The ‘shut up and watch’ standard: Super Bowl advertisers are judged as much as the players

- Share via

Who was the least valuable player in last year’s Super Bowl? Viewers might say it was the tousle-haired young boy in the Nationwide Insurance spot, talking about all the cool things he missed because he was killed in a household accident.

Headline writers dubbed it the “Dead Kid” commercial. Social media buzzed with outrage. The company was forced to issue a statement explaining it didn’t mean to upset anyone. Nationwide’s chief marketing officer soon left his job.

Such are the risks of running a commercial in the biggest annual television event. But the advertisers who are paying close to $5 million for a 30-second spot to be a part of Super Bowl 50 on CBS on Sunday know that their high-profile role in the event means they are going to be judged as much as the players and coaches on the field.

“It’s absolutely nerve racking,” said David Angelo, chairman of the Los Angeles ad agency David & Goliath, which produced a Kia Motors ad featuring Christopher Walken that will air Sunday. “You want to make sure you’re representing your client’s brand in the best way possible.”

The pressure has heightened because the Super Bowl is becoming a rare species in television: people watch it live, on a TV set, instead of recording it for later or streaming it on a smartphone or other device.

When an average of 114.4 million viewers watched the New England Patriots heart-stopping victory over the Seattle Seahawks on NBC last year, it marked the fifth time in the last six years that the Super Bowl has set a record for the largest U.S. TV audience.

The game’s surging popularity has advertisers paying more each year to be a part of the surest bet to reach the most TV viewers in one shot.

Kantar Media reports Super Bowl ad spending has gone from $205 million in 2010 to $345.4 million in 2015 — a period in which overall TV ad revenue growth flattened out. The average cost of a 30-second Super Bowl commercial in that time has risen to $4.4 million from $3.1 million. Ad Age Datacenter projects spending on Super Bowl 50 will hit $377 million, with the average spot selling for $4.8 million.

At that price, advertisers need to deliver not just a commercial, but a piece of entertainment content that will compete for a place in the national pop-culture conversation.

“When we’re working on a Super Bowl ad, I tell our people to create something that will make you want to be able to stand in front of the TV set and tell everybody, ‘Shut up. My spot is on.’ It’s your time to shine,” Angelo said.

That need to stand out has also driven up the cost of making Super Bowl spots to $2 million and up — a boon to Los Angeles postproduction houses, producers, directors, animation companies and visual-effects shops that enhance commercials.

This year’s batch includes a lineup of movie stars such as Seth Rogen and Amy Schumer for Bud Light, Ryan Reynolds for Hyundai and Alec Baldwin for Amazon.

It wasn’t always this way. In the 1970s, networks that didn’t have the game could still earn massive ratings by airing first-time telecasts of theatrical movies such as “Gone With the Wind” and “The Godfather.” It was the era when ABC, CBS and NBC dominated, before the proliferation of cable, home video players and streaming services made almost every film readily available.

“The Super Bowl didn’t have much significance then,” said Joe Pytka, the Los Angeles director of dozens of Super Bowl ads. He recalls the Academy Awards telecast being the most prestigious advertising platform until the early 1980s.

Many of the messages of the Super Bowl spots in those early years reflected the sober economic environment of the time and did not require spectacular creativity.

As the Big Three auto companies saw imports eat into their market share, the high-profile ad campaign of Super Bowl IX in 1975 was from Chrysler, offering $400 rebates to customers to move vehicles out of its overstocked dealerships.

A shift began when Apple and its ad agency, Chiat Day, chose Super Bowl XVIII to introduce the Macintosh personal computer with a spot called “1984,” directed by Ridley Scott, the English filmmaker known at the time for “Alien.” The dystopian-themed ad showing a hammer-throwing woman destroying a giant screen that displayed a Big Brother-like figure was produced for a then eye-popping $400,000.

After being exposed to the 77.6 million viewers watching the game, Apple’s “1984” received the kind of free publicity not seen since President Johnson’s famous 1964 campaign ad “Daisy,” which showed a little girl picking petals during a nuclear blast countdown. Like that spot, TV news programs replayed “1984” in its entirety, giving Apple exposure that went well beyond the $450,000 paid to run it during the game.

“That really set the bar for ads to do more than sell,” Angelo said. “They had to have gravitas. They had to provoke.”

The competition to break out on the Super Bowl became gladiatorial with the rise of USA Today’s “Ad Meter.” In 1989, the Gannett Co.’s newspaper began using a research firm to test audience’s reaction to the ads and rank their popularity. Several dozen people were gathered in an undisclosed location and handed what looked like oven dials that were turned up or down in response to what they saw.

Within a few years, the published results became part of the postgame chatter Monday mornings and the Ad Meter annually struck fear in the hearts of advertisers and agency executives.

“Back in the day we couldn’t tell people where it was going to be,” said Dottie Enrico, a former USA Today reporter now with the American Assn. of Advertising Agencies. “We thought that trucks of Pepsi or fleets of Chevy trucks would show up.”

Soon advertising executives had bonuses written into their contracts based on a high Ad Meter ranking for a Super Bowl spot. The publication’s rankings are still anxiety-producing enough for some companies to avoid the game altogether.

“There are advertisers who run commercials in NFL games all season that do not go into the Super Bowl because they don’t want their creative to be judged by the Ad Meter,” said Jo Ann Ross, president of network sales for CBS.

Pytka, who has directed several first-place winners in the Ad Meter, believes the public competition improved the quality of the commercials in the game.

“The Ad Meter made people aware that viewers want to be entertained when they watch television, especially in the Super Bowl,” said the director, whose spots for Budweiser, Pepsi and Nike have ranked among the most popular over the years. “When you’re spending time with somebody, make their time valuable. Don’t bore them.”

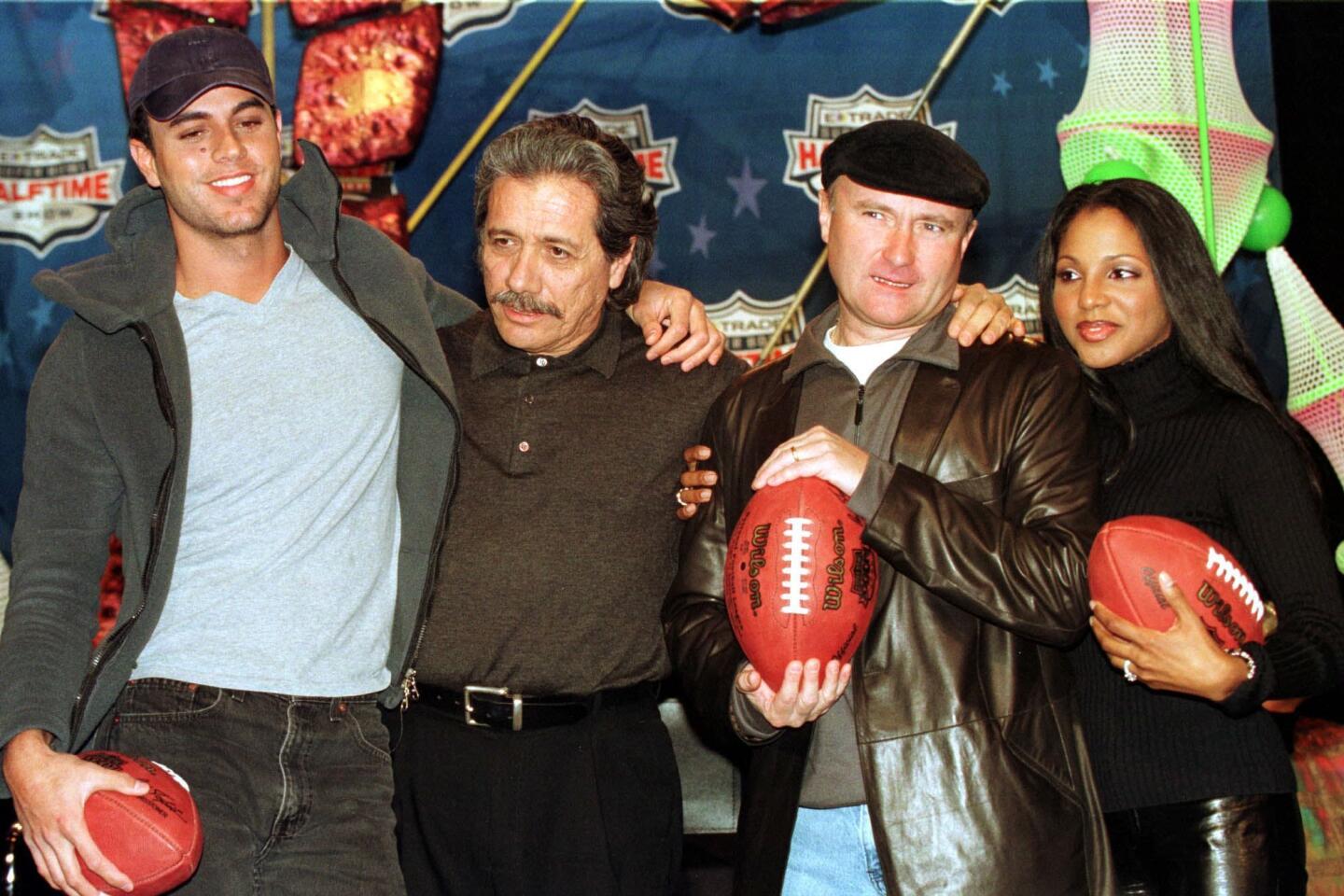

In 2000, Super Bowl commercials reached an even higher level of consumer consciousness, thanks to an influx of advertisers that emerged during the Internet bubble of the time.

Fueled by their inflated stock prices, e-commerce start-ups looking to make an impact on consumers rushed to buy time on the game. On Madison Avenue, the game is remembered as “the Dot-com Bowl.”

“It was the first time anyone sold a spot in the Super Bowl for $3 million, which was considered an extraordinary number in 2000,” said Ed Erhardt, who heads global sales and marketing for ESPN. “And that was driven by that exuberance around how quickly you could make your brand name known on one day.”

Most of the tech firms that ran commercials in that game (remember the Pets.com sock puppet?) either went out of business or were folded into other companies. But the digital revolution that left those firms as collateral damage altered the way marketers use the Super Bowl commercial and how viewers watch them as online streaming video reached critical mass.

It was long typical of advertisers to keep their Super Bowl spots under wraps until the game. Now such secrecy seems quaint. Combining Super Bowl ads with an online marketing push is now standard procedure.

In 2015, YouTube users spent 840 million minutes watching Super Bowl ads, an increase of 127% over 2014. YouTube says 37% of those views occurred before the kickoff of Super Bowl XLIX.

David Bushman, television curator for the Paley Center for Media said the tipping point for Super Bowl ad viewing online occurred in 2011, with the popular Volkwagen ad called “The Force,” showing a kid in a Darth Vader costume using his powers to control his family’s Passat. The German carmaker agreed with its ad agency Deutsch that the 60-second version for the spot was worth exposing earlier online, and it was viewed 17 million times before game time.

“It was transformative,” Bushman said. “It became more than just a commercial. It became a marketing campaign strategy that the commercial was just one part of.”

stephen.battaglio@latimes.com

Hoy: Léa esta historia en español

More to Read

From the Oscars to the Emmys.

Get the Envelope newsletter for exclusive awards season coverage, behind-the-scenes stories from the Envelope podcast and columnist Glenn Whipp’s must-read analysis.

You may occasionally receive promotional content from the Los Angeles Times.