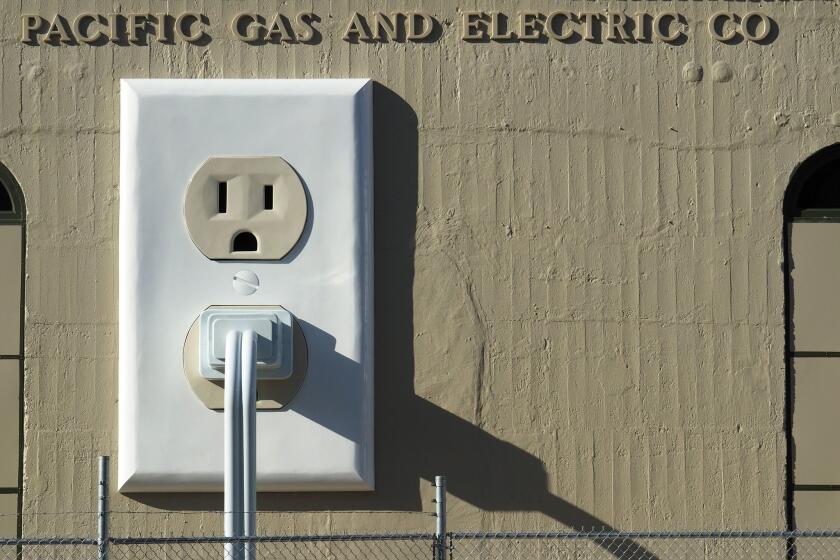

Would public ownership of Pacific Gas & Electric reduce the risk of wildfire?

- Share via

This summer is yet another marked by wildfire in California. Blazes have ignited throughout the state, including a deadly one that exploded near the Oregon border in late July. The fall is likely to be worse.

Pacific Gas & Electric, serving most of Northern and Central California, has spent the summer preparing for another autumn of extreme fire risk. Nearly the entire state has been consumed by severe drought, and the seasonal winds will stress the company’s power lines and increase the risk of trees battering live wires. Since a single spark has the potential to ignite a catastrophic fire, PG&E will almost certainly have to shut off parts of its system when the Diablo winds pick up, a last resort measure to reduce risk.

The company first deployed this strategy at scale in 2019 with a series of power outages that wreaked havoc on communities and the economy. The first blackouts began just after midnight on Oct. 9. The lights first went out in the North Bay and in the Sierra. The East and South Bay were next, and then parts of the Central Valley. By evening, more than 2 million people were in the dark.

Within hours, Northern California had come to a near-standstill. Hospitals in the East Bay rushed to move refrigerated medications to facilities with power. Nursing home residents were left in the dark. Businesses shuttered. As the outages persisted for days, economists estimated the losses were in the billions.

“We simply could not continue running parts of this system given the risk to public safety,” Bill Johnson, the chief executive of PG&E at the time, explained. “We must have zero risk of a spark.” He had feared a replay of the catastrophes of two prior years. In 2017, the company’s power lines ignited more than a dozen fires in the wine country region that killed 22 people. In 2018, a power line broke in the wind, emitting sparks that ignited the Camp fire that killed 84 people, destroyed the town of Paradise and consumed more than 150,000 acres.

The world watched in shock as California, the world’s fifth largest economy, sputtered because a utility company had to turn off part of its system. As pundits made derisive jokes, Gov. Gavin Newsom hastily called a news conference.

“What’s happened is unacceptable, and it has happened because of neglect,” Newsom said. “It’s happened because of decisions that were deferred, delayed, or not made by the largest investor-owned utility in the state of California and one of the largest in the nation. This current operation is unacceptable.”

And the blackouts weren’t over yet. They would continue through the weeks ahead, with millions losing power that month.

PG&E’s blackout strategy was driven by its fear of causing more destruction, as well as its need to get out of bankruptcy court. It could barely handle $30 billion in liability costs that it was already facing. Shutting off the power was an existential decision for both the company and its customers.

It was a dark dilemma. PG&E could no longer provide safe and reliable service when the Diablo winds blew in Northern California. That was supposed to be the central objective for every utility. For PG&E, it had become an either-or proposition.

Even before the blackouts, Newsom’s team had contemplated what it would take for the state to take ownership of PG&E. Across the state, residents were hoping for dramatic transformation of the company.

“PG&E as we know it may or may not be able to figure this out, and if they cannot, we are not going to sit around and be passive,” Newsom said. “The state will prepare itself as backup for a scenario where we do that job for them.”

All across Northern California, the leaders of the cities and towns that had gone for days without power were ruminating on whether their locales could somehow break free of the giant utility.

The most prominent among them was San Francisco, PG&E’s home for more than a century. The city wanted to establish its own municipal utility, publicly owned and operated. The idea had been months in the making. Mayor London Breed and her staff had started exploring it as early as January 2019, shortly after the company filed for bankruptcy. Within two months, the city had launched a formal study on whether going the municipal route would benefit residents, and what it might cost to do it.

PG&E said it reached a settlement with the Butte County district attorney’s office on March 17. The utility’s critics say the plea deal is too lenient.

The study cut to the heart of a larger question about the provision of electricity in the U.S., the majority of which is done through investor-owned utilities. If private capital is eliminated, then what? Public ownership, most often through a city or a town, is one of the only alternatives.

The public ownership model emerged at the turn of the 20th century as large, investor-backed companies like PG&E built out power plants and wire lines in pursuit of economies of scale. In some cases, public utilities formed in fast-growing cities wary of large corporations sweeping in to sell them power, or in communities too remote to attract that sort of investment.

As Pacific Gas & Electric exits bankruptcy, it’s not clear there’s anything fundamentally different about the California utility.

But public ownership fell out of favor in many places as private utilities expanded their transmission networks, making it easier to deliver power to remote areas. Private utilities acquired dozens of municipal ones and often fought to block cities and towns from defecting on the grounds that remaining customers would have to pay more to keep the system functioning.

Residents of Sacramento, for example, voted in 1923 to purchase PG&E’s local distribution lines and operate them through a municipal agency. PG&E fought the city for more than 20 years. The case went all the way to the California Supreme Court, which, in 1946, at last determined that Sacramento had the right to proceed. PG&E was forced to sell.

Public utilities are one alternative to private ownership. Nonprofit cooperatives are the other. Cooperatives were established after the Great Depression to serve regions that private utilities couldn’t — or wouldn’t — serve. Large swaths of farming and mountain communities, with residents loosely spread out over hundreds of square miles, didn’t fit the emerging business model as investor-owned power companies built out their systems. There are still more than 800 electric cooperatives across the country.

California’s second-largest wildfire on record was started when a tree came into contact with electrical lines, Cal Fire investigators determined.

A group led by San Jose Mayor Sam Liccardo and several utility-industry experts emerged to propose turning PG&E into a cooperative, which would allow the company to take money that otherwise would have gone to shareholders and invest it in the system. And it would be able to raise money more cheaply, by issuing low-interest bonds. That would save billions of dollars in financing costs and reduce the need to raise rates on customers.

Newsom’s team spent hours at the whiteboard, gaming out the options for PG&E. The question wasn’t simply who should own the company. Any effort to change PG&E’s ownership model would have broad economic implications for all of California.

One of the biggest challenges to a public takeover was the sheer cost of securing ownership. California would have to find tens of billions of dollars to buy out PG&E’s shareholders and acquire its assets. That would probably require establishing a new state power authority to issue bonds to finance the purchase, and the debt would fall to customers to repay over time. A cooperative would use debt financing to the same end.

Transforming PG&E into either a public utility or a cooperative would eliminate shareholders and their need for dividends, freeing it to reinvest its revenue in making the system safer. Both would have access to capital at lower costs, potentially reducing rates.

But neither option would eliminate the utility’s problems. Its customers would become responsible for problems with the grid and liable for fire damage. The utility’s power lines, no matter the ownership, would inevitably spark again. The risk would never be zero, and with climate change and hotter, drier conditions, it would go up every year.

Any bid to purchase the whole system would face staunch resistance from shareholders, delay PG&E’s exit from bankruptcy, hold up compensation for fire victims, and spook investors in the state’s other large utilities. A takeover was possible, but not without a fight.

Ultimately, Newsom chose the status quo. But it didn’t solve the long-term problem. His decision meant that the company’s shareholders would continue to expect returns on their investments, challenging the company to deliver them while also spending billions to maintain the safety of its system.

For years, PG&E had produced returns for investors in part by cutting spending on safety measures. Newsom’s decision left it to the company to decide how to reorient its spending at a time when fire risk was growing and becoming more expensive to manage.

Those years of underinvestment in safety had mounting consequences, all made more dire by climate change.

In July 2021, roughly a year after PG&E emerged from bankruptcy, a tree fell on a small power line deep within the Feather River Canyon, not far from Paradise. Sparks showered the dry ground and ignited a fire. It was a hot day, with scarcely any wind to fan the flames. The Dixie fire, with no shortage of fuel, raged for three months, burned more than 960,000 acres, destroyed hundreds of structures, cost the federal and state governments more than $630 million to contain and became the second largest fire in California history.

Katherine Blunt covers renewable energy and utilities for the Wall Street Journal. This article is an adapted excerpt from her book “California Burning: The Fall of Pacific Gas and Electric — and What It Means for America’s Power Grid,” which will be published Aug. 30.

More to Read

A cure for the common opinion

Get thought-provoking perspectives with our weekly newsletter.

You may occasionally receive promotional content from the Los Angeles Times.