Facebook’s Mark Zuckerberg faces the perils of Wall Street

Congratulations to Mark Zuckerberg on his surprise wedding last Saturday. I certainly hope his marriage gets off to a better start than Friday’s initial public offering of shares in his social networking colossus, Facebook.

Wall Street analysts are now saying the opening share price of $38 was too high for investors wary of buying into a business that delivers millions of messages and photos from college drinking parties but produces a comparatively modest revenue stream. As a result, at the close of trading on Tuesday, Facebook’s estimated market value had dropped to $85 billion from the $104-billion value set by the IPO.

Still, Zuckerberg can lose a billion bucks on a stock deal and keep that boyish smile on his face. If I lose a few thousand from my pitiful portfolio because Greece is going rogue, I feel as if civilization is teetering near collapse.

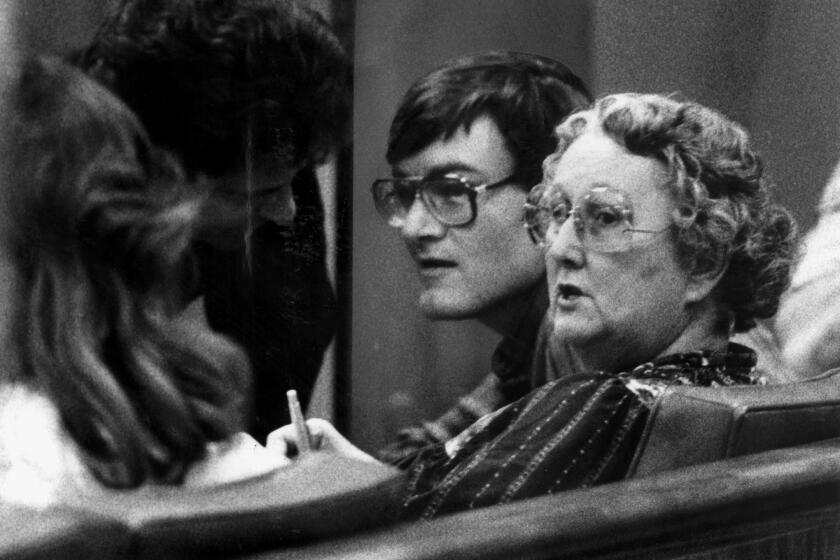

The machinations of Wall Street always remind me of my grandfather, Andrew Herman Horsey, a working man who made a living any way he could -- cop, game warden, butcher, cannery foreman -- and would have lived out his old age nearly penniless if Franklin D. Roosevelt had not invented the social safety net. I have written before about how Grandpa got angry every time the stock market report appeared on TV.

“Why do they run that?” he would bellow. “It’s just for gamblers.”

If he wasn’t right then, he would be right now. The reasonably predictable market that existed from Roosevelt’s time up into the Clinton years, the place where you could put in a modest amount of money, as my parents did, and be pretty sure it would grow into a nice retirement fund over a couple of decades -- that market is long gone.

People who were talked out of a pension and into a 401k 15 years ago have, more often than not, seen that nest egg go rotten. Wall Street has become a bigger gamble than Las Vegas, and there aren’t even free drinks to soften the blow when you lose. Everybody is in the market these days, but only a few very big players actually get to play. Hedge fund managers, derivatives hawkers and slick guys in suits from banks that are too big to fail place all the bets and roll all the dice. We just stand on the sidelines watching our modest investments take a stomach-churning roller coaster ride.

I have a couple of friends who are smart and successful investment planners. Their view of our financial future? The optimistic one thinks we are heading for hard times; the other is certain we are simply doomed. I met a wild-eyed guy over in rural Montana who also expects the worst. He tried to persuade me to do what he has done, liquidate every investment and buy bars of silver. He may be right, but I’m not quite ready to throw in with the folks who keep a stack of guns and two years of freeze-dried rations tucked away in an underground bunker.

My imaginary financial plan, until last weekend, was to somehow introduce my darling daughter to Mark Zuckerberg and surf through any future economic meltdowns in the wake of my billionaire son-in-law. Now that scheme is shot.

Instead, I’ll have to rely on my wits like my other grandfather, Halfdon Garfield Jaeger. During the Great Depression, he owned two general stores in northern Idaho. When his customers reached the point where they could no longer pay their bills, he found a new profession with a more reliable clientele. Grandpa became an undertaker.

Facebook may be a risky investment, but death is always a sure bet.

More to Read

A cure for the common opinion

Get thought-provoking perspectives with our weekly newsletter.

You may occasionally receive promotional content from the Los Angeles Times.