Laguna Beach packs house for meeting on insurance and wildfire

Laguna Beach residents piled into the council chambers on Tuesday to learn what could be done about the growing concern of the insurability of their properties against the threat of wildfire.

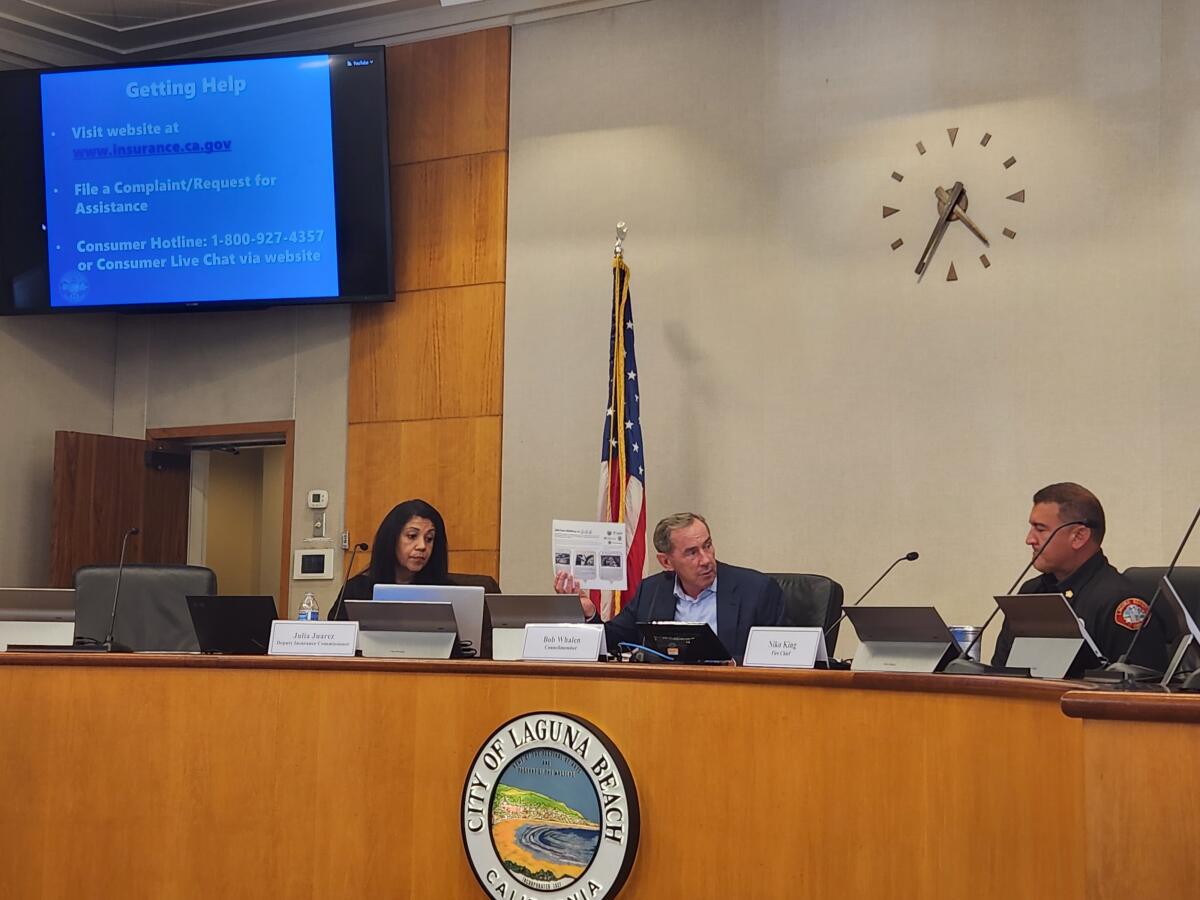

The town hall meeting featured a three-person panel made up of Councilman Bob Whalen, Fire Chief Niko King and Julia Juarez, the deputy commissioner of community relations and outreach for the California Department of Insurance.

Whalen opened the meeting by acknowledging a number of uncomfortable truths, including the town’s place in the very high fire hazard severity zone and the plight of residents and stakeholders who said they have faced the realities of losing insurance or “seeing premiums really skyrocket.”

Laguna Beach residents have long remembered the devastating blaze of 1993, and the community has more recently dealt with the Aliso and Emerald fires.

“We’ve been proactive in addressing the risks as a community,” Whalen said. “I think many of you are aware of that. We approved a wildfire mitigation and fire safety report in 2019. We spent over $23 million so far implementing a number of those recommendations. They have made our community safer. We hope that eventually our efforts at wildfire safety are going to translate into more insurance availability, a better insurance rating for our city and easier access to insurance.”

A dozen insurance companies account for 85% of the state’s homeowners market, Juarez said. As the insurance industry has become increasingly reluctant to write new policies due to risk assessment and cost recovery issues, consumers have turned to the FAIR Plan.

The FAIR Plan, which Juarez said was meant to serve as a last-resort stopgap while homeowners looked for new fire insurance, has increased to about 3% of the market. Recognizing the trend of consumers having to exercise that option, Juarez said that state Insurance Commissioner Ricardo Lara requested that the FAIR Plan double coverage for homeowners from $1.5 million to $3 million. Businesses can receive coverage of up to $6 million.

Additional steps taken have included a collaboration with fire agencies to create standards for protecting homes, the surrounding areas and whole communities in an approach referred to as “Safer from Wildfires.” Those who take action on the criteria qualify for a discount on their insurance.

The steps include vegetation management, providing defensible space and upgrading windows to multi-paned glass, among others, and can be found at insurance.ca.gov.

Insurance companies also have to disclose wildfire risk scores to consumers.

“In the past, the Department of Insurance would only look at what [insurance companies lost] for the last 10 years and then decide how much they would allow them to increase their rates by the losses they had in the last 10 years,” Juarez said. “As of 2018, that might have worked, but from 2018 on, we have had the worst wildfires in our history, and so because of that, the losses have been insane throughout the state. We have seen that insurance companies have lost more money here in the state than they have in any other state in the country.”

Juarez added that insurance companies are seeking catastrophic modeling, enabling them to look at the specific situation of a home and its surrounding area to be able to charge an appropriate rate.

“It’s important [for the insurance companies] to know what is happening for the consumer, but also we have to walk that fine line in the Department of Insurance to ensure that insurance is a viable market,” Juarez said. “You need to be able to pay for it, and they need to be able to provide for any losses that we see in the state.”

The panel responded to questions from the community following the presentation. Among the inquiries were the anticipated timeline for undergrounding projects, as well as steps that could be taken to make sure neighbors did their part to keep the community safe from wildfire.

“There’s definitely an avenue,” King said in response to the latter. “Our fire marshal can address that, or our fire inspector, and we can go out and inspect and make sure that there is or is not a hazard, and if there is a hazard that exists, we can have them mitigate it. We just need to know about it.”

In answer to the question on undergrounding power lines, a project removing 20 utility poles along Bluebird Canyon Drive between Cress Street and Saling Way is scheduled to get underway on Sept. 9, city officials said. The work could result in traffic delays and parking restrictions for the next six months.

Fire mitigation efforts include the utilization of goats to chew up vegetation in 10 of the two dozen fuel modification zones throughout the city.

Answering an inquiry about how Laguna Beach came to be placed in the very high fire hazard severity zone, King elaborated on what it means from a public safety perspective, mentioning that authorities factor in fuel, weather and topography in determining wildfire risk.

“What they see is the higher likelihood that a risk exists in a community, and what this all means, being in the very high fire hazard severity zone, is that we have stricter building codes here that we can help protect our community.”

All the latest on Orange County from Orange County.

Get our free TimesOC newsletter.

You may occasionally receive promotional content from the Daily Pilot.