Should Congress post Trump’s tax returns publicly? I don’t think so

- Share via

Donald Trump should have released his tax returns when he was running for president, and in not doing so he was deceptive, sleazy and in violation of a long-standing tradition that fosters transparency and honesty. He obviously hoped to hide unfavorable information from the voters.

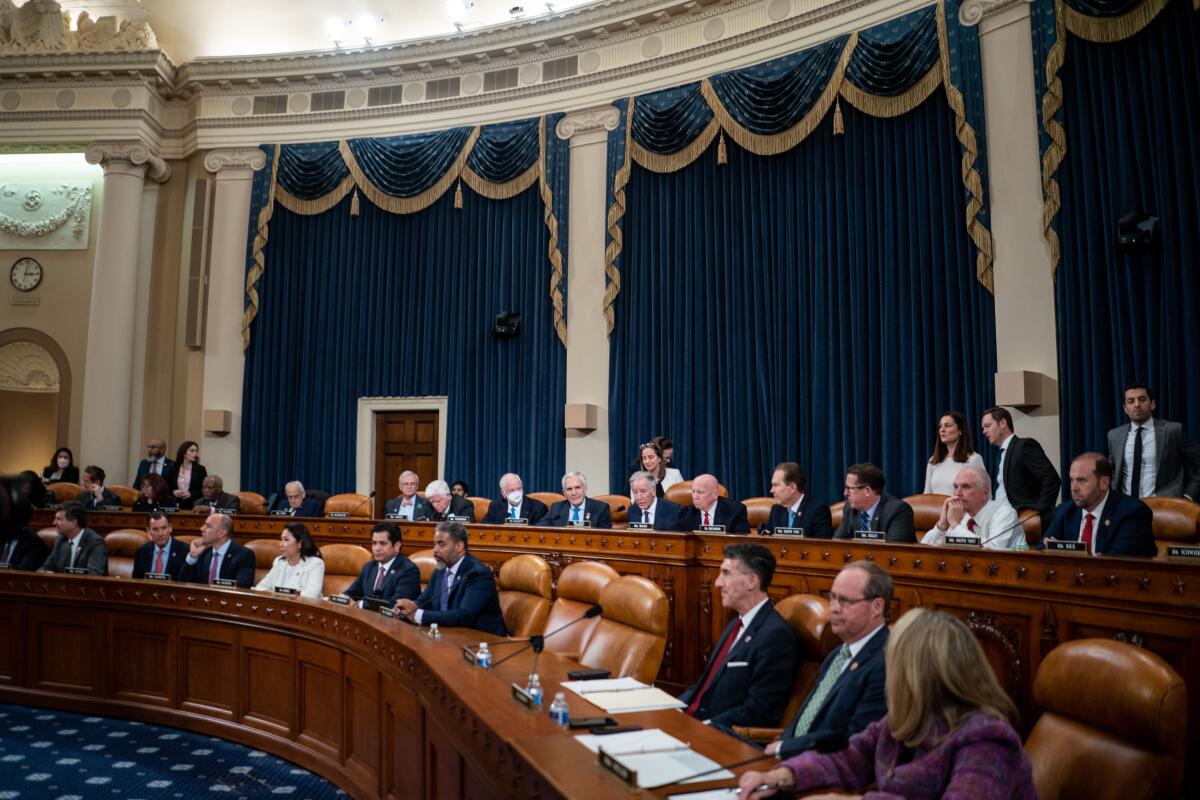

Despite that, I don’t believe the House Ways and Means Committee should release his tax returns to the public now.

The committee fought a long battle all the way to the Supreme Court to obtain copies of the returns. It argued that it needed them to evaluate the effectiveness of an IRS program that audits the tax filings of presidents.

Republicans squawked all the way, saying the Democrats who controlled the committee were being disingenuous, and that no, no, no, they weren’t seeking to do a legitimate evaluation — they were just creating a pretext to get ahold of Trump’s returns for a humiliating public fishing expedition into what taxes had or hadn’t been paid.

The courts ultimately ruled that the committee could have six years of Trump’s federal tax returns. That battle ended last month.

Opinion Columnist

Nicholas Goldberg

Nicholas Goldberg served 11 years as editor of the editorial page and is a former editor of the Op-Ed page and Sunday Opinion section.

But on Tuesday, the committee voted to do something that goes well beyond what’s necessary to evaluate the IRS’ presidential audit program: The committee is now going to release Trump’s taxes publicly, posting the full returns (minus certain identifiers like Social Security numbers and bank account numbers) for all to see. And quickly too, in the coming days, before the Democrats lose control of the committee to the Republicans on Jan. 3.

Why make the returns public? How does that help Congress figure out whether the IRS auditing process is working? How does it further the legitimate oversight goals of the committee?

Answer: It doesn’t. It turns out the Republicans are right. (This may be the first time since the Civil War.) As they correctly noted, this is a politically motivated move to release information that might harm or embarrass the former president.

In theory, I’m all for embarrassing Trump. (With these two caveats: First, no one can embarrass Trump more than he embarrasses himself, and second, he’s entirely shameless so he doesn’t really get embarrassed in any normal sense of the word.) The ex-president is a dishonest thug who needs to be called to account for his misbehavior.

But in this particular case, I think the Democrats are in the wrong. For one thing, releasing the private tax returns probably won’t shed much light on anything. The New York Times already received leaked details of more than two decades of Trump’s tax filings and published long stories that should’ve shocked the world. Billionaire pays less in federal taxes in some years than you and I do! Trump paid no federal income taxes at all in 10 out of 15 years!

Can Trump still legally block the release? Why did the IRS fail to audit him? What have we learned from the tax summaries already released?

Furthermore, the Manhattan district attorney’s office has many of Trump’s tax returns as well, and prosecutors can pursue cases using the data they uncover.

But the main reason I object to posting the returns is that I worry — perhaps quaintly, in this day and age — about the continued politicization of governmental processes, and the continued breaking of established norms, in this case making private tax filings public. I know I’ll get a thousand emails saying “the Republicans wouldn’t hesitate to do the same to us” and “if we’re civil and respectful and always play by Marquess of Queensberry rules while our political opponents continue their underhanded tricks, we will always be beaten.”

There’s certainly some truth to that. But there’s truth to the flip side too: If nobody plays by the rules, there will soon be no rules to play by. When you’re doing something as sensitive and politically explosive as investigating a former president — at a tense time in history when there’s talk of civil war and violence is on the rise and bitter political partisanship is smoldering — it makes sense to be careful to respect the established process, be as honest as possible, refrain from unnecessary politicization and not escalate conflict unnecessarily.

Among other things, posting Trump’s taxes seems likely to result in tit-for-tat posting of other people’s private tax returns. Will we soon be seeing Hunter Biden’s tax returns on the web?

It’ll also give Republicans some basis for saying that, actually, it is Democrats who go low when others go high.

Unsurprisingly, the committee vote was along party lines. Like so much of what goes on in Washington these days.

If Congress thinks all presidents or presidential candidates should release their tax returns for public scrutiny — which I believe is a good idea — it should pass a law that mandates that going forward. It should not find circuitous, pretextual ways of going after particular presidents.

The returns the Ways and Means Committee received apparently showed that Trump often paid little or nothing in federal income taxes between 2015 and 2020 despite reporting millions in earnings, thanks to steep losses elsewhere. That’s similar to what the New York Times found in its reporting.

The unembarrassable Trump once said in a debate when Hillary Clinton accused him of not paying much in federal taxes: “That makes me smart.”

Voters need to know more about the sources and scope of presidential candidates’ wealth and about potential conflicts of interests.

But posting Trump’s returns at this point and under these circumstances and given the arguments that were made to obtain them, serves politics much more than transparency.

More to Read

A cure for the common opinion

Get thought-provoking perspectives with our weekly newsletter.

You may occasionally receive promotional content from the Los Angeles Times.