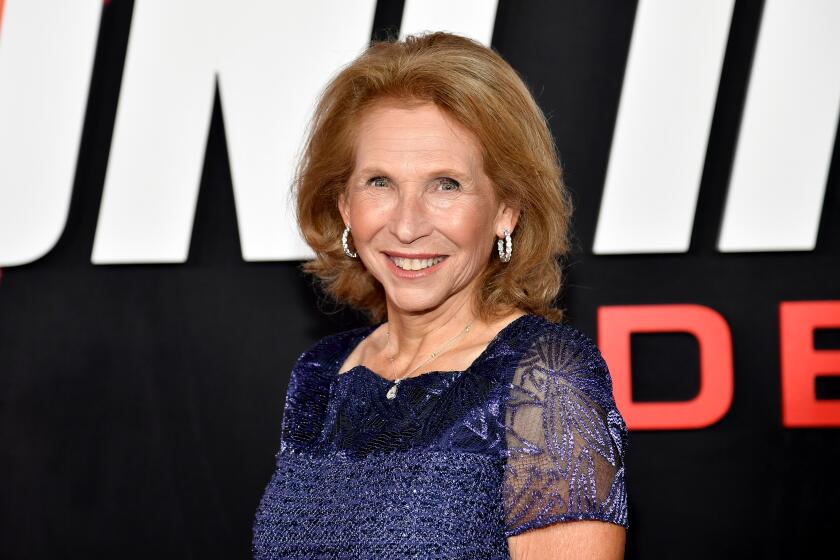

After months of high drama and boardroom tension, Paramount Global’s proposed sale to David Ellison’s Skydance Media collapsed Tuesday after failing to win approval from its onetime biggest supporter, controlling shareholder Shari Redstone.

The Redstone family investment vehicle, National Amusements Inc., announced it had failed to reach “mutually acceptable terms” with Skydance for the clan’s controlling shares in the entertainment company that owns CBS, Comedy Central, Nickelodeon and the Melrose Avenue movie studio Paramount Pictures.

“NAI is grateful to Skydance for their months of work in pursuing this potential transaction and looks forward to the ongoing, successful production collaboration between Paramount and Skydance,” the family said in the statement. Skydance co-produces many of the Paramount studio’s major franchises, including “Mission: Impossible” and “Top Gun.”

For now, Redstone seems determined to hold on to the media company her family has controlled since 1987 — despite its financial challenges and turbulence in the entertainment industry as consumers shift to streaming services and away from traditional TV channels.

A deal with Skydance was within reach, but the heirs of the late media tycoon Sumner Redstone (Shari’s father) had wrestled with parting with Paramount, which has long been considered a crown jewel, even when its stock was trading at such lows. The company has lost about two-thirds of its value from five years ago.

Rather than leading Paramount to reclaim its place among industry titans, Redstone’s tenure atop the company has been marred by miscalculations and setbacks.

National Amusements said it supports Paramount’s recently installed triumvirate of executives serving in an “office of the CEO”: division heads George Cheeks, Chris McCarthy and Brian Robbins. It also backed their business plan, which includes cost-cutting, and the board’s efforts “to explore opportunities to drive value creation for all Paramount shareholders.”

Paramount shares fell 8% to $11.04 on Tuesday.

Redstone’s decision came just as Paramount Global’s independent directors were scheduled to vote on Ellison’s proposed $8-billion takeover of the media company. David Ellison is the son of billionaire tech mogul Larry Ellison, the co-founder of software company Oracle Corp.

There had long been divisions among Paramount’s board members. Some opposed the two-phase transaction, believing it would have given the Redstone family a premium for their shares at the expense of regular investors. Nonetheless, the committee of independent board directors had reached an informal agreement with Skydance about 10 days ago.

The committee had not made a formal recommendation on the deal to Paramount’s full board.

National Amusements had asked the committee to make its recommendation before the company’s annual shareholders meeting last week, but that deadline came and went. The holding company had wanted a larger Paramount board to consider the transaction, but the investor meeting marked the end of the terms of four directors. That left just six board members to consider the monumental transaction.

Shari Redstone and her children must decide whether to accept a deal that provides family members with $1.7 billion.

Just before the committee vote, National Amusements alerted the group that it would not approve the deal. National Amusements controls 77% of Paramount’s voting shares.

The stunning reversal came after Skydance and its backers RedBird Capital Partners and private equity giant KKR had reached agreement late last week with National Amusements representatives on the financial terms of the deal, according to people familiar with the matter who were not authorized to comment.

That breakthrough came after Skydance worked to sweeten the deal and give nonvoting shareholders the ability to exit the company at a slight premium.

But that move reduced the amount of cash offered to the Redstones — upsetting the family matriarch, according to people close to the transaction.

Additionally, Redstone had requested that other shareholders, including nonvoting stock owners, be allowed to weigh in on the proposed sale. The Skydance group refused, the knowledgeable people said.

In recent weeks, Redstone received overtures from potential buyers for National Amusements and its controlling Paramount shares. Both offers were higher than the amount that National Amusements would have received as part of the Skydance bid.

Former top Seagram and Warner Music executive Edgar Bronfman Jr., as well as Hollywood producer Steven Paul (“Ghost in the Shell,” “Baby Geniuses”), have separately expressed their desire to buy National Amusements, two of the people close to the matter said.

But any deal with Bronfman, who is backed by Bain Capital, would be contingent on him performing due diligence. The former entertainment executive and liquor scion — who pushed his family to acquire Universal Studios Inc. before selling it to France’s Vivendi more than two decades ago — has suggested paying more than $2 billion for the Redstone firm.

Redstone is leaving her options open, the knowledgeable people said.

Skydance Media CEO David Ellison, son of billionaire Larry Ellison, has emerged as a strong contender to take over the iconic Paramount studios.

Despite early momentum for the Skydance deal, it recently became clear that it was on shaky ground. Two sources confirmed earlier Tuesday that the lead independent director, Charles Phillips, was long opposed to the Skydance deal and was expected to vote against it.

Phillips, a former president of Oracle, had made his views known to Redstone, a second knowledgeable person said.

Redstone had believed the Ellison proposal was the best viable option to preserve the media company. The family didn’t want to see Paramount broken apart, which would have been the strategy of another suitor: Apollo Global Management and Sony Pictures Entertainment. That group’s proposed $26-billion bid lost steam as the Skydance deal appeared to have the inside track.

Tensions over the deal have plagued the board throughout the year. In April, Paramount Chief Executive Bob Bakish, who opposed the Ellison deal, was ousted.

Corporate governance experts had said the controversial transaction would invite shareholder lawsuits because of the Redstones’ influence in the company.

Paramount Global Chair Shari Redstone must decide whether to sell her family’s controlling stake in the battered media company. For now, the company operates under a three-executive CEO structure.

The Wall Street Journal first reported the deal’s collapse. Puck’s Matt Belloni first reported news of the meeting and Phillips’ opposition.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.