The future of foreclosures

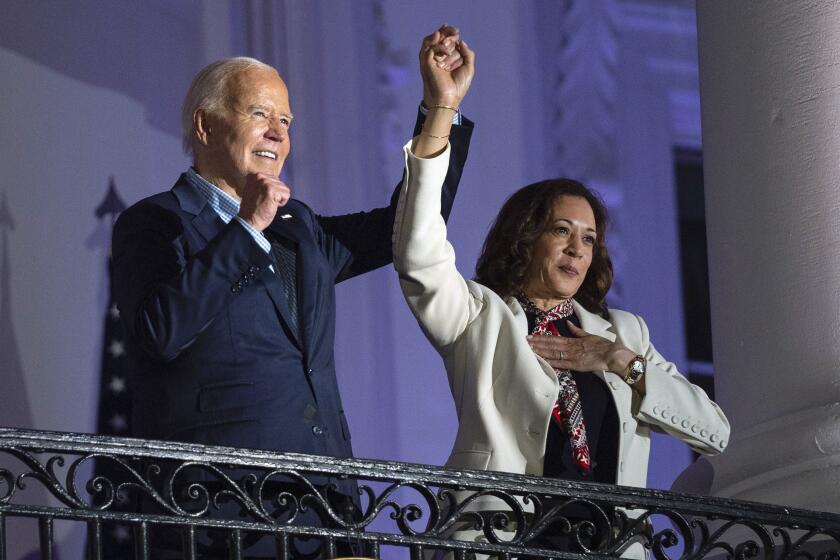

It’s been five years since the housing bubble burst, yet hundreds of thousands of California homeowners remain in default and en route to foreclosure. Some of these troubled borrowers will benefit from new consumer protections included in a nationwide settlement that five major banks agreed to in February, including a requirement that foreclosure proceedings wait until the bank considers a modified mortgage that would be less costly to borrower and lender alike. Those protections, however, extend no further than the five banks and the loans they service. This week, state lawmakers are set to take up a series of mortgage-related bills backed by Atty. Gen. Kamala Harris, beginning with a measure (AB 1602) to enshrine the national settlement’s safeguards into California law and apply them to all borrowers in the state. Also included in the package are proposals to improve lenders’ record keeping and extend the statute of limitations for prosecuting certain mortgage-related crimes.

The measures are sensible and important, yet they’re running into resistance from bank lobbyists. One of the main complaints is that some of the bills would encourage defaulting borrowers to file lawsuits to drag out the foreclosure process, even if they have no intention or ability to keep their homes.

Complaints about potentially abusive lawsuits would be more persuasive if they weren’t coming from an industry whose companies foreclosed on properties despite falsified court affidavits (by “robo-signing” documents) and serious discrepancies in the ownership records. Nevertheless, to minimize the risk of spurious claims and delaying tactics, sponsors have amended the legislation to significantly narrow individuals’ right to sue. Borrowers also would be deterred from making multiple spurious applications for mortgage modifications.

Ultimately, many foreclosures simply can’t be averted. Some borrowers took on too much risk, and the recession cut other borrowers’ income so substantially that they can no longer afford their homes. But lenders, overwhelmed by the number of borrowers who ran into financial trouble, took procedural shortcuts that led them to foreclose on many borrowers who could have been rescued with a less costly mortgage modification. The bills Harris has sponsored would provide more protection against abuses and errors in the foreclosure process and promote mortgage modifications without requiring lenders to do anything that’s not in their financial interests. That’s hardly too much to ask.

More to Read

A cure for the common opinion

Get thought-provoking perspectives with our weekly newsletter.

You may occasionally receive promotional content from the Los Angeles Times.